Question: Section 1 Commercial B3 /20 Fill out a B3 using the information provided below. Importer Ted's Books 1234 Library Ave Bookcity. Ontario P5T 155 Business

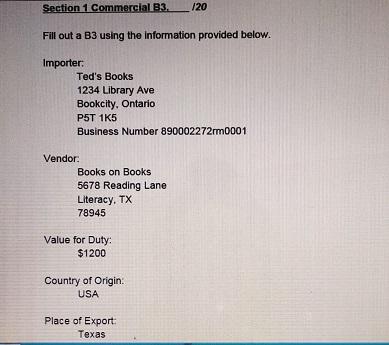

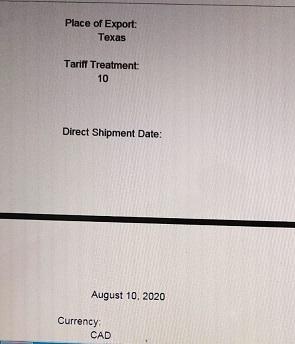

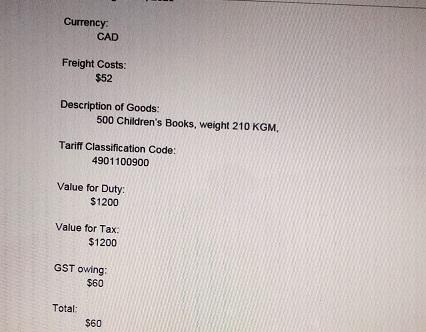

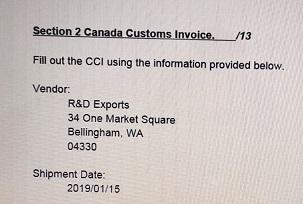

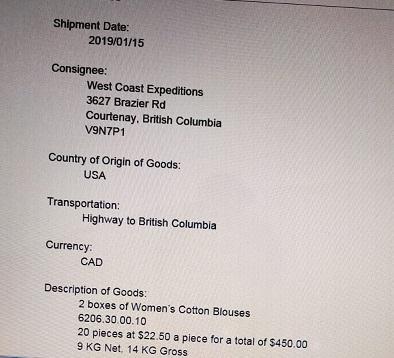

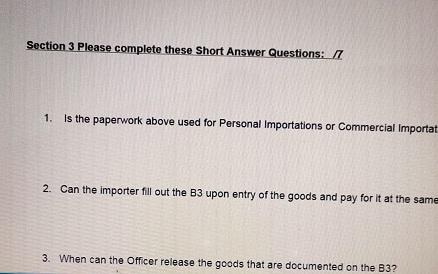

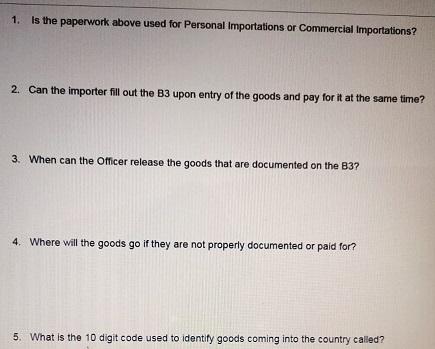

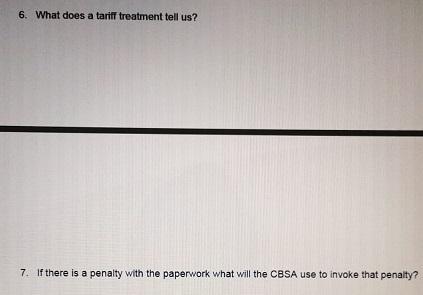

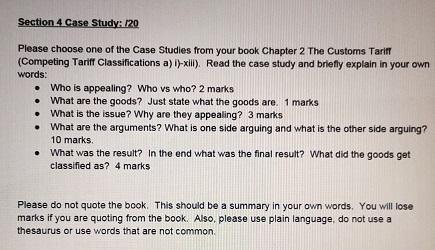

Section 1 Commercial B3 /20 Fill out a B3 using the information provided below. Importer Ted's Books 1234 Library Ave Bookcity. Ontario P5T 155 Business Number 890002272rm0001 Vendor: Books on Books 5678 Reading Lane Literacy. TX 78945 Value for Duty: $1200 Country of Origin: USA Place of Export Texas Place of Export: Texas Tariff Treatment 10 Direct Shipment Date: August 10, 2020 Currency CAD Currency CAD Freight Costs: $52 Description of Goods 500 Children's Books, weight 210 KGM, Tariff Classification Code: 4901100900 Value for Duty: $1200 Value for Tax $1200 GST owing: $60 Total: $60 Section 2 Canada Customs Invoice. /13 Fill out the CCI using the information provided below. Vendor: R&D Exports 34 One Market Square Bellingham, WA 04330 Shipment Date: 2019/01/15 Shipment Date: 2019/01/15 Consignee: West Coast Expeditions 3627 Brazier Rd Courtenay. British Columbia V9N7P1 Country of Origin of Goods: USA Transportation: Highway to British Columbia Currency: CAD Description of Goods: 2 boxes of Women's Cotton Blouses 6206.30.00.10 20 pieces at $22.50 a piece for a total of $450.00 9 KG Net, 14 KG Gross Section 3 Please complete these Short Answer Questions: 1. Is the paperwork above used for Personal Importations or Commercial Importat 2. Can the importer fill out the B3 upon entry of the goods and pay for it at the same 3. When can the Officer release the goods that are documented on the B3? 1. Is the paperwork above used for Personal Importations or Commercial Importations? 2. Can the importer fill out the B3 upon entry of the goods and pay for it at the same time? 3. When can the Officer release the goods that are documented on the B3? 4. Where will the goods go if they are not properly documented or paid for? 5. What is the 10 digit code used to identify goods coming into the country called? 6. What does a tarif treatment tell us? 7. If there is a penalty with the paperwork what will the CBSA use to invoke that penalty? Section 4 Case Study /20 Please choose one of the Case Studies from your book Chapter 2 The Customs Tarif (Competing Tariff Classifications a) i)-xill). Read the case study and briefly explain in your own words: Who is appealing? Who vs who? 2 marks . What are the goods? Just state what the goods are, 1 marks What is the issue? Why are they appealing? 3 marks What are the arguments? What is one side arguing and what is the other side arguing? 10 marks What was the result? In the end what was the final result? What did the goods get classified as? 4 marks Please do not quote the book. This should be a summary in your own words. You will lose marks if you are quoting from the book. Also, please use plain language, do not use a thesaurus or use words that are not common Section 1 Commercial B3 /20 Fill out a B3 using the information provided below. Importer Ted's Books 1234 Library Ave Bookcity. Ontario P5T 155 Business Number 890002272rm0001 Vendor: Books on Books 5678 Reading Lane Literacy. TX 78945 Value for Duty: $1200 Country of Origin: USA Place of Export Texas Place of Export: Texas Tariff Treatment 10 Direct Shipment Date: August 10, 2020 Currency CAD Currency CAD Freight Costs: $52 Description of Goods 500 Children's Books, weight 210 KGM, Tariff Classification Code: 4901100900 Value for Duty: $1200 Value for Tax $1200 GST owing: $60 Total: $60 Section 2 Canada Customs Invoice. /13 Fill out the CCI using the information provided below. Vendor: R&D Exports 34 One Market Square Bellingham, WA 04330 Shipment Date: 2019/01/15 Shipment Date: 2019/01/15 Consignee: West Coast Expeditions 3627 Brazier Rd Courtenay. British Columbia V9N7P1 Country of Origin of Goods: USA Transportation: Highway to British Columbia Currency: CAD Description of Goods: 2 boxes of Women's Cotton Blouses 6206.30.00.10 20 pieces at $22.50 a piece for a total of $450.00 9 KG Net, 14 KG Gross Section 3 Please complete these Short Answer Questions: 1. Is the paperwork above used for Personal Importations or Commercial Importat 2. Can the importer fill out the B3 upon entry of the goods and pay for it at the same 3. When can the Officer release the goods that are documented on the B3? 1. Is the paperwork above used for Personal Importations or Commercial Importations? 2. Can the importer fill out the B3 upon entry of the goods and pay for it at the same time? 3. When can the Officer release the goods that are documented on the B3? 4. Where will the goods go if they are not properly documented or paid for? 5. What is the 10 digit code used to identify goods coming into the country called? 6. What does a tarif treatment tell us? 7. If there is a penalty with the paperwork what will the CBSA use to invoke that penalty? Section 4 Case Study /20 Please choose one of the Case Studies from your book Chapter 2 The Customs Tarif (Competing Tariff Classifications a) i)-xill). Read the case study and briefly explain in your own words: Who is appealing? Who vs who? 2 marks . What are the goods? Just state what the goods are, 1 marks What is the issue? Why are they appealing? 3 marks What are the arguments? What is one side arguing and what is the other side arguing? 10 marks What was the result? In the end what was the final result? What did the goods get classified as? 4 marks Please do not quote the book. This should be a summary in your own words. You will lose marks if you are quoting from the book. Also, please use plain language, do not use a thesaurus or use words that are not common

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock