Question: Section 2: Accounting Applications How does Choice Candy determine the cost of a candy bar? Assume that one of Choice Candy's factories produces 50-pound blocks

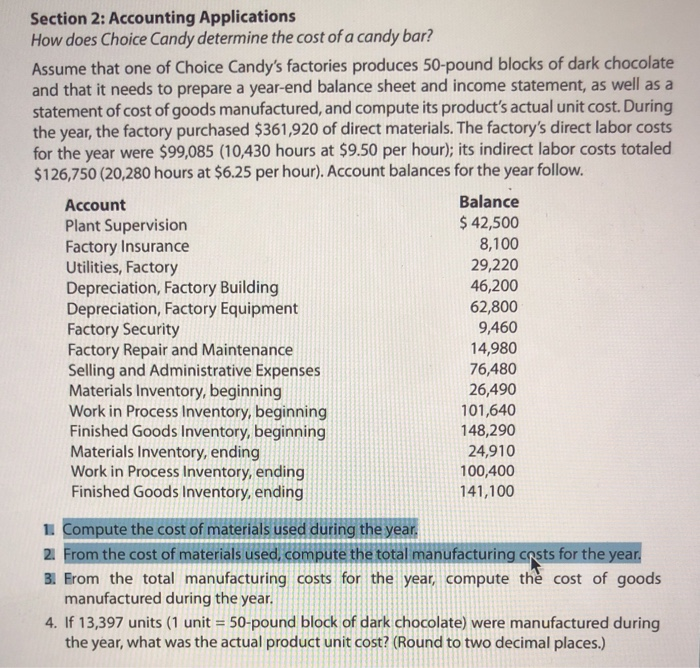

Section 2: Accounting Applications How does Choice Candy determine the cost of a candy bar? Assume that one of Choice Candy's factories produces 50-pound blocks of dark chocolate and that it needs to prepare a year-end balance sheet and income statement, as well as a statement of cost of goods manufactured, and compute its product's actual unit cost. During the year, the factory purchased $361,920 of direct materials. The factory's direct labor costs for the year were $99,085 (10,430 hours at $9.50 per hour); its indirect labor costs totaled $126,750 (20,280 hours at $6.25 per hour). Account balances for the year follow. Account Balance Plant Supervision $ 42,500 Factory Insurance 8,100 Utilities, Factory 29,220 Depreciation, Factory Building 46,200 Depreciation, Factory Equipment 62,800 Factory Security 9,460 Factory Repair and Maintenance 14,980 Selling and Administrative Expenses 76,480 Materials Inventory, beginning 26,490 Work in Process Inventory, beginning 101,640 Finished Goods Inventory, beginning 148,290 Materials Inventory, ending 24,910 Work in Process Inventory, ending 100,400 Finished Goods Inventory, ending 141,100 1. Compute the cost of materials used during the year. 2. From the cost of materials used, compute the total manufacturing costs for the year. 31 From the total manufacturing costs for the year, compute the cost of goods manufactured during the year. 4. If 13,397 units (1 unit = 50-pound block of dark chocolate) were manufactured during the year, what was the actual product unit cost? (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts