Question: SECTION 2: LONG QUESTION [27 Marks] Reba Tech (REBA) sells computer software packages, including license renewals and provides clients with online support. The company was

![SECTION 2: LONG QUESTION [27 Marks] Reba Tech (\"REBA\") sells computer](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6700d95764e82_8866700d956e1dbf.jpg)

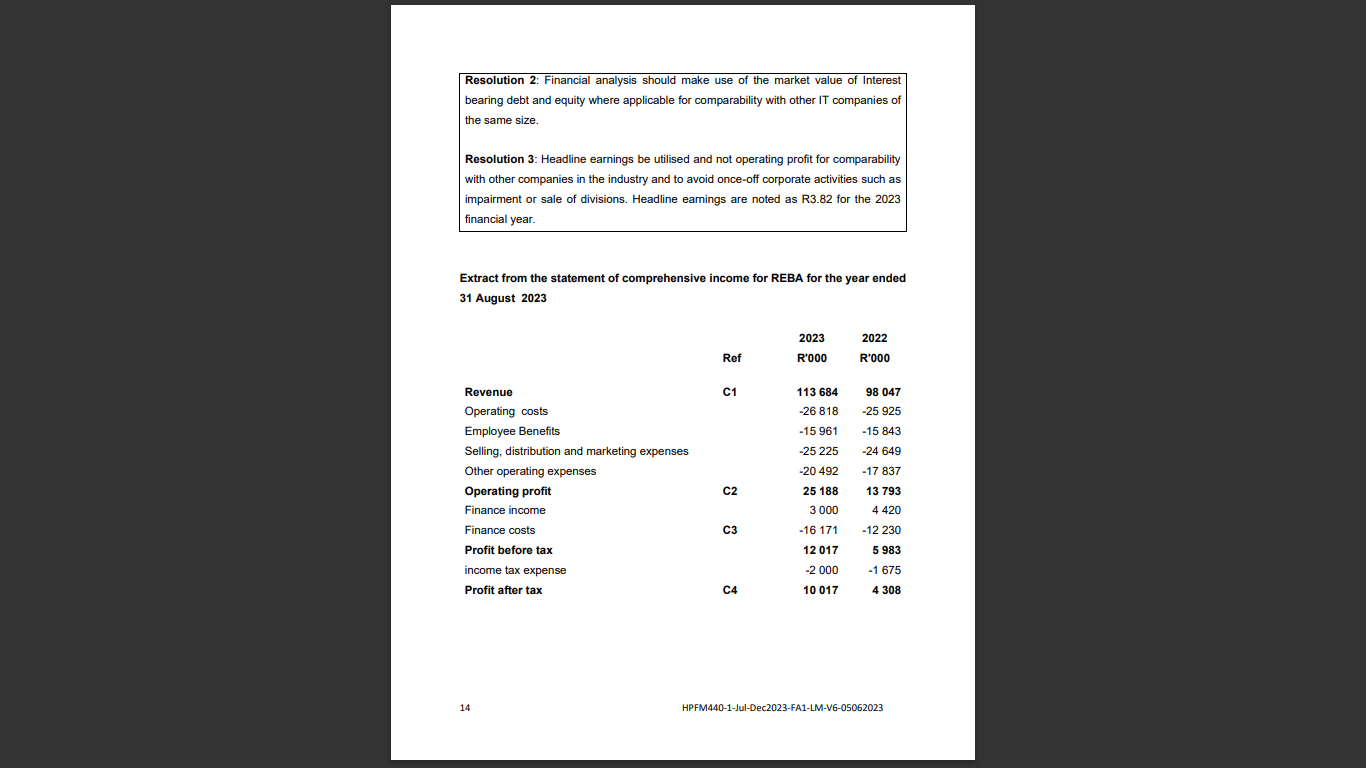

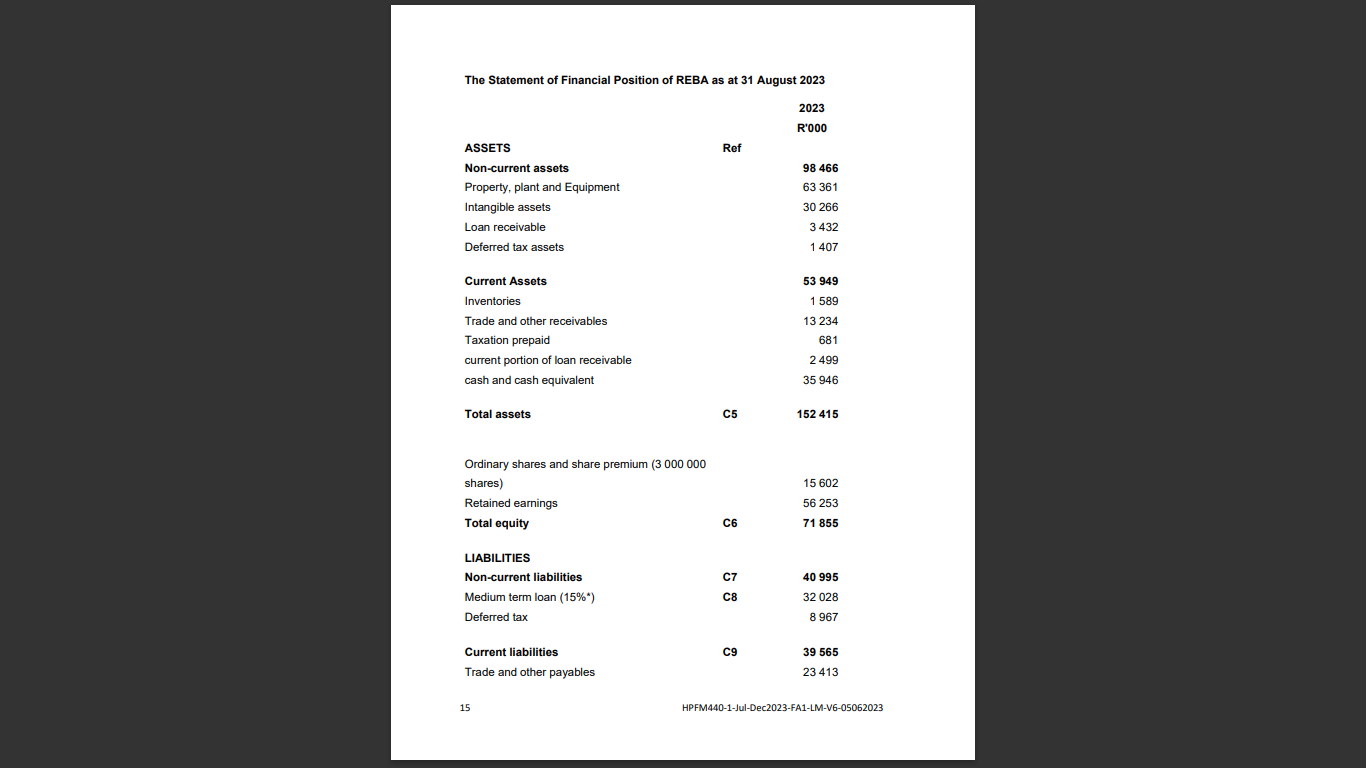

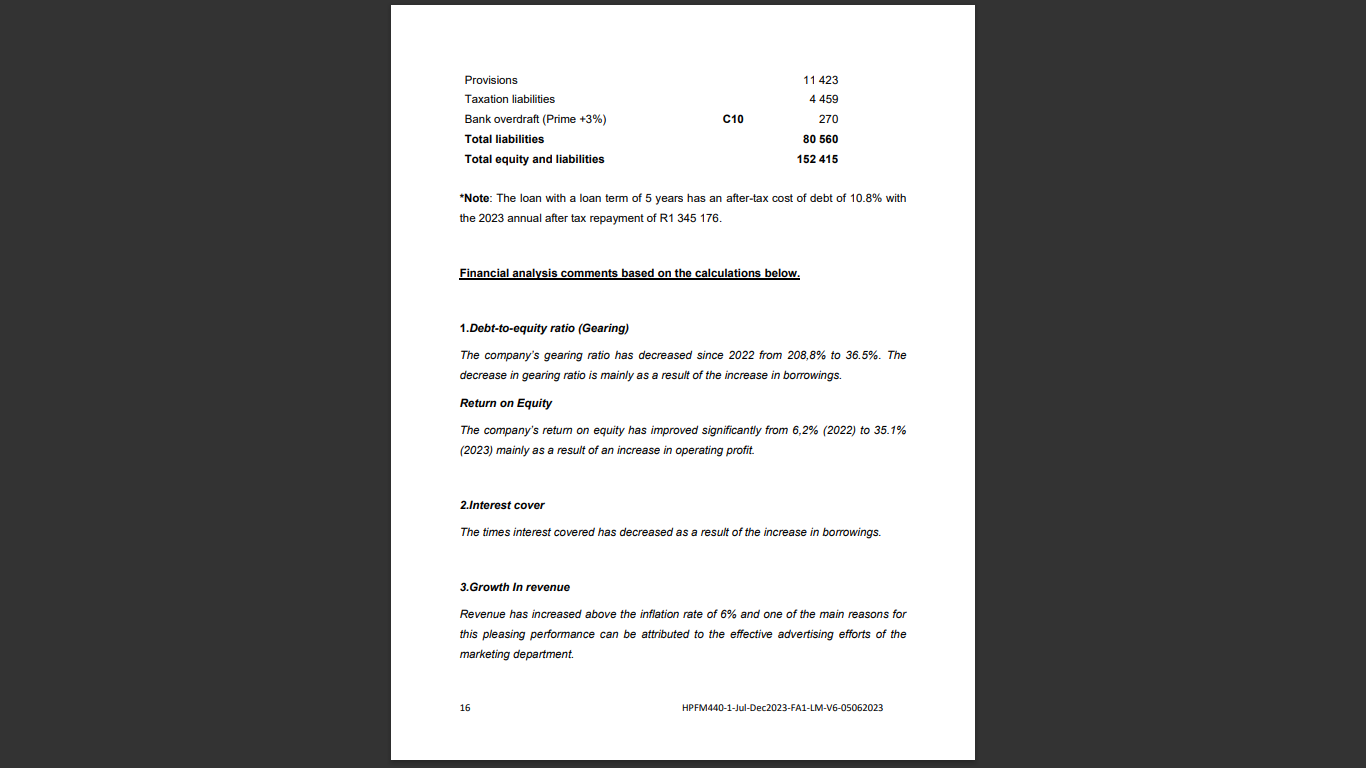

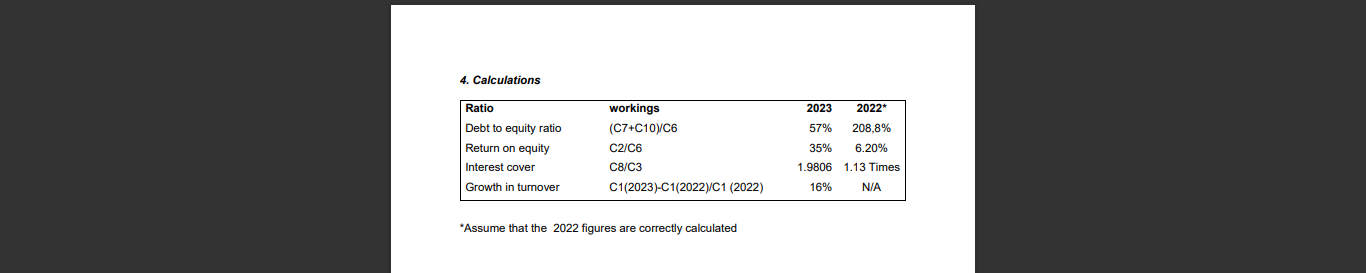

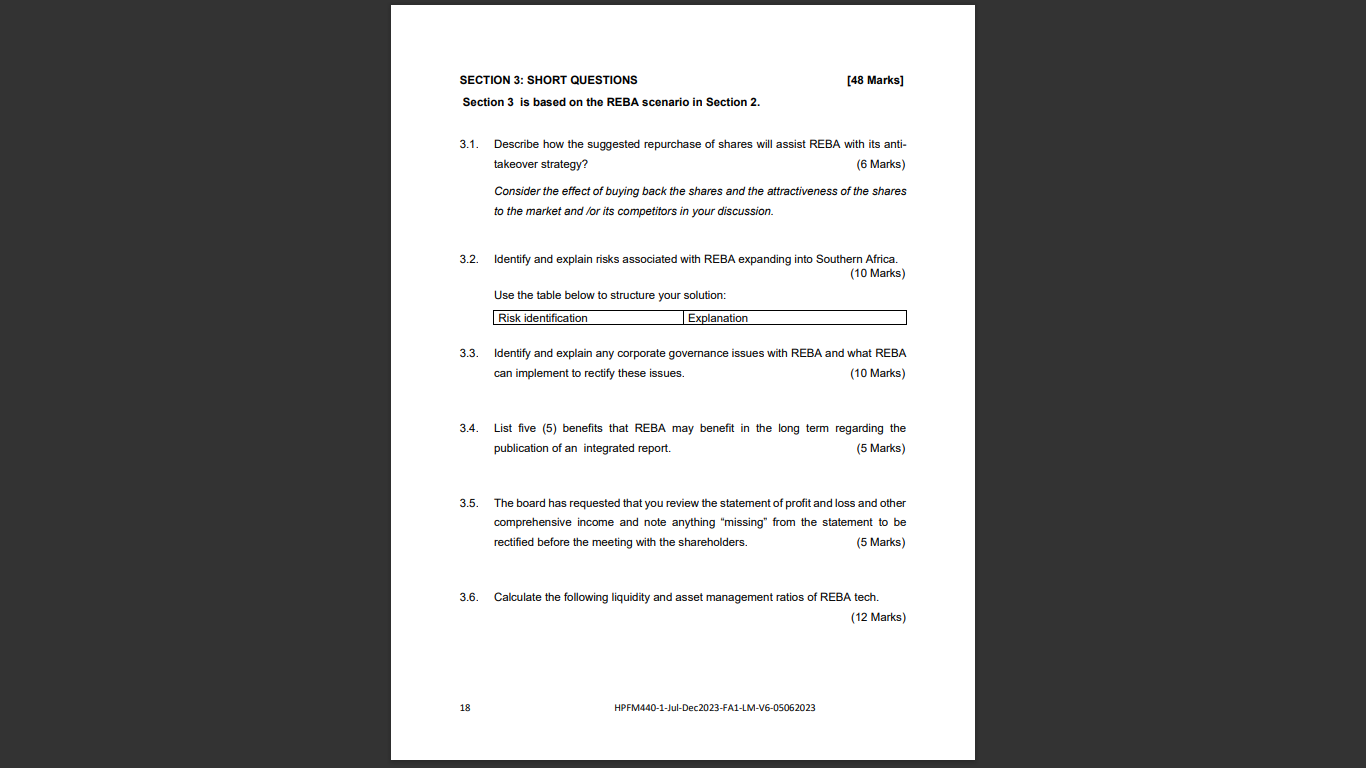

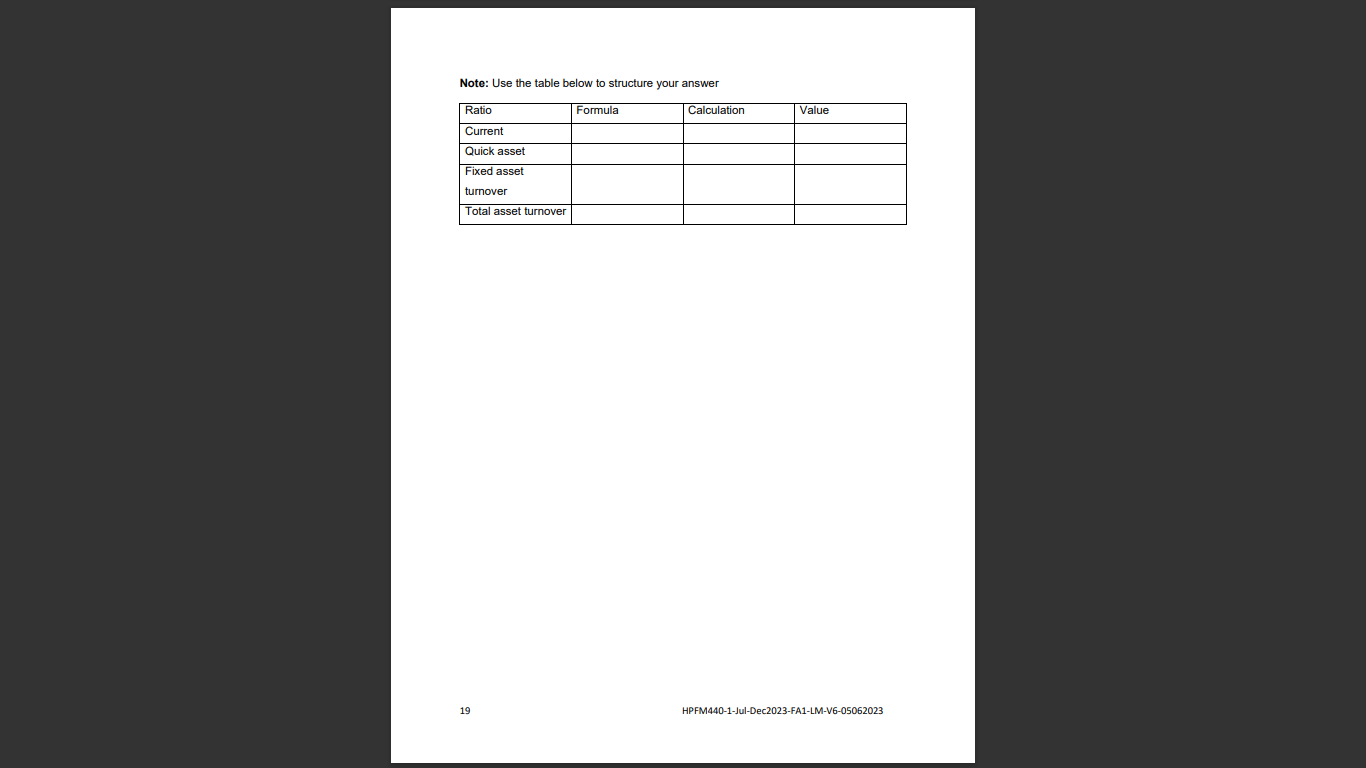

SECTION 2: LONG QUESTION [27 Marks] Reba Tech (\"REBA\") sells computer software packages, including license renewals and provides clients with online support. The company was founded by Reba Masole, who has since retired and is no longer involved in the daily operating activities of REBA. Jika Ltd. (JIKA) is one of REBA's biggest competitors and part of JIKA's strategic plan is to expand in Southern Africa, sharing a common vision with REBA. JIKA has started negotiations with Reba's youngest daughter, Lebohang Masole, in an effort to successfully take over REBA. Reba Masole is not keen on handing her family's heritage to outsiders. Therefore, she proposes repurchasing the shares at a \10 premium above the share's market price as an anti-takeover strategy. This repurchase will take the form of a specific repurchase and the \10 premium is certified as being reasonable by an independent valuator. REBA's board of directors consists of six directors, with one being an independent nonexecutive director, agreed with Reba Masole that the integrated reporting requirement of King IV applies to listed companies on the JSE main board but sees no need for Reba to disclose one. As part of REBA's growth strategy, they aim to list on the Johannesburg Stock Exchange Main board within the following 12 months. REBA is currently an ALTX listed company. The Board made the following resolutions in a prior meeting in relation to the financial analysis for REBA : Resolution 1: The Market price for one share is valued at R26.05 and the target debt to equity ratio is \\( 35: 65 \\), which is in line with the average capital structure in the IT industry. Resolution 2: Financial analysis should make use of the market value of Interest bearing debt and equity where applicable for comparability with other IT companies of the same size. Resolution 3: Headline earnings be utilised and not operating profit for comparability with other companies in the industry and to avoid once-off corporate activities such as impairment or sale of divisions. Headline earnings are noted as R3.82 for the 2023 financial year. Extract from the statement of comprehensive income for REBA for the year ended 31 August 2023 14 HPFM440-1-Jul-Dec2023-FA1-LM-V6-05062023 The Statement of Financial Position of REBA as at 31 August 2023 *Note: The loan with a loan term of 5 years has an after-tax cost of debt of \10.8 with the 2023 annual after tax repayment of R1 345176 . Financial analysis comments based on the calculations below. 1.Debt-to-equity ratio (Gearing) The company's gearing ratio has decreased since 2022 from \208,8 to \36.5. The decrease in gearing ratio is mainly as a result of the increase in borrowings. Return on Equity The company's return on equity has improved significantly from 6,2\\% (2022) to \35.1 (2023) mainly as a result of an increase in operating profit. 2.Interest cover The times interest covered has decreased as a result of the increase in borrowings. 3.Growth In revenue Revenue has increased above the inflation rate of \6 and one of the main reasons for this pleasing performance can be attributed to the effective advertising efforts of the marketing department. 4. Calculations \"Assume that the 2022 figures are correctly calculated SECTION 3: SHORT QUESTIONS [48 Marks] Section 3 is based on the REBA scenario in Section 2. 3.1. Describe how the suggested repurchase of shares will assist REBA with its antitakeover strategy? (6 Marks) Consider the effect of buying back the shares and the attractiveness of the shares to the market and /or its competitors in your discussion. 3.2. Identify and explain risks associated with REBA expanding into Southern Africa. (10 Marks) Use the table below to structure your solution: Risk identification Explanation 3.3. Identify and explain any corporate governance issues with REBA and what REBA can implement to rectify these issues. (10 Marks) 3.4. List five (5) benefits that REBA may benefit in the long term regarding the publication of an integrated report. (5 Marks) 3.5. The board has requested that you review the statement of profit and loss and other comprehensive income and note anything \"missing\" from the statement to be rectified before the meeting with the shareholders. (5 Marks) 3.6. Calculate the following liquidity and asset management ratios of REBA tech. (12 Marks) 18 HPFM440-1-Jul-Dec2023-FA1-LM-V6-05062023 Note: Use the table below to structure your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts