Question: Section 1 (40 pt., 5pt. each) The file Data_2013.XLS contains data through 1987 on new car sales and other economic variables. The variables are: Domestic

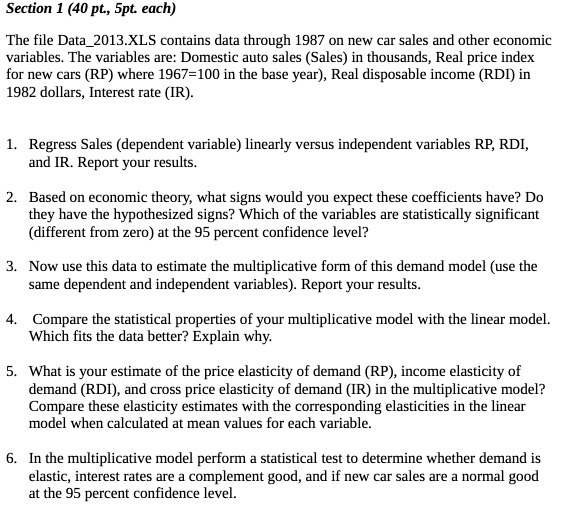

Section 1 (40 pt., 5pt. each) The file Data_2013.XLS contains data through 1987 on new car sales and other economic variables. The variables are: Domestic auto sales (Sales) in thousands, Real price index for new cars (RP) where 1967=100 in the base year), Real disposable income (RDI) in 1982 dollars, Interest rate (IR). 1. Regress Sales (dependent variable) linearly versus independent variables RP, RDI, and IR. Report your results. 2. Based on economic theory, what signs would you expect these coefficients have? Do they have the hypothesized signs? Which of the variables are statistically significant (different from zero) at the 95 percent confidence level? 3. Now use this data to estimate the multiplicative form of this demand model (use the same dependent and independent variables). Report your results. 4. Compare the statistical properties of your multiplicative model with the linear model. Which fits the data better? Explain why. 5. What is your estimate of the price elasticity of demand (RP), income elasticity of demand (RDI), and cross price elasticity of demand (IR) in the multiplicative model? Compare these elasticity estimates with the corresponding elasticities in the linear model when calculated at mean values for each variable. 6. In the multiplicative model perform a statistical test to determine whether demand is elastic, interest rates are a complement good, and if new car sales are a normal good at the 95 percent confidence level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts