Question: Section 1 - Q6 [Section 1 general information stays the same. It is repeated for your information.] The Ginsberg Co. issued 10-year bonds on April

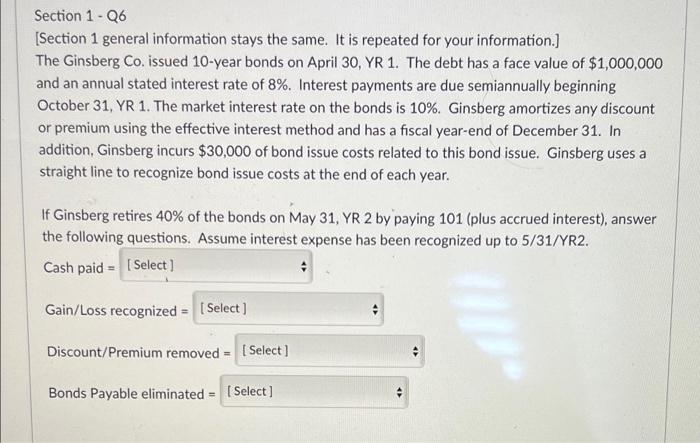

Section 1 - Q6 [Section 1 general information stays the same. It is repeated for your information.] The Ginsberg Co. issued 10-year bonds on April 30, YR 1. The debt has a face value of $1,000,000 and an annual stated interest rate of 8%. Interest payments are due semiannually beginning October 31, YR 1. The market interest rate on the bonds is 10%. Ginsberg amortizes any discount or premium using the effective interest method and has a fiscal year-end of December 31. In addition, Ginsberg incurs $30,000 of bond issue costs related to this bond issue. Ginsberg uses a straight line to recognize bond issue costs at the end of each year. If Ginsberg retires 40% of the bonds on May 31, YR 2 by paying 101 (plus accrued interest), answer the following questions. Assume interest expense has been recognized up to 5/31/YR2. Cash paid [Select] Gain/Loss recognized = [Select] Discount/Premium removed= [Select] Bonds Payable eliminated= [Select] #

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts