Question: Section 2: Calculations Show all calculations made for complete marks. (26 marks total) Calculate how much income tax you will pay if you live in

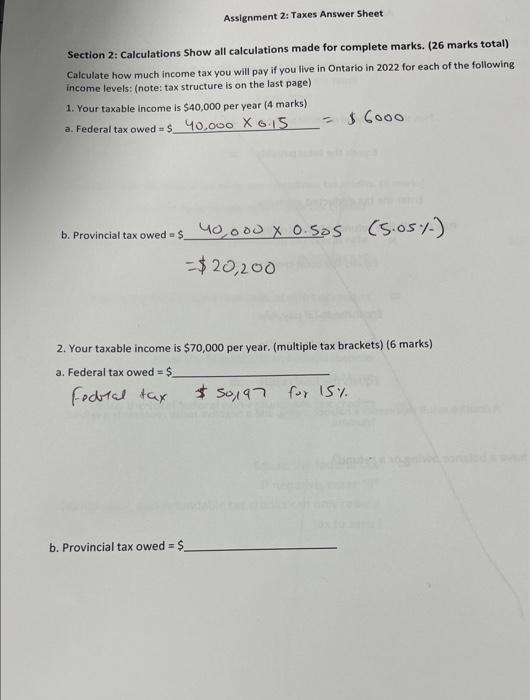

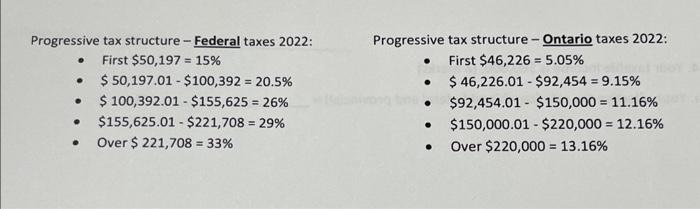

Section 2: Calculations Show all calculations made for complete marks. (26 marks total) Calculate how much income tax you will pay if you live in Ontario in 2022 for each of the following income levels: (note: tax structure is on the last page) 1. Your taxable income is $40,000 per year ( 4 marks) a. Federal tax owed =$40,0000.15=$6000 b. Provincial tax owed =$40,0000.505(5.05%) =$20,200 2. Your taxable income is $70,000 per year. (multiple tax brackets) (6 marks) a. Federal tax owed =$ fodval tax \$ so, 97 for 15% b. Provincial tax owed =$ Progressive tax structure - Federal taxes 2022: Progressive tax structure - Ontario taxes 2022: - First $50,197=15% - First $46,226=5.05% - $50,197.01$100,392=20.5% - $46,226.01$92,454=9.15% - $100,392.01$155,625=26% - $92,454.01$150,000=11.16% - $155,625.01$221,708=29% - $150,000.01$220,000=12.16% - Over $221,708=33% - Over $220,000=13.16%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts