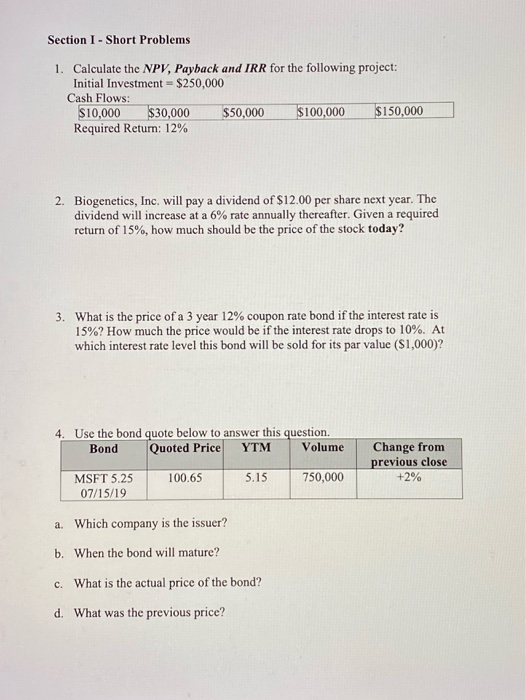

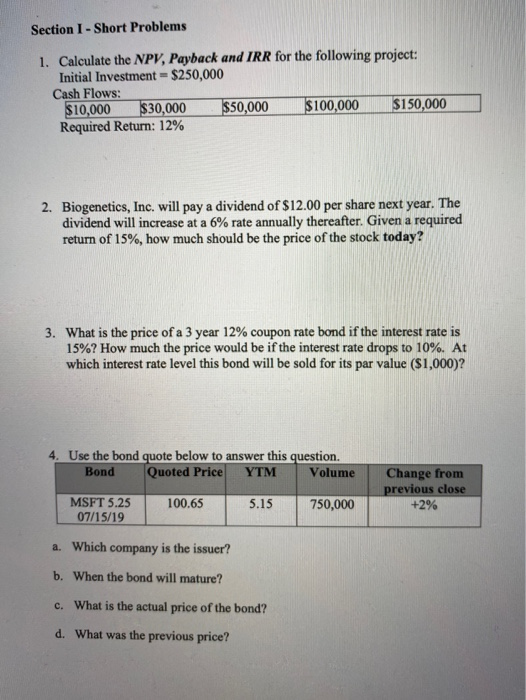

Question: Section 1 - Short Problems 1. Calculate the NPV, Payback and IRR for the following project: Initial Investment = $250,000 Cash Flows: $10,000 $30,000 $50,000

Section 1 - Short Problems 1. Calculate the NPV, Payback and IRR for the following project: Initial Investment = $250,000 Cash Flows: $10,000 $30,000 $50,000 $100,000 $150,000 Required Return: 12% 2. Biogenetics, Inc. will pay a dividend of $12.00 per share next year. The dividend will increase at a 6% rate annually thereafter. Given a required return of 15%, how much should be the price of the stock today? 3. What is the price of a 3 year 12% coupon rate bond if the interest rate is 15%? How much the price would be if the interest rate drops to 10%. At which interest rate level this bond will be sold for its par value (S1,000)? 4. Use the bond quote below to answer this question. Bond Quoted Price YTM Volume Change from previous close +2% 100.65 5.15 750,000 MSFT 5.25 07/15/19 a. Which company is the issuer? b. When the bond will mature? c. What is the actual price of the bond? d. What was the previous price? Section 1 - Short Problems 1. Calculate the NPV, Payback and IRR for the following project: Initial Investment = $250,000 Cash Flows: $10,000 $30,000 $50,000 $100,000 $150,000 Required Return: 12% 2. Biogenetics, Inc. will pay a dividend of $12.00 per share next year. The dividend will increase at a 6% rate annually thereafter. Given a required return of 15%, how much should be the price of the stock today? 3. What is the price of a 3 year 12% coupon rate bond if the interest rate is 15%? How much the price would be if the interest rate drops to 10%. At which interest rate level this bond will be sold for its par value ($1,000)? 4. Use the bond quote below to answer this question. Bond Quoted Price YTM Volume Change from previous close +2% MSFT 5.25 07/15/19 100.65 5.15 750,000 a. Which company is the issuer? b. When the bond will mature? c. What is the actual price of the bond? d. What was the previous price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts