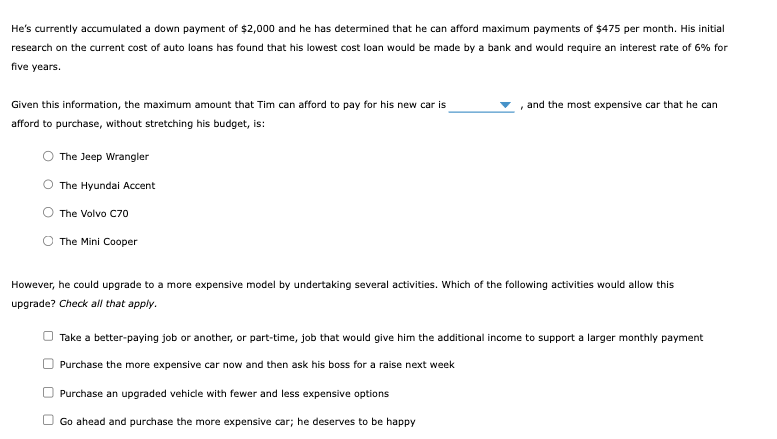

Question: SECOND DROPDOWN OPTIONS ($30,555/ $19,928/$26,570) How much car can I afford? Before buying a car, it is critical that you determine both the complete price

SECOND DROPDOWN OPTIONS ($30,555/ $19,928/$26,570)

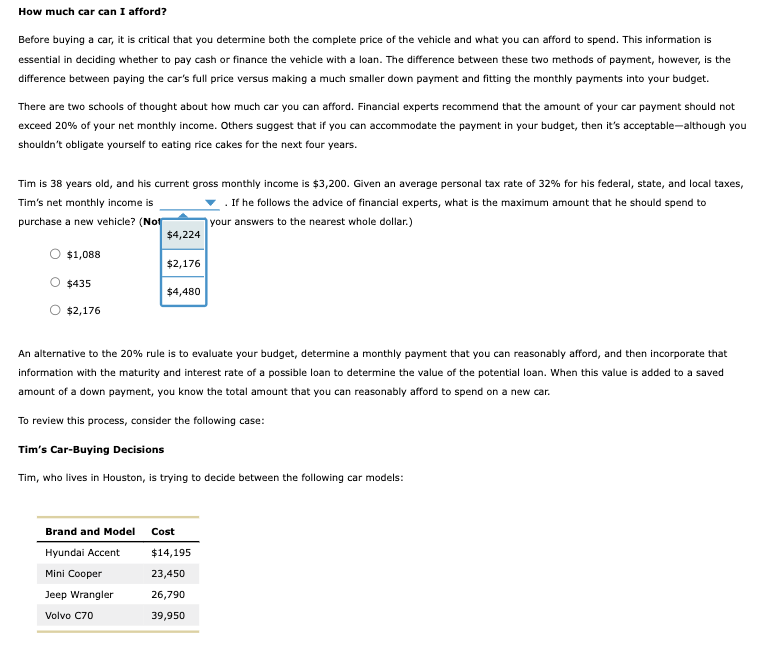

How much car can I afford? Before buying a car, it is critical that you determine both the complete price of the vehicle and what you can afford to spend. This in essential in deciding whether to pay cash or finance the vehicle with a loan. The difference between these two methods of payment, however, is the difference between paying the car's full price versus making a much smaller down payment and fitting the monthly payments into your budget. There are two schools of thought about how much car you can afford. Financial experts recommend that the amount of your car exceed 20% of your net monthly income. Others suggest that if you can accommodate the payment in your budget, then it's acceptable-although you shouldn't obligate yourself to eating rice cakes for the next four years. Tim's net monthly income is . If he follows the advice of financial experts, what is the maximum amount the should spend to purchase a new vehicle? (No your answers to the nearest whole dollar.) $1,088 $435 $2,176 An alternative to the 20% rule is to evaluate your budget, determine a monthly payment that you can reasonably afford, and then incorporate that information with the maturity and interest rate of a possible loan to determine the value of the potential loan. When this value is added to a saved amount of a down payment, you know the total amount that you can reasonably afford to spend on a new car. To review this process, consider the following case: Tim's Car-Buying Decisions Tim, who lives in Houston, is trying to decide between the following car models: He's currently accumulated a down payment of $2,000 and he has determined that he can afford maximum payments of $475 per month. His initial research on the current cost of auto loans has found that his lowest cost loan would be made by a bank and would require an interest rate of 6% five years. Given this information, the maximum amount that Tim can afford to pay for his new car is , and the most expensive car that he can afford to purchase, without stretching his budget, is: The Jeep Wrangler The Hyundai Accent The Volvo C70 The Mini Cooper However, he could upgrade to a more expensive model by undertaking several activities. Which of the following activities would allow this upgrade? Check all that apply. Take a better-paying job or another, or part-time, job that would give him the additional income to support a larger monthly payment Purchase the more expensive car now and then ask his boss for a raise next week Purchase an upgraded vehicle with fewer and less expensive options Go ahead and purchase the more expensive car; he deserves to be happy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts