Question: second term is calleu The first term is called the systemic risk of the stock, and the analysis, typically on monthly The parameters for companies,

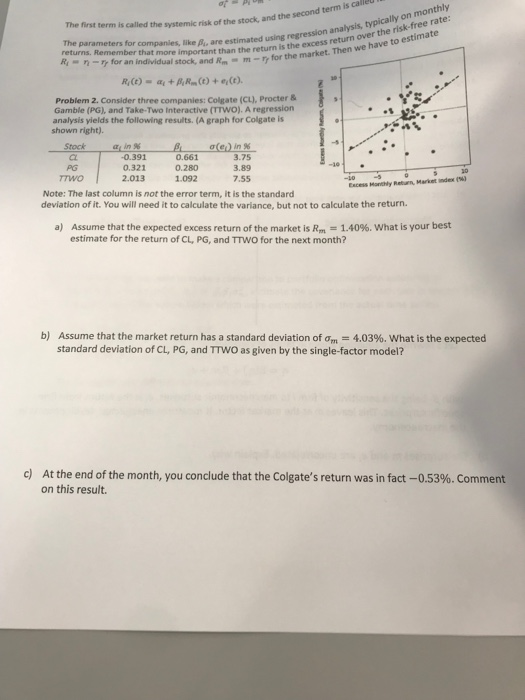

second term is calleu The first term is called the systemic risk of the stock, and the analysis, typically on monthly The parameters for companies, like Ai, are estimated using regression returns. Remember that more important than the return ithe he Problem 2. Consider three companies: Colgate (CL), Procter & Gamble (PG), and Take-Two Interactive (TTWO). A regression analysis yields the following results.(A graph for Colgate is shown right). Stock in% CL -0.391 0.661 3.75 0.321 0.280 1.092 PG 3.89 TTWO 2.013 7.55 Note: The last column is not the error term, it is the standard deviation of it. You will need it to calculate the variance, but not to calculate the return. a) Assume that the expected excess return of the market is Rm 1.40%. What is your best estimate for the return of CL, PG, and TTWO for the next month? Assume that the market return has a standard deviation of m-4.03%, what is the expected b) standard deviation of CL, PG, and TTWO as given by the single-factor model? c) At the end of the month, you conclude that the Colgate's return was in fact-0.53%. Comment on this result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts