Question: SECA Overview ... or Self-Employed Contributions Act In 1951, the Self-Employment Contributions Act (SECA) extended coverage under the social security system to the self-employed. a.

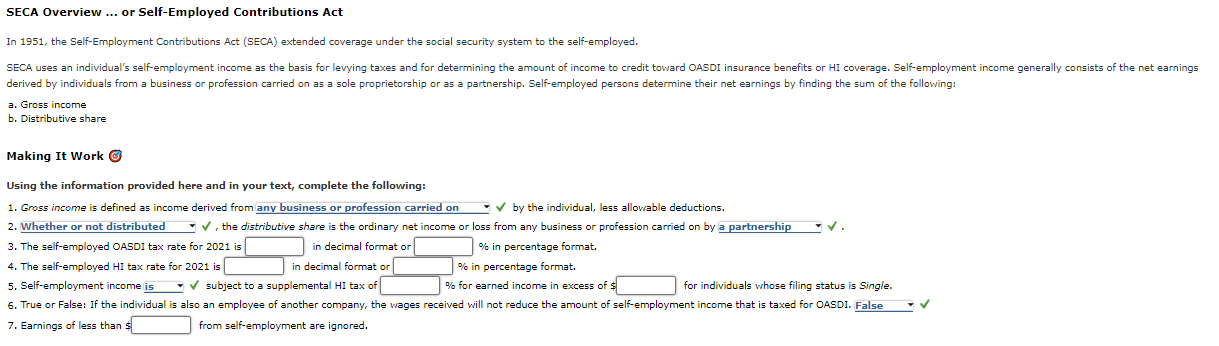

SECA Overview ... or Self-Employed Contributions Act In 1951, the Self-Employment Contributions Act (SECA) extended coverage under the social security system to the self-employed. a. Gross income b. Distributive share Making It Work (C) Using the information provided here and in your text, complete the following: 1. Gross income is defined as income derived from by the individual, less allowable deductions. , the distributive share is the ordinary net income or loss from any business or profession carried on by 3. The self-employed OASDI tax rate for 2021 is in decimal format or in percentage format. 4. The self-employed HI tax rate for 2021 is in decimal format o in percentage format. 7. Earnings of less than : from self-employment are ignored. SECA Overview ... or Self-Employed Contributions Act In 1951, the Self-Employment Contributions Act (SECA) extended coverage under the social security system to the self-employed. a. Gross income b. Distributive share Making It Work (C) Using the information provided here and in your text, complete the following: 1. Gross income is defined as income derived from by the individual, less allowable deductions. , the distributive share is the ordinary net income or loss from any business or profession carried on by 3. The self-employed OASDI tax rate for 2021 is in decimal format or in percentage format. 4. The self-employed HI tax rate for 2021 is in decimal format o in percentage format. 7. Earnings of less than : from self-employment are ignored

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts