Question: Section 1 . Short answer / Discussion . Make sure your answers are specific enough to answer the entire question for full credit. Each question

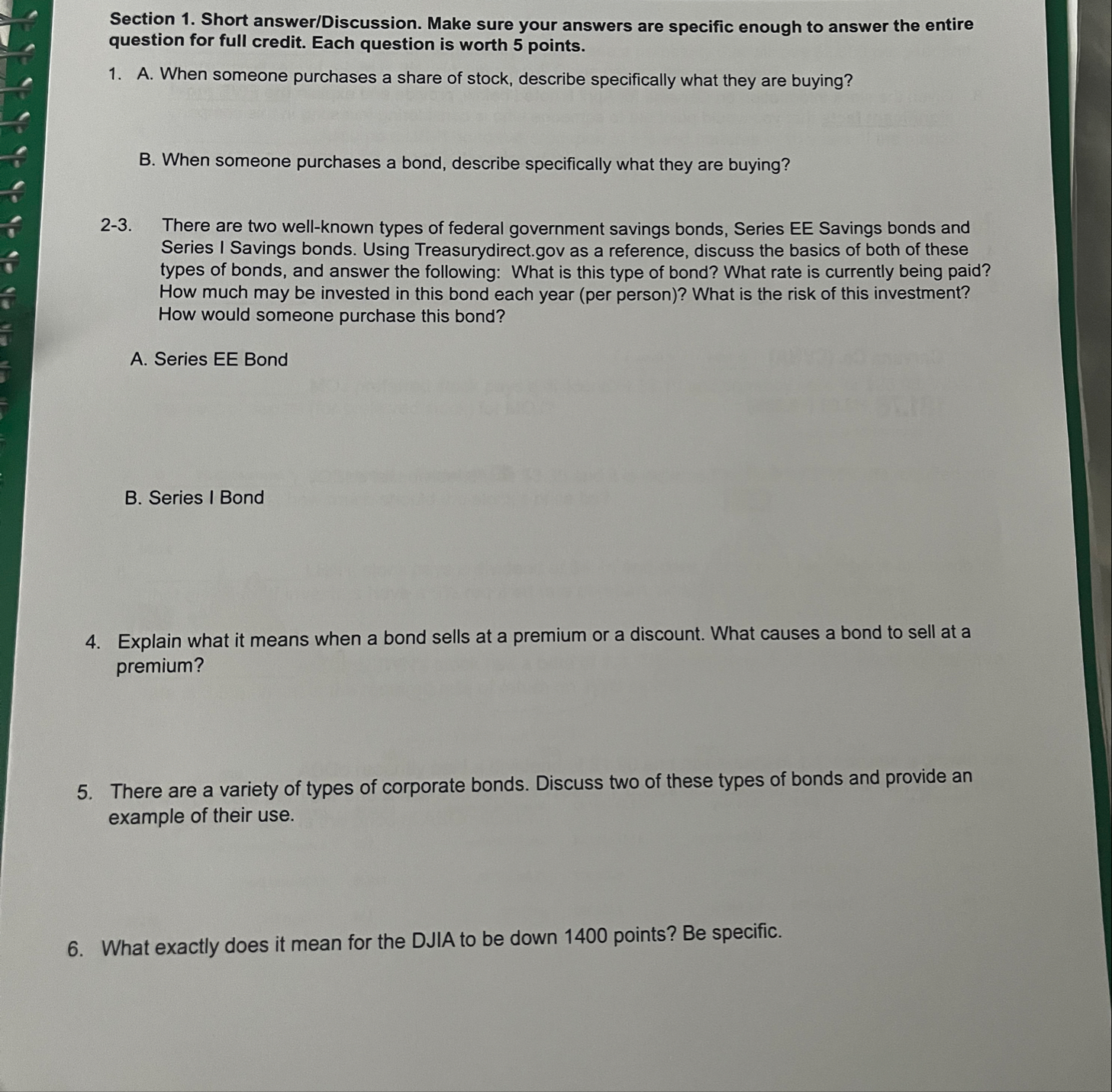

Section Short answerDiscussion Make sure your answers are specific enough to answer the entire question for full credit. Each question is worth points.

A When someone purchases a share of stock, describe specifically what they are buying?

B When someone purchases a bond, describe specifically what they are buying?

There are two wellknown types of federal government savings bonds, Series EE Savings bonds and Series I Savings bonds. Using

Treasurydirect.gov as a reference, discuss the basics of both of these types of bonds, and answer the following: What is this type of bond? What rate is currently being paid? How much may be invested in this bond each year per person What is the risk of this investment? How would someone purchase this bond?

A Series EE Bond

B Series I Bond

Explain what it means when a bond sells at a premium or a discount. What causes a bond to sell at a premium?

There are a variety of types of corporate bonds. Discuss two of these types of bonds and provide an example of their use.

What exactly does it mean for the DJIA to be down points? Be specific.

Section Stock and Bond Valuation Problems. points each. Please show all of your work and write your answers in the blank.

What is the price of a coupon bond that will mature in years, assuming the market return is percent?

Olivia has an opportunity to purchase a perpetuity that will pay $ per year and her required rate of return is How much will Olivia pay for this perpetuity?

Assume a USPI bond has a coupon of and matures in years. If the market rate on similar bonds is what is the price of this bond?

What is the yield to maturity on an year, coupon bond that is selling for $

What is the price of a bond that has a coupon, years left until maturity, and the market rate is

MOJ preferred stock pays a dividend of $ and currently sells for $ What is the cost of capital for preferred stock for MOJ?

JOBL's last dividend was $ and it is expected to grow by If the required rate of return is how much should the stock's price be

LBNs stock pays a dividend of $ and does not expect any change or growth in that aiviaena. II mivestors have a required rate of return, what is the price of the shares?

Assume JWNs stock has a beta of The market return is and the riskfree rate is vvirat is the required rate of return on JWN stock?

ABCo recently paid a dividend of $ and has a beta of Assume a growth rate of percent per year and a riskfree rate on Treasury bonds of percent. If the market rate of return is percent, what is the price of ABCo stock?

Section Fillinthe Blank. points each.

The average number of years until a bond's cash flows are received is called

relationship is one in which one party acts on behalf of another party.

stockholders have the right to vote to elect a board of directors, whereas stockholders do not have corporate voting rights.

A financial instrument that considers payments that continues forever is called a

The right of a debtor to retire a bond repay the lender prior to maturity is called

A series of periodic payments to retire a bond issue is called a

The document specifying the terms of a bond or debt issue is called the

The coupon on a bond is treated as a when calculating the present value of all future returns on a bond.

A key incentive to buy a municipal bond is

There is relationship between bond prices and interest rates.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock