Question: Section 1. Another utilization of cash flow analysis is setting the bid price on a project. To calculate the bid price, we set the project

Section 1.

Another utilization of cash flow analysis is setting the bid price on a project. To calculate the bid price, we set the project NPV equal to zero and find the required price. Thus, the bid price represents a financial break-even level for the project. The technique for calculating a bid price can be extended to many other types of problems. Answer the following questions using the same technique as setting a bid price; that is, set the project NPV to zero and solve for the variable in question.

Guthrie Enterprises needs someone to supply it with 128,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you've decided to bid on the contract. It will cost you $950,000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that, in five years, this equipment can be salvaged for $78,000. Your fixed production costs will be $333,000 per year, and your variable production costs should be $11.10 per carton. You also need an initial investment in net working capital of $83,000. Assume your tax rate is 34 percent and you require a return of 10 percent on your investment.

Assuming that the price per carton is $17.80, find the quantity of cartons per year you need to supply to break even. (Do not round intermediate calculations and round your final answer to nearest whole number.)

Section 2.

Given the discussions we had during lecture one, use your understanding and knowledge gained from such lecture and answer the following questions. Kindly submit online, your appropriate answers

1) There is a conflict of interest between stockholders and managers. In theory, stockholders are expected to exercise control over managers through the annual meeting or the board of directors. In practice, why might these disciplinary mechanisms not work?

2. Stockholders can transfer wealth from bondholders through a variety of actions. How would the following actions by stockholders transfer wealth from bondholders?

? a. An increase in dividends

? b. A leveraged buyout

? c. Acquiring a risky business

? How would bondholders protect themselves against these actions?

3) There are some corporate strategists who have suggested that firms focus on maximizing market share rather than market prices. When might this strategy work, and when might it fail?

4) It is often argued that managers, when asked to maximize stock price, have to choose between being socially responsible and carrying out their fiduciary duty. Do you agree? Can you provide an example where social responsibility and firm value maximization go hand in hand?

CORPORATE FINANCE

Week Two-Four Lecture Assignments

Instruction

Given the discussions we had during lecture one, use your understanding and knowledge gained from such lecture and answer the following questions. Kindly submit online, your appropriate answers

Question 1

Aluworks Co. is expected to pay a $21.00 dividend next year. The dividend will decline by 10 percent annually for the following three years. In year 5, Aluworks will sell off assets worth $100 per share. The year 5 dividend, which includes a distribution of some of the proceeds of the asset sale, is expected to be $60. In year 6, the dividend is expected to decrease to $40 and will be maintained at $40 for one additional year. The dividend is then expected to grow by 5 percent annually thereafter. If the required rate of return is 12 percent, what is the value of one share of Aluworks?

Question 2

Baggai Enterprises has an ROA of 10 percent, retains 30 percent of earnings, and has an equity multiplier of 1.25. Mondale Enterprises also has an ROA of 10 percent, but it retains two-thirds of earnings and has an equity multiplier of 2.00.

1. What are the sustainable dividend growth rates for (A) Baggai Enterprises and (B)

Mondale Enterprises?

2. Identify the drivers of the difference in the sustainable growth rates of Baggai Enterprises and Mondale Enterprises.

Question 3 (Relative Valuation Approach)

Company A's EPS is $1.50. Its closest competitor, Company B, is trading at a P/E of

22. Assume the companies have a similar operating and financial profile.

a). If Company A's stock is trading at $37.50, what does that indicate about its value relative to Company B?

b). If we assume that Company A's stock should trade at about the same P/E as Company

B's stock, what will we estimate as an appropriate price for Company A's stock?

Question 4

Toyota Motor Corporation (TYO: 7203; NYSE: TM) is one of the world's largest vehicle manufacturers. The company's most recent fiscal year ended on 31 March 2008. In early May 2008, you are valuing Toyota stock, which closed at 5,480 on the previous day. You have used a free cash flow to equity (FCFE) model to value the company stock and have obtained a value of 6,122 for the stock. For ease of communication, you want to express your valuation in terms of a forward P/E based on your forecasted fiscal year 2009 EPS of 580. Toyota's fiscal year 2009 is from April 2008 through March 2009.

1. What is Toyota's justified P/E based on forecasted fundamentals?

2. Based on a comparison of the current price of 5,480 with your estimated intrinsic value of 6,122, the stock appears to be slightly undervalued. Use your answer to question 1 to state this evaluation in terms of P/Es.

Question 5

Joel Williams follows Sonoco Products Company (NYSE: SON), a manufacturer of paper and plastic packaging for both consumer and industrial use. SON appears to have a dividend policy of recognizing sustainable increases in the level of earnings with increases in dividends, keeping the dividend payout ratio within a range of 40 percent to 60 percent. Williams also notes: SON's most recent quarterly dividend (ex-dividend date: 15 August 2007) was $0.26, consistent with a current annual dividend of 4x $0.26 =$1.04 per year. SON's forecasted dividend growth rate is 6.0 percent per year. With a beta of 1.13, given an equity risk premium (expected excess return of equities over the risk-free rate, E [RM] - RF) of 4.5 percent and a risk-free rate (RF)of 5 percent, SON's required return on equity is r= RF + beta[E(RM) - RF]=5.0+1.13(4.5)=10.1 percent, using the capital asset pricing model (CAPM).

Williams believes the Gordon growth model may be an appropriate model for valuing SON.

1. Calculate the Gordon growth model value for SON stock.

2. The current market price of SON stock is $30.18. Using your answer to question 1, judge whether SON stock is fairly valued, undervalued, or overvalued.

Question 6

Vincent Nguyen, an analyst, is examining the stock of British Airways (London Stock Exchange: BAY) as of the beginning of 2008. He notices that the consensus forecast by analysts is that the stock will pay a ? 4 dividend per share in 2009 (based on 21 analysts) and a ? 5 dividend in 2010 (based on 10 analysts). Nguyen expects the price of the stock at the end of 2010 to be ? 250. He has estimated that the required rate of return on the stock is 11 percent. Assume all dividends are paid at the end of the year.

Required:

a) Using the DDM, estimate the value of BAY stock at the end of 2009.

b) Using the DDM, estimate the value of BAY stock at the end of 2008.

Part II.

Solve the following.

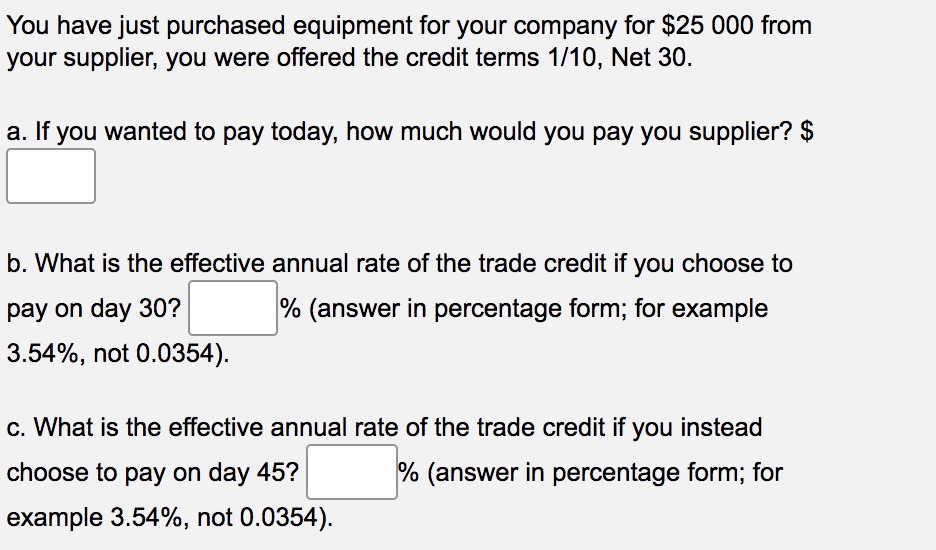

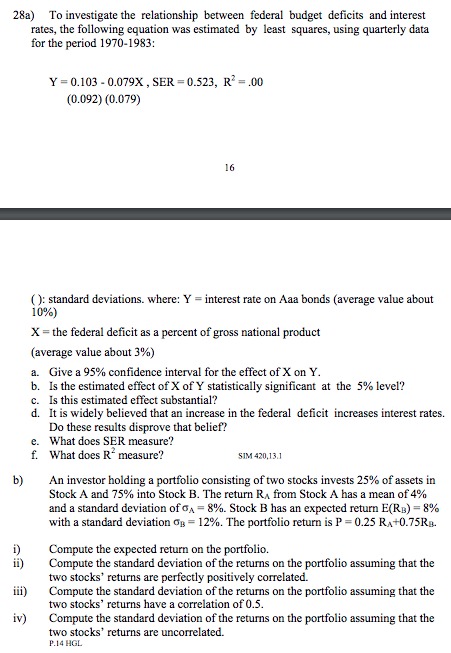

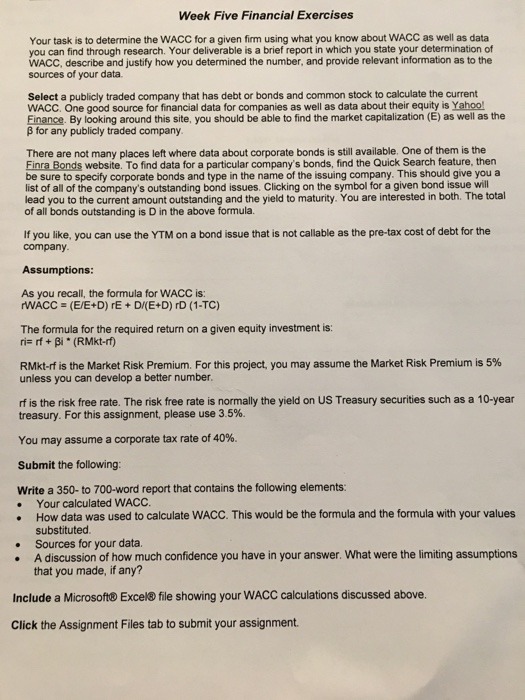

You have just purchased equipment for your company for $25 000 from your supplier, you were offered the credit terms 1(10, Net 30. a. If you wanted to pay today, how much would you pay you supplier? $ D b. What is the effective annual rate of the trade credit if you choose to pay on day 30? DVD (answer in percentage form; for example 3.54%, not 0.0354). c. What is the effective annual rate of the trade credit if you instead choose to pay on day 45? ':|% (answer in percentage form; for example 3.54%, not 0.0354). 28a) To investigate the relationship between federal budget deficits and interest rates, the following equation was estimated by least squares, using quarterly data for the period 1970-1983: Y = 0.103 - 0.079X , SER = 0.523, R' =.00 (0.092) (0.079) 16 (): standard deviations. where: Y = interest rate on Aaa bonds (average value about 10%) X = the federal deficit as a percent of gross national product (average value about 3%) a. Give a 95% confidence interval for the effect of X on Y. b. Is the estimated effect of X of Y statistically significant at the 5% level? C. Is this estimated effect substantial? d. It is widely believed that an increase in the federal deficit increases interest rates. Do these results disprove that belief? What does SER measure? f. What does R measure? SIM 420,13.1 b) An investor holding a portfolio consisting of two stocks invests 25% of assets in Stock A and 75% into Stock B. The return RA from Stock A has a mean of 4% and a standard deviation of GA = 8%. Stock B has an expected return E(Ry) = 8% with a standard deviation On = 12%. The portfolio return is P = 0.25 RA+0.75Ra. i) Compute the expected return on the portfolio. iD) Compute the standard deviation of the returns on the portfolio assuming that the two stocks' returns are perfectly positively correlated. iii) Compute the standard deviation of the returns on the portfolio assuming that the two stocks' returns have a correlation of 0.5. iv) Compute the standard deviation of the returns on the portfolio assuming that the two stocks' returns are uncorrelated. P.14 HGLWeek Five Financial Exercises Your task is to determine the WACC for a given firm using what you know about WACC as well as data you can find through research. Your deliverable is a brief report in which you state your determination of WACC, describe and justify how you determined the number, and provide relevant information as to the sources of your data. Select a publicly traded company that has debt or bonds and common stock to calculate the current WACC. One good source for financial data for companies as well as data about their equity is Yahoo! Finance. By looking around this site, you should be able to find the market capitalization (E) as well as the B for any publicly traded company. There are not many places left where data about corporate bonds is still available, One of them is the Finra Bonds website. To find data for a particular company's bonds, find the Quick Search feature, then be sure to specify corporate bonds and type in the name of the issuing company. This should give you a list of all of the company's outstanding bond issues. Clicking on the symbol for a given bond issue will lead you to the current amount outstanding and the yield to maturity. You are interested in both. The total of all bonds outstanding is D in the above formula. If you like, you can use the YTM on a bond issue that is not callable as the pre-tax cost of debt for the company. Assumptions: As you recall, the formula for WACC is: WACC = (E/E+D) rE + D/(E+D) rD (1-TC) The formula for the required return on a given equity investment is: ri= if + Bi * (RMkt-rf) RMkt-rf is the Market Risk Premium. For this project, you may assume the Market Risk Premium is 5% unless you can develop a better number. of is the risk free rate. The risk free rate is normally the yield on US Treasury securities such as a 10-year treasury. For this assignment, please use 3.5%. You may assume a corporate tax rate of 40%. Submit the following: Write a 350-to 700-word report that contains the following elements: Your calculated WACC. How data was used to calculate WACC. This would be the formula and the formula with your values substituted. Sources for your data. A discussion of how much confidence you have in your answer. What were the limiting assumptions that you made, if any? Include a Microsoft Excel file showing your WACC calculations discussed above. Click the Assignment Files tab to submit your assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts