Question: SECOND TIME POSTING THIS, THE FIRST PERSON WAS WRONG AND REFUSED TO FIX IT. Exercise 16-7 (Algo) Temporary difference; future deductible amounts; taxable income given

SECOND TIME POSTING THIS, THE FIRST PERSON WAS WRONG AND REFUSED TO FIX IT.

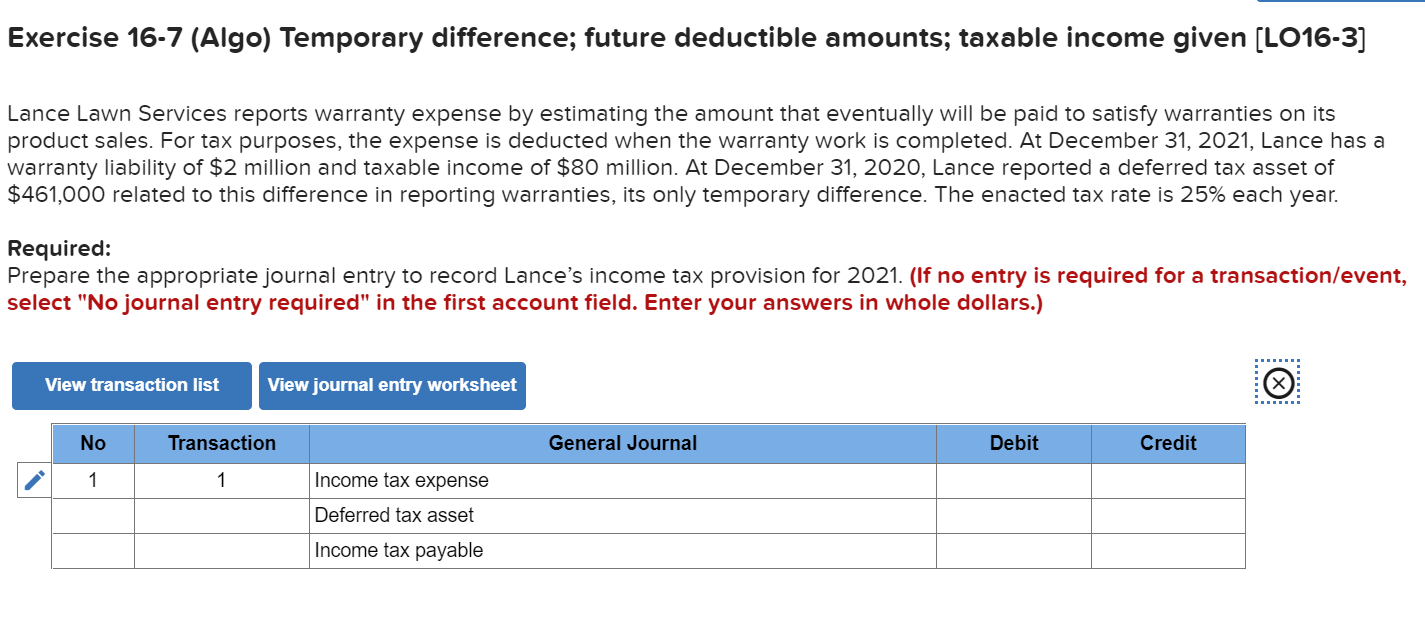

Exercise 16-7 (Algo) Temporary difference; future deductible amounts; taxable income given (L016-3] Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $80 million. At December 31, 2020, Lance reported a deferred tax asset of $461,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year. Required: Prepare the appropriate journal entry to record Lance's income tax provision for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 1 1 Income tax expense Deferred tax asset Income tax payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts