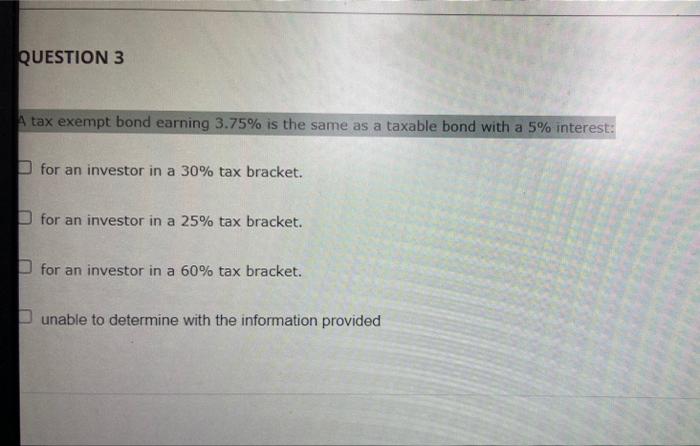

Question: Second attempt at an assignment, therefore i can eliminate one option from each question ; Question 3 is NOT ; For an investor in a

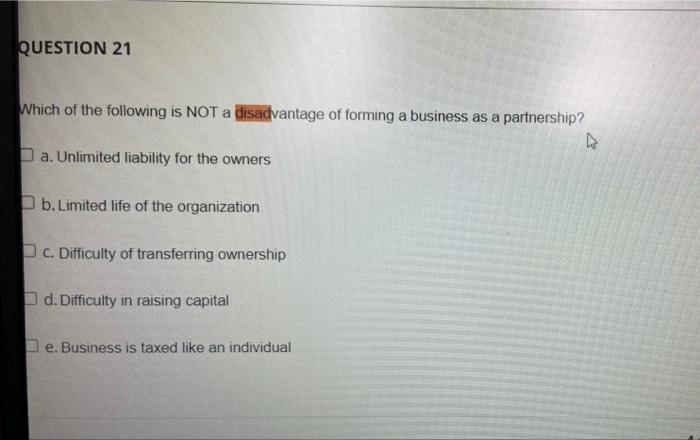

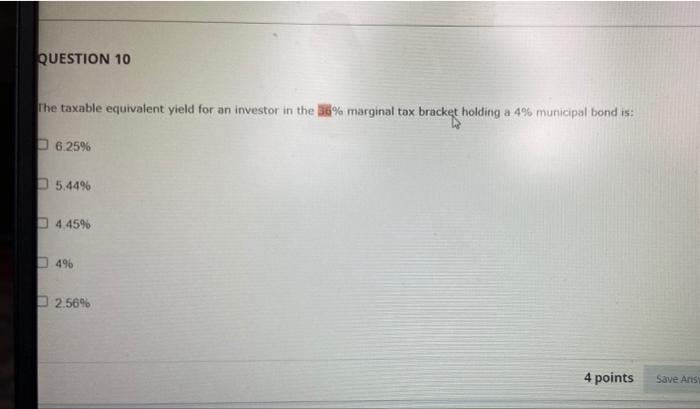

QUESTION 3 A tax exempt bond earning 3.75% is the same as a taxable bond with a 5% interest: for an investor in a 30% tax bracket. for an investor in a 25% tax bracket. for an investor in a 60% tax bracket. unable to determine with the information provided QUESTION 21 Which of the following is NOT a disadvantage of forming a business as a partnership? a. Unlimited liability for the owners b. Limited life of the organization c. Difficulty of transferring ownership d. Difficulty in raising capital e. Business is taxed like an individual QUESTION 10 The taxable equivalent yield for an investor in the 38% marginal tax bracket holding a 4% municipal bond is: 6.25% 5.44% 4.45% 496 2.56% 4 points Save Ans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts