Question: second problem, we assume that the firm has a peldod of nonconstant growth. Quantitative Problem 1: Assurne today is December 31, 2019. Baringten thdustries expects

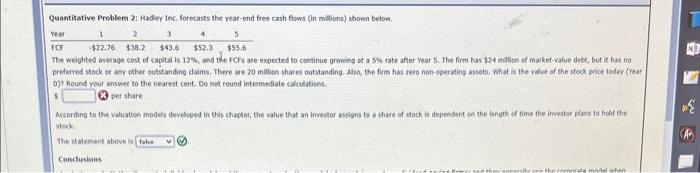

second problem, we assume that the firm has a peldod of nonconstant growth. Quantitative Problem 1: Assurne today is December 31, 2019. Baringten thdustries expects that its 2020 after-tax operating income [Earr(1 - T)] nill be $400 milion and is 2020 depredaticn expense will be 560 million. Barington's 2020 oross cacital expenditures are expected to be tioo millise and the change in its net operating woiking capital for 2020 will be $20 milich. The firm's free cash flow is expected to grow at a constant rate of 5% annualy. Assame that its free cahh fow occurs at the end of each rear. The firm's walghted average cost of capital is 6.7%; the market valoe of the company's debt is $2.2 biliony and the company has 190 millon shares of common stock outstanding. Tre firm has no preferred stock on its balance sheet and has no plans to use it for fuAure capital budoeting projects. Also, the firm has zero nen operating assets. Using the corporate valuation mode! what sheuld be the company's stode price today (December 31, 2019)? Do not round latermediake calculations, found veur answer to the nearest cent. per share Quantitative Problem 2: Hadey inc. forecasts the vear-end free cash fows (in mitions) shown below, The weightes average cost of capital is 12\%, and the FCFs are expected to continue growing at a $ mote after vear 5 . The firm has 524 millioh of market-value debe, but it fas no preferred stock or anr other cutstanding daims. There are 20 million shares outstanding. Also, the firm has rero noh-oberating assets. What in the yalue of the stock onice today (Year 0)? Reund your answer to the nearest cent, De not round intermediate calculations. (3) 5 ber share According to the valuation models develoged in this chaptec, the value that an liweisor asbons to a thare of atock is depenifent on the length of time the imvester placs to hold the sterk The thatemere above is Cosclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts