Question: Section 1 (Multiple Choice ) 5 Questions (1 Mark per question) Answer All Questions 1. Marcos Enterprises has three separate divisions. The firm allocates each

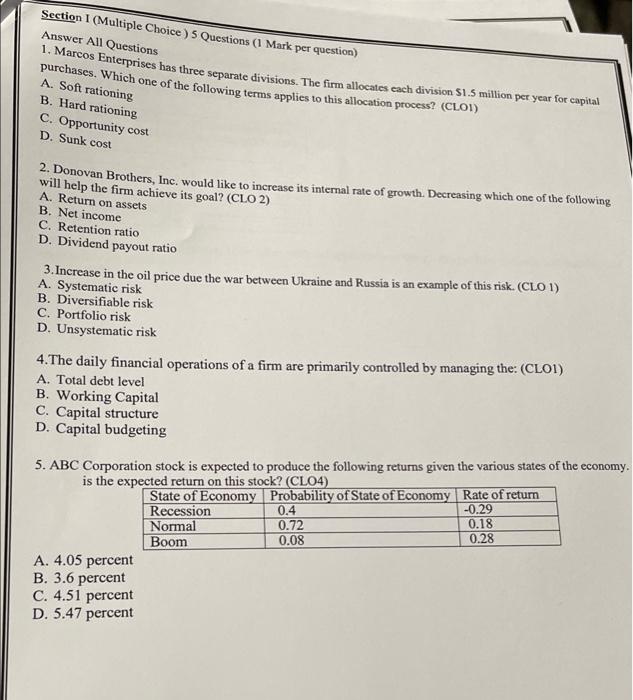

Section 1 (Multiple Choice ) 5 Questions (1 Mark per question) Answer All Questions 1. Marcos Enterprises has three separate divisions. The firm allocates each division S1.5 million per year for capital purchases. Which one of the following terms applies to this allocation process? (CLOT) A. Soft rationing B. Hard rationing C. Opportunity cost D. Sunk cost 2. Donovan Brothers, Inc. would like to increase its internal rate of growth. Decreasing which one of the following will help the firm achieve its goal? (CLO 2) A. Return on assets B. Net income C. Retention ratio D. Dividend payout ratio 3. Increase in the oil price due the war between Ukraine and Russia is an example of this risk. (CLO 1) A. Systematic risk B. Diversifiable risk C. Portfolio risk D. Unsystematic risk 4.The daily financial operations of a firm are primarily controlled by managing the: (CLOI) A. Total debt level B. Working Capital C. Capital structure D. Capital budgeting 5. ABC Corporation stock is expected to produce the following returns given the various states of the economy. is the expected return on this stock? (CL04) State of Economy Probability of State of Economy Rate of return Recession 0.4 -0.29 Normal 0.72 0.18 Boom 0.08 0.28 A. 4.05 percent B. 3.6 percent C. 4.51 percent D. 5.47 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts