Question: Section 11: Problem Solving-Fill in the Blanks (Maximum Points = 28) Note: Write your answer in clear and legible handwriting in the blank for the

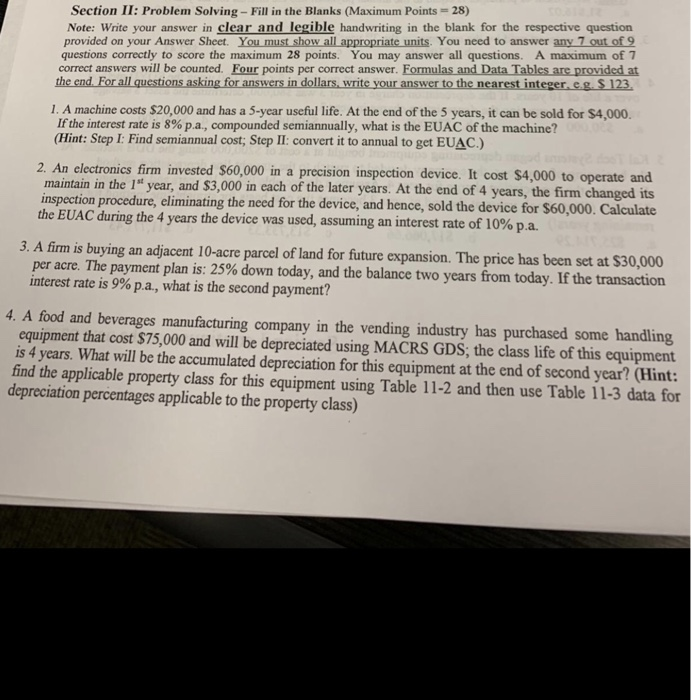

Section 11: Problem Solving-Fill in the Blanks (Maximum Points = 28) Note: Write your answer in clear and legible handwriting in the blank for the respective question provided on your Answer Sheet. You must show all appropriate units. You need to answer any 7 out of 9 questions correctly to score the maximum 28 points. You may answer all questions. A maximum of 7 correct answers will be counted. Four points per correct answer. Formulas and Data Tables are provided at the end For all questions asking for answers in dollars, write your answer to the nearest integer cg. S123 1. A machine costs $20,000 and has a 5-year useful life. At the end of the 5 years, it can be sold for $4,000 Ifthe interest rate is 8% p.a., compounded semiannually, what is the EUAC of the machine? (Hint: Step I: Find semiannual cost, Step II: convert it to annual to get EUAC.) An clectronics firm invested $60,000 in a precision inspection device. It cost $4,000 to operate and maintain in the 1 year, and $3,000 in each of the later years. At the end of 4 years, the firm changed its inspection procedure, eliminating the need for the device, and hence, sold the device for $60,000. Calculate the EUC during the 4 years the device was used, assuming an interest rate of 10% pa. 3. A firm is buying an adjacent 10-acre parcel of land for future expansion. The price has been set at $30,000 per acre. The payment plan is: 25% down today, and the balance two years from today. If the transaction interest rate is 9% pa, what is the second payment? 4. A food and beverages manufacturing company in the vending industry has purchased some handling equipment that cost $75,000 and will be depreciated using MACRS GDS, the class life of this equipment is 4 years. What will be the accumulated depreciation for this equipment at the end of second year? (Hint: find the applicable property class for this equipment using Table 11-2 and then use Table 11-3 data for depreciation percentages applicable to the property class) Section 11: Problem Solving-Fill in the Blanks (Maximum Points = 28) Note: Write your answer in clear and legible handwriting in the blank for the respective question provided on your Answer Sheet. You must show all appropriate units. You need to answer any 7 out of 9 questions correctly to score the maximum 28 points. You may answer all questions. A maximum of 7 correct answers will be counted. Four points per correct answer. Formulas and Data Tables are provided at the end For all questions asking for answers in dollars, write your answer to the nearest integer cg. S123 1. A machine costs $20,000 and has a 5-year useful life. At the end of the 5 years, it can be sold for $4,000 Ifthe interest rate is 8% p.a., compounded semiannually, what is the EUAC of the machine? (Hint: Step I: Find semiannual cost, Step II: convert it to annual to get EUAC.) An clectronics firm invested $60,000 in a precision inspection device. It cost $4,000 to operate and maintain in the 1 year, and $3,000 in each of the later years. At the end of 4 years, the firm changed its inspection procedure, eliminating the need for the device, and hence, sold the device for $60,000. Calculate the EUC during the 4 years the device was used, assuming an interest rate of 10% pa. 3. A firm is buying an adjacent 10-acre parcel of land for future expansion. The price has been set at $30,000 per acre. The payment plan is: 25% down today, and the balance two years from today. If the transaction interest rate is 9% pa, what is the second payment? 4. A food and beverages manufacturing company in the vending industry has purchased some handling equipment that cost $75,000 and will be depreciated using MACRS GDS, the class life of this equipment is 4 years. What will be the accumulated depreciation for this equipment at the end of second year? (Hint: find the applicable property class for this equipment using Table 11-2 and then use Table 11-3 data for depreciation percentages applicable to the property class)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts