Question: SECTION 1 1 . 4 PROBLEM SET: CHAPTER REVIEW Determine whether the games are strietly determined. If the games are strictly determined, find the optimal

SECTION PROBLEM SET: CHAPTER REVIEW

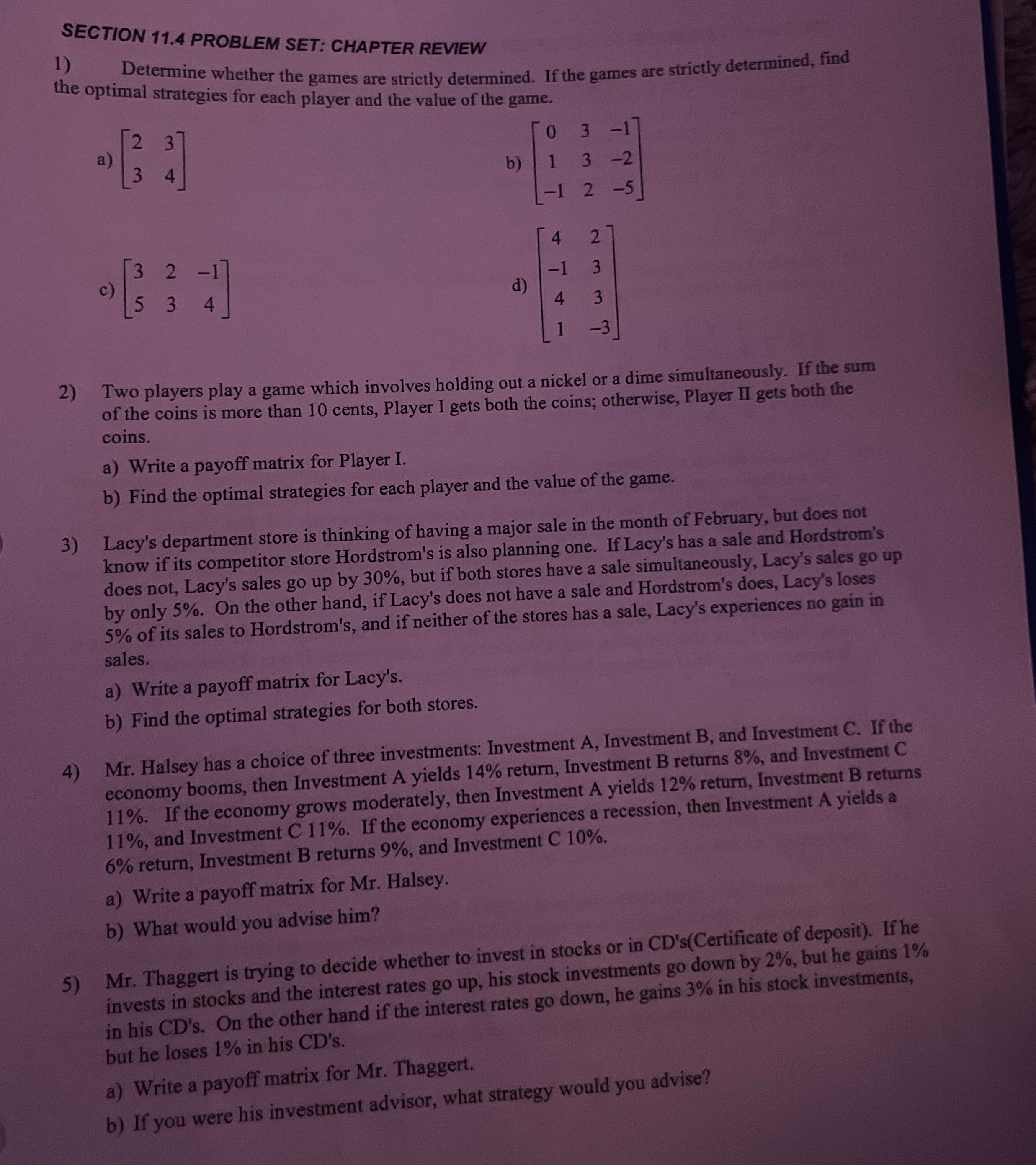

Determine whether the games are strietly determined. If the games are strictly determined, find the optimal strategies for each player and the value of the game.

a

b

c

d

Two players play a game which involves holding out a nickel or a dime simultaneously. If the sum of the coins is more than cents, Player I gets both the coins; otherwise, Player II gets both the coins.

a Write a payoff matrix for Player I.

b Find the optimal strategies for each player and the value of the game.

Lacy's department store is thinking of having a major sale in the month of February, but does not know if its competitor store Hordstrom's is also planning one. If Lacy's has a sale and Hordstrom's does not, Lacy's sales go up by but if both stores have a sale simultaneously, Lacy's sales go up by only On the other hand, if Lacy's does not have a sale and Hordstrom's does, Lacy's loses of its sales to Hordstrom's, and if neither of the stores has a sale, Lacy's experiences no gain in sales.

a Write a payoff matrix for Lacy's.

b Find the optimal strategies for both stores.

Mr Halsey has a choice of three investments: Investment Investment and Investment If the economy booms, then Investment A yields return, Investment B returns and Investment If the economy grows moderately, then Investment A yields return, Investment B returns and Investment If the economy experiences a recession, then Investment A yields a return, Investment B returns and Investment C

a Write a payoff matrix for Mr Halsey.

b What would you advise him?

Mr Thaggert is trying to decide whether to invest in stocks or in CDsCertificate of deposit If he invests in stocks and the interest rates go up his stock investments go down by but he gains in his CDs On the other hand if the interest rates go down, he gains in his stock investments, but he loses in his CDs

a Write a payoff matrix for Mr Thaggert.

b If you were his investment advisor, what strategy would you advise?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock