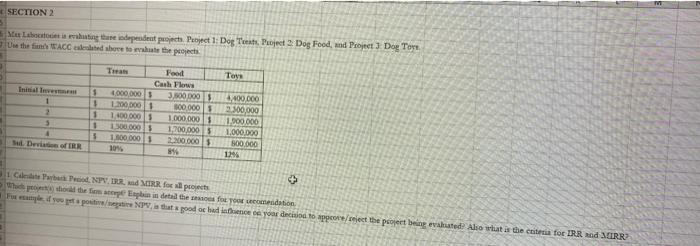

Question: SECTION 2 Labout the dependent Pject 1: Dog Pet 2 Dog Food and ProtDog Tors Uue the fame ACC aleated so that the posts Tone

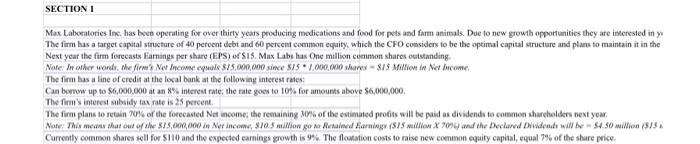

SECTION 2 Labout the dependent Pject 1: Dog Pet 2 Dog Food and ProtDog Tors Uue the fame ACC aleated so that the posts Tone 1 2 3 1 1 1 5 Team Food Cash Flows 4 000 000 3. ODOOS 1.200.000 300 000 14000000 1.000.000 1.300.000 1.700.000 1.800.000 2.300.000 10% 89 4400 000 2.300,000 1.000.000 1.000.000 500.000 124 Sul De RR 1 Cabedah.P. 132. MR. for all projects Weefs Espais detalhes for mendation Puppe istodoc bud fonce your decisions to appeare/reject the project being evaluated Also wlut entra for IRR od MIRE SECTION 1 Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in The firm has a target capital structure of 40 percent debt and 60 percent common equity, which the CFO considers to be the optimal capital structure and plans to maintain it in the Next year the firm forecasts Kamings per share (EPS) of SIS. Max Labs has one million common shares outstanding Note: I other words. Me firm's Net Incompuls $15.000.000 since $15 1.000.000 sares - $15 Million in Net Income The firm has a line of credit at the local bank at the following interest rates Can bomow up to $6,000,000 at an 8% interest rate the tate goes to 10% for amounts above $6,000,000 The firm's interest subsidy tax rate is 25 percent The firm plans to retain 70% of the forecasted Net income, the remaining 80% of the estimated profits will be paid as dividends to common shareholders next year Note: This means that out of the $75,000,000 in Ner Income $70.3 wow go to Named Earning (375 million X7014) and the Declared Dividend will be $4.50 willon (513 Currently common shares sell for 5110 and the expected earnings growth is 9%. The flotation costs to raise new common equity capital, equal 7% of the share pice. SECTION 2 Labout the dependent Pject 1: Dog Pet 2 Dog Food and ProtDog Tors Uue the fame ACC aleated so that the posts Tone 1 2 3 1 1 1 5 Team Food Cash Flows 4 000 000 3. ODOOS 1.200.000 300 000 14000000 1.000.000 1.300.000 1.700.000 1.800.000 2.300.000 10% 89 4400 000 2.300,000 1.000.000 1.000.000 500.000 124 Sul De RR 1 Cabedah.P. 132. MR. for all projects Weefs Espais detalhes for mendation Puppe istodoc bud fonce your decisions to appeare/reject the project being evaluated Also wlut entra for IRR od MIRE SECTION 1 Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in The firm has a target capital structure of 40 percent debt and 60 percent common equity, which the CFO considers to be the optimal capital structure and plans to maintain it in the Next year the firm forecasts Kamings per share (EPS) of SIS. Max Labs has one million common shares outstanding Note: I other words. Me firm's Net Incompuls $15.000.000 since $15 1.000.000 sares - $15 Million in Net Income The firm has a line of credit at the local bank at the following interest rates Can bomow up to $6,000,000 at an 8% interest rate the tate goes to 10% for amounts above $6,000,000 The firm's interest subsidy tax rate is 25 percent The firm plans to retain 70% of the forecasted Net income, the remaining 80% of the estimated profits will be paid as dividends to common shareholders next year Note: This means that out of the $75,000,000 in Ner Income $70.3 wow go to Named Earning (375 million X7014) and the Declared Dividend will be $4.50 willon (513 Currently common shares sell for 5110 and the expected earnings growth is 9%. The flotation costs to raise new common equity capital, equal 7% of the share pice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts