Question: second time posting because it was completely wrong the first attempt. [The following information applies to the questions displayed below.] On January 1, when the

second time posting because it was completely wrong the first attempt.

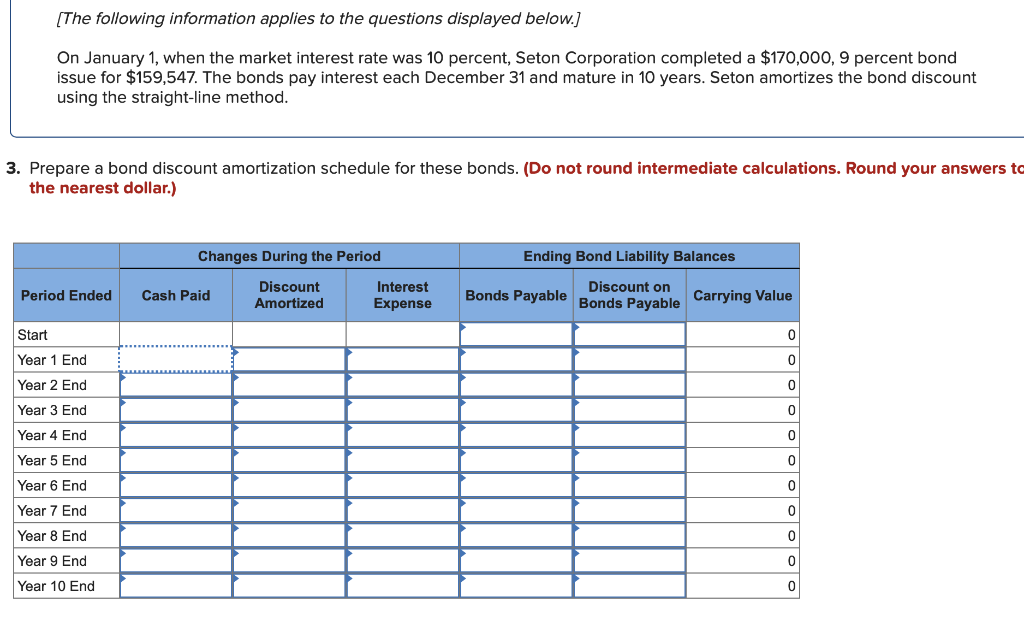

[The following information applies to the questions displayed below.] On January 1, when the market interest rate was 10 percent, Seton Corporation completed a $170,000, 9 percent bond issue for $159,547. The bonds pay interest each December 31 and mature in 10 years. Seton amortizes the bond discount using the straight-line method. 3. Prepare a bond discount amortization schedule for these bonds. (Do not round intermediate calculations. Round your answers to the nearest dollar.) Changes During the Period Ending Bond Liability Balances Period Ended Cash Paid Discount Amortized Interest Expense Bonds Payable Discount on Bonds Payable Carrying Value 0 0 0 Start Year 1 End Year 2 End Year 3 End Year 4 End Year 5 End Year 6 End 0 0 0 0 Year 7 End 0 Year 8 End 0 Year 9 End 0 Year 10 End 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts