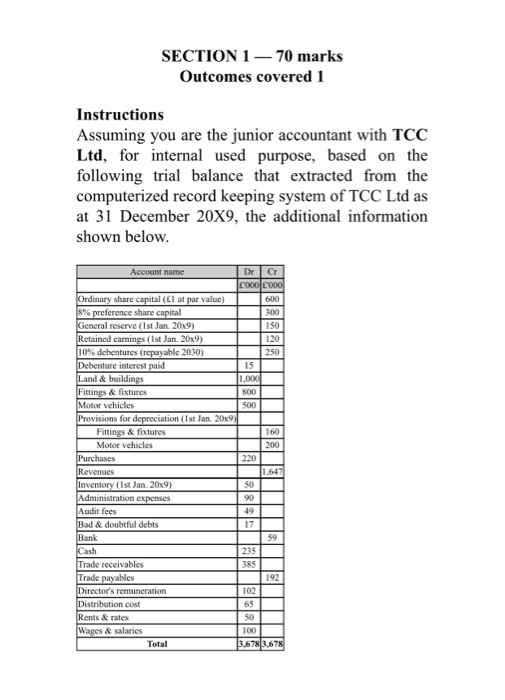

Question: SECTION 1 70 marks Outcomes covered 1 Instructions Assuming you are the junior accountant with TCC Ltd, for internal used purpose, based on the following

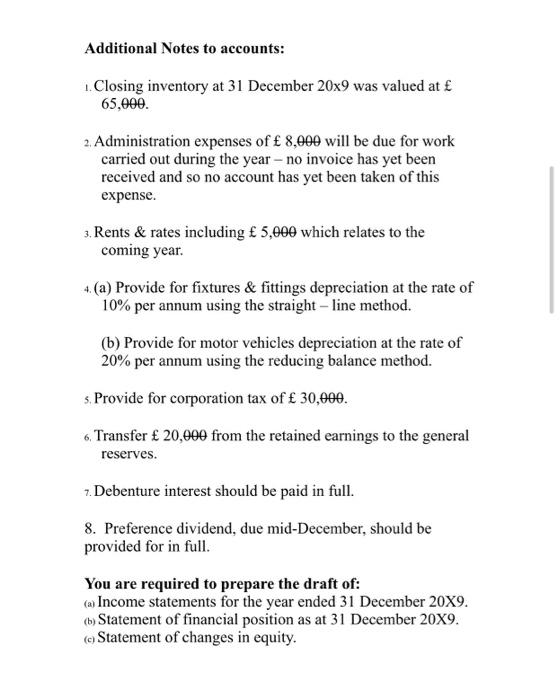

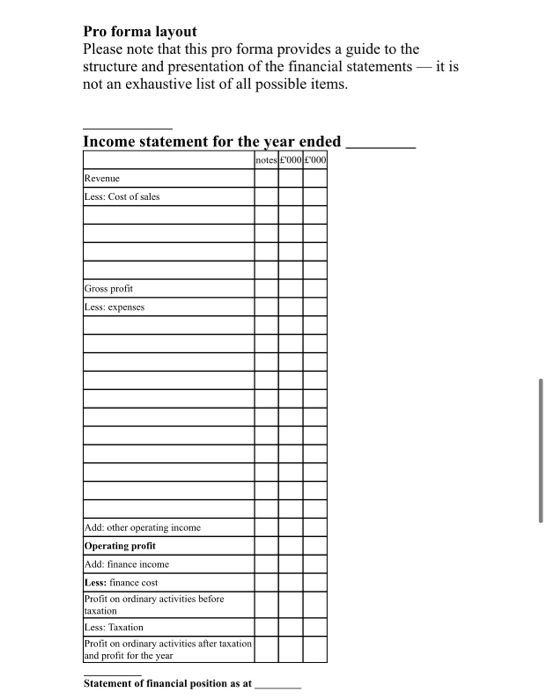

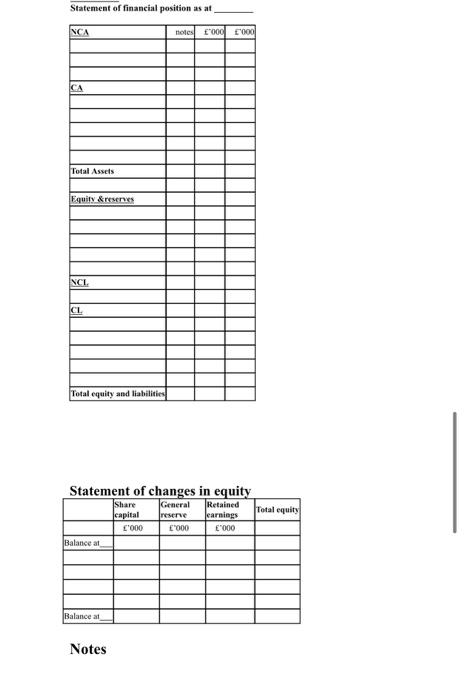

SECTION 1 70 marks Outcomes covered 1 Instructions Assuming you are the junior accountant with TCC Ltd, for internal used purpose, based on the following trial balance that extracted from the computerized record keeping system of TCC Ltd as at 31 December 20X9, the additional information shown below. Account name Dr Cr coolcool 600 300 150 120 250 15 1.000 800 500 160 200 220 Ordinary share capital (El at par value) s%preference share capital General reserve (Ist Jan. 20x9) Retained earnings (Ist Jan. 20x9) 10% debentures (repayable 2030) Debenture interest paid Land & buildings Fittings & fixtures Motor vehicles Provisions for depreciation (Ist Jan. 20x9 Fittings & fixtures Motor vehicles Purchases Revenues Inventory (Ist Jan. 20x9) Administration expenses Audit fees Bad & doubtful debts Bank Cash Trade receivables Trade payables Director's remuneration Distribution cost Rents & rates Wages & salaries Total 50 90 49 17 59 235 385 192 102 65 SO 100 3.678 3.678 Additional Notes to accounts: 1. Closing inventory at 31 December 20x9 was valued at 65,000. 2. Administration expenses of 8,000 will be due for work carried out during the year no invoice has yet been received and so no account has yet been taken of this expense. 3. Rents & rates including 5,000 which relates to the coming year. 4. (a) Provide for fixtures & fittings depreciation at the rate of 10% per annum using the straight-line method. (b) Provide for motor vehicles depreciation at the rate of 20% per annum using the reducing balance method. s. Provide for corporation tax of 30,000. 6. Transfer 20,000 from the retained earnings to the general reserves. 7. Debenture interest should be paid in full. 8. Preference dividend, due mid-December, should be provided for in full. You are required to prepare the draft of: (a) Income statements for the year ended 31 December 20X9. (b) Statement of financial position as at 31 December 20X9. (eStatement of changes in equity. Pro forma layout Please note that this pro forma provides a guide to the structure and presentation of the financial statements it is not an exhaustive list of all possible items. Income statement for the year ended notes &0000000 Revenue Less: Cost of sales Gross profit Less expenses Add: other operating income Operating profit Add: finance income Less: finance cost Profit on ordinary activities before taxation Less: Taxation Profit on ordinary activities after taxation and profit for the year Statement of financial position as at Statement of financial position as at NCA notes E'000 000 CA Total Assets Fquity &reserves NCL Total equity and liabilities Statement of changes in equity Share General Retained capital reserve earnings L'000 "000 E"000 Total equity Balance at Balance at Notes SECTION 1 70 marks Outcomes covered 1 Instructions Assuming you are the junior accountant with TCC Ltd, for internal used purpose, based on the following trial balance that extracted from the computerized record keeping system of TCC Ltd as at 31 December 20X9, the additional information shown below. Account name Dr Cr coolcool 600 300 150 120 250 15 1.000 800 500 160 200 220 Ordinary share capital (El at par value) s%preference share capital General reserve (Ist Jan. 20x9) Retained earnings (Ist Jan. 20x9) 10% debentures (repayable 2030) Debenture interest paid Land & buildings Fittings & fixtures Motor vehicles Provisions for depreciation (Ist Jan. 20x9 Fittings & fixtures Motor vehicles Purchases Revenues Inventory (Ist Jan. 20x9) Administration expenses Audit fees Bad & doubtful debts Bank Cash Trade receivables Trade payables Director's remuneration Distribution cost Rents & rates Wages & salaries Total 50 90 49 17 59 235 385 192 102 65 SO 100 3.678 3.678 Additional Notes to accounts: 1. Closing inventory at 31 December 20x9 was valued at 65,000. 2. Administration expenses of 8,000 will be due for work carried out during the year no invoice has yet been received and so no account has yet been taken of this expense. 3. Rents & rates including 5,000 which relates to the coming year. 4. (a) Provide for fixtures & fittings depreciation at the rate of 10% per annum using the straight-line method. (b) Provide for motor vehicles depreciation at the rate of 20% per annum using the reducing balance method. s. Provide for corporation tax of 30,000. 6. Transfer 20,000 from the retained earnings to the general reserves. 7. Debenture interest should be paid in full. 8. Preference dividend, due mid-December, should be provided for in full. You are required to prepare the draft of: (a) Income statements for the year ended 31 December 20X9. (b) Statement of financial position as at 31 December 20X9. (eStatement of changes in equity. Pro forma layout Please note that this pro forma provides a guide to the structure and presentation of the financial statements it is not an exhaustive list of all possible items. Income statement for the year ended notes &0000000 Revenue Less: Cost of sales Gross profit Less expenses Add: other operating income Operating profit Add: finance income Less: finance cost Profit on ordinary activities before taxation Less: Taxation Profit on ordinary activities after taxation and profit for the year Statement of financial position as at Statement of financial position as at NCA notes E'000 000 CA Total Assets Fquity &reserves NCL Total equity and liabilities Statement of changes in equity Share General Retained capital reserve earnings L'000 "000 E"000 Total equity Balance at Balance at Notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts