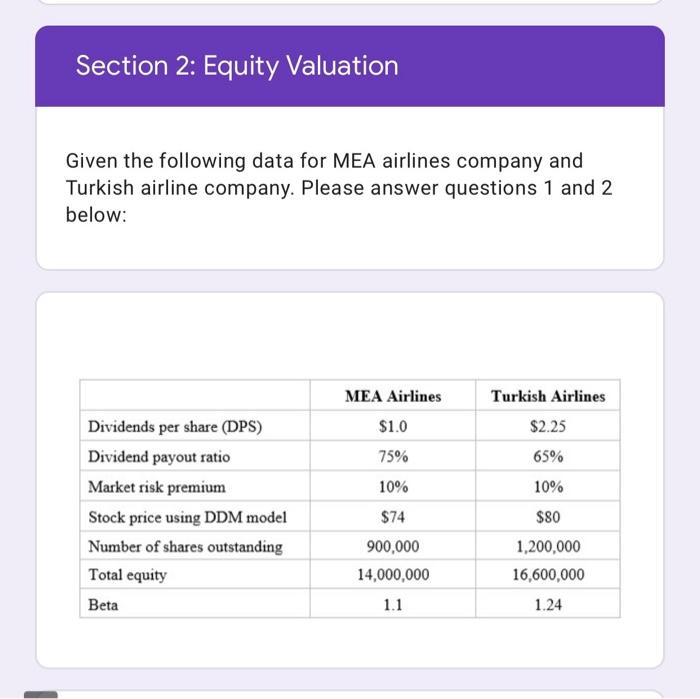

Question: Section 2: Equity Valuation Given the following data for MEA airlines company and Turkish airline company. Please answer questions 1 and 2 below: : Turkish

Section 2: Equity Valuation Given the following data for MEA airlines company and Turkish airline company. Please answer questions 1 and 2 below: : Turkish Airlines $2.25 65% Dividends per share (DPS) Dividend payout ratio Market risk premium Stock price using DDM model Number of shares outstanding Total equity Beta MEA Airlines $1.0 75% 10% $74 900,000 14,000,000 1.1 10% $80 1,200,000 16,600,000 1.24 2. The market capitalization rate (r) of Turkish airline company exceeds that of MEA airlines company by: OA) 11.8% B) 3.5% C) 8.6% D) 8.2% OE) None of the above. Page 4 of 6 Back Next Clear form Never submit passwords through Google Forms. This form was created inside of Lebanese International University. Report Abuse Google Forms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts