Question: SECOND TIME POSTING. IF YOU ANSWERED LAST TIME STOP. DONT ANSWER AGAIN. YOU DID IT ALL WRONG. LIKE...SO WRONG. PLEASE ALL 3 QUESTIONS WERE ANSWERED

SECOND TIME POSTING. IF YOU ANSWERED LAST TIME STOP. DONT ANSWER AGAIN. YOU DID IT ALL WRONG. LIKE...SO WRONG. PLEASE ALL 3 QUESTIONS WERE ANSWERED BY THE SAME "EXPERT" ALL T\3 WRONG. JUST TO HELP YOU BETTER YOURSELF I AM POSTING THAT I NEED JUST TWO NUMBERS. AND FOR YOU TO RECONSIDER YOUR KNOWLEDGE ON THIS SUBJECT BECAUSE YOU GOT IT ALL WRONG.

I NEED JUST THE NUMBERS FOR STOCK CS AND PS AND EXPLANATIONS. THANKS

Playtown Corporation purchased 75 percent of Sandbox Corporation common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of the common shares of Sandbox held by the noncontrolling interest was $90,000. Sandbox's balance sheet contained the following balances:

referred Stock ($10 par value)$ 200,000Common Stock ($5 par value)150,000Retained Earnings210,000Total Stockholders' Equity$ 560,000

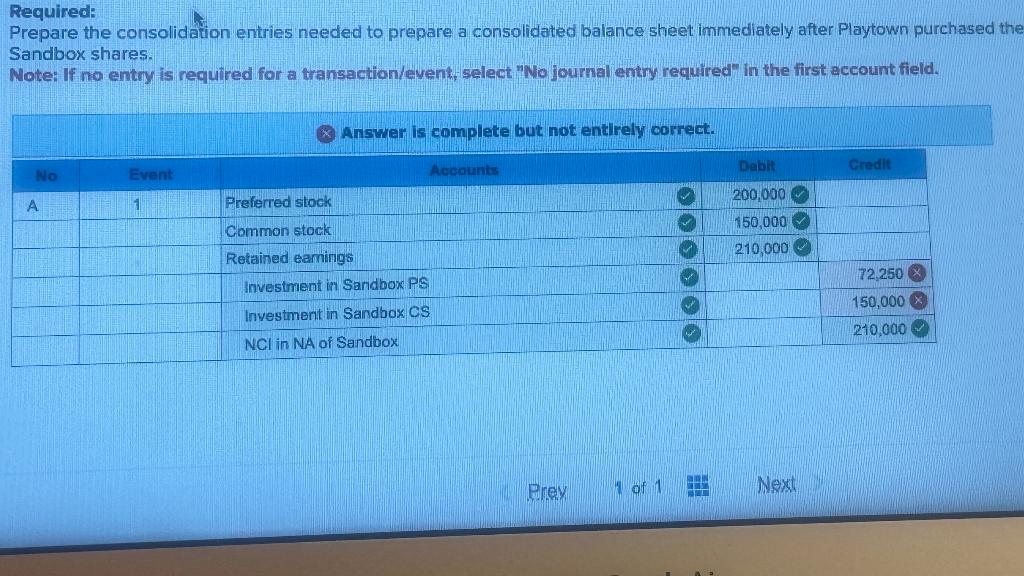

Required: Prepare the consolidation entries needed to prepare a consolidated balance sheet immediately after Playtown purchased the Sandbox shares. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Required: Prepare the consolidation entries needed to prepare a consolidated balance sheet immediately after Playtown purchased th Sandbox shares. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts