Question: Section 2 - Part A The partner has requested you to prepare a preliminary analytical review on the information provided by your company. The partner

Section 2 - Part A

The partner has requested you to prepare a preliminary analytical review on the information provided by your company. The partner suggests that, as a minimum, you address key balance sheet and profit and loss horizontal analysis, vertical analysis and ratios over the period 2017 to 2020. Based on these results and the nature of your company's business and its markets, outline the apparent trends and changes in these ratios, the key risk areas for the audit and the matters that will have to be addressed in the audit plan. Give examples of relevant assertions and at least one audit procedure for each assertion.

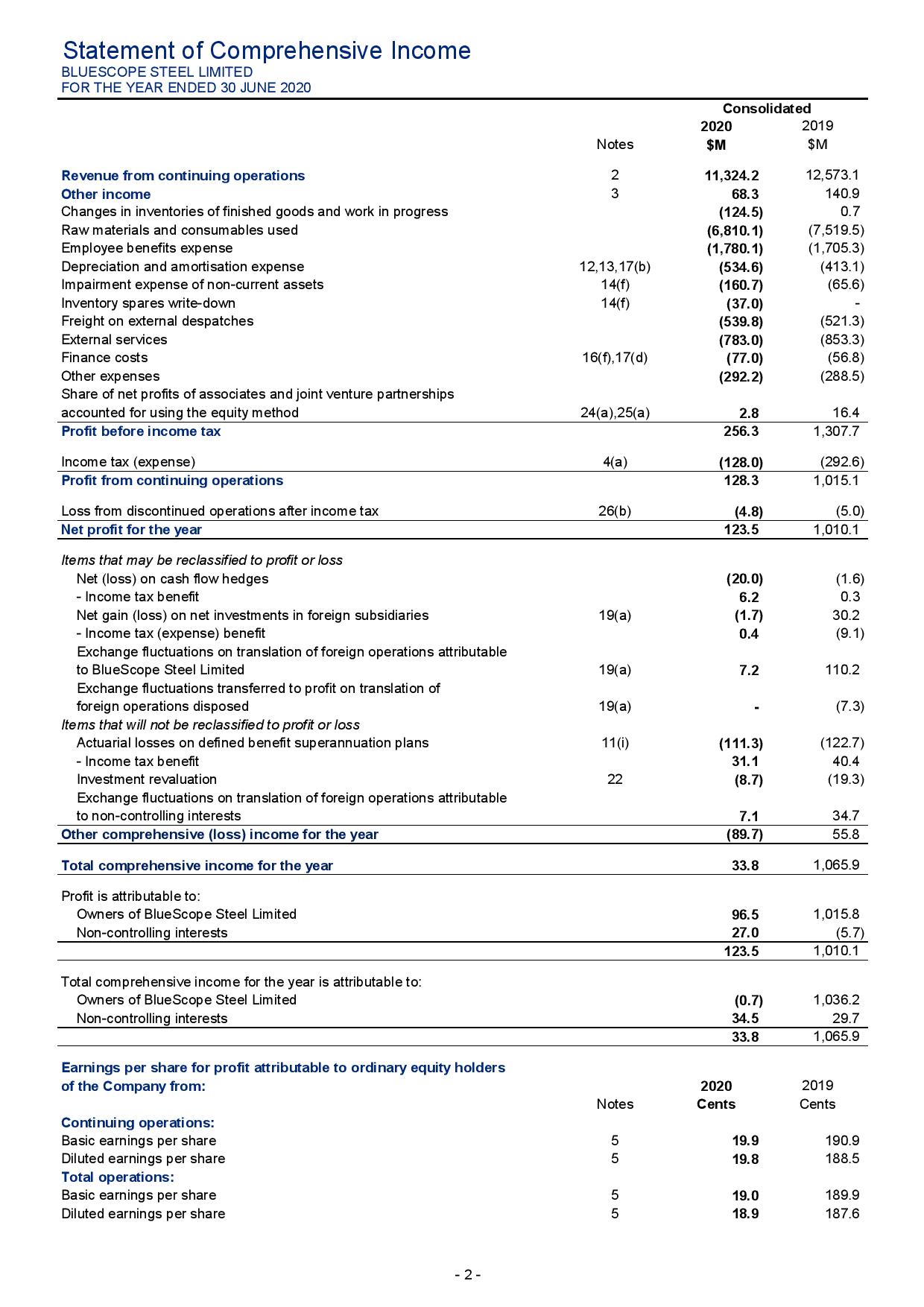

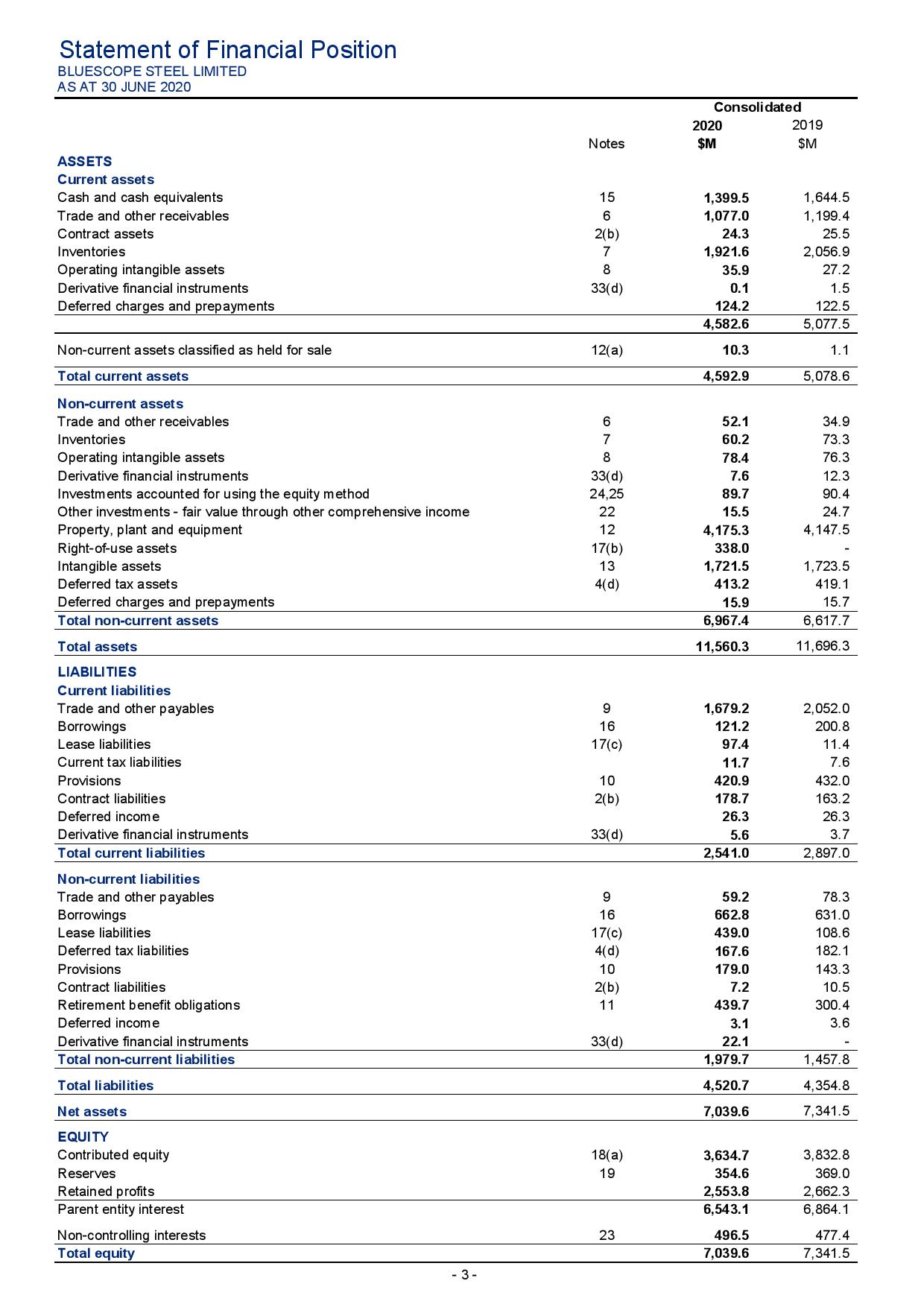

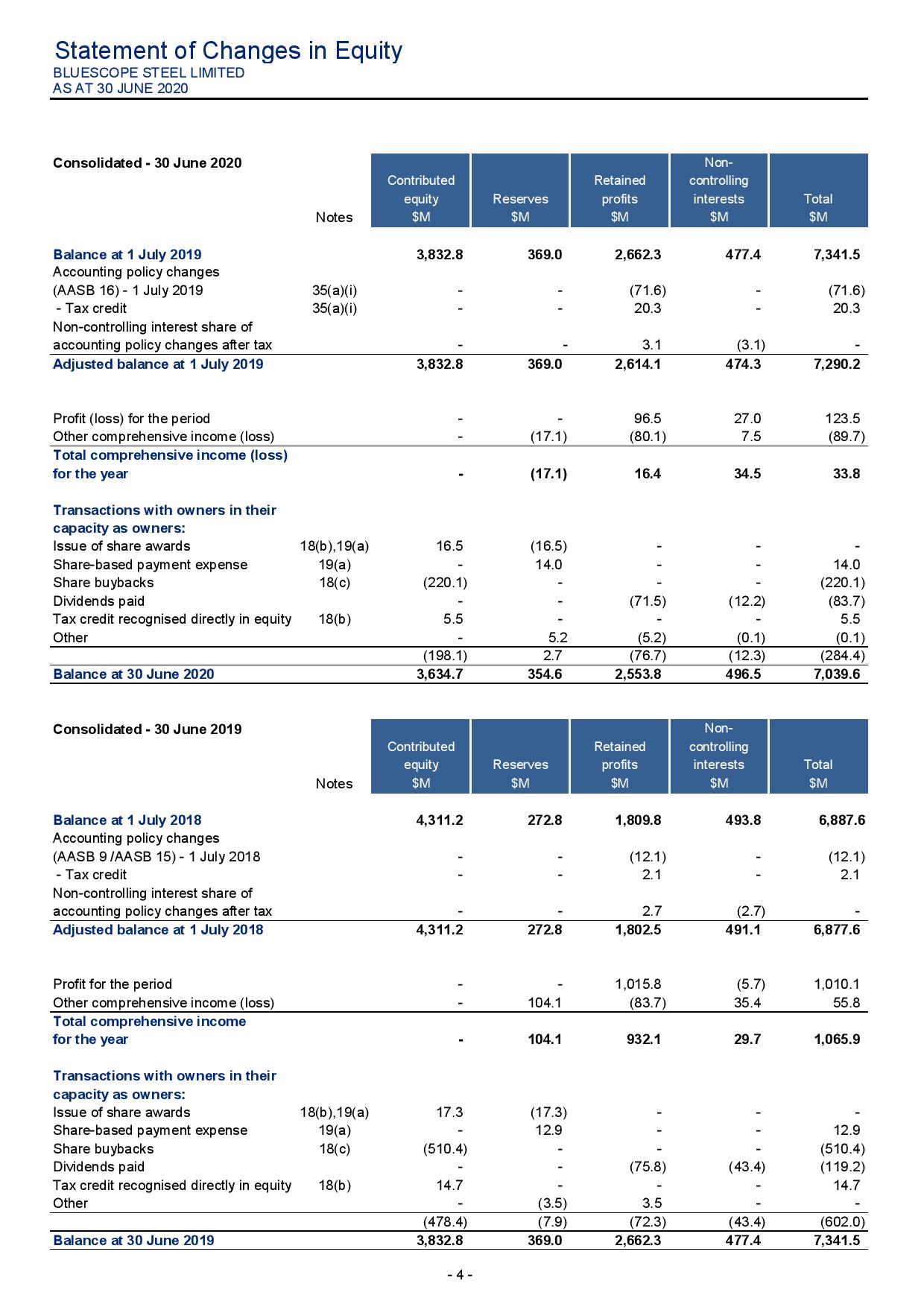

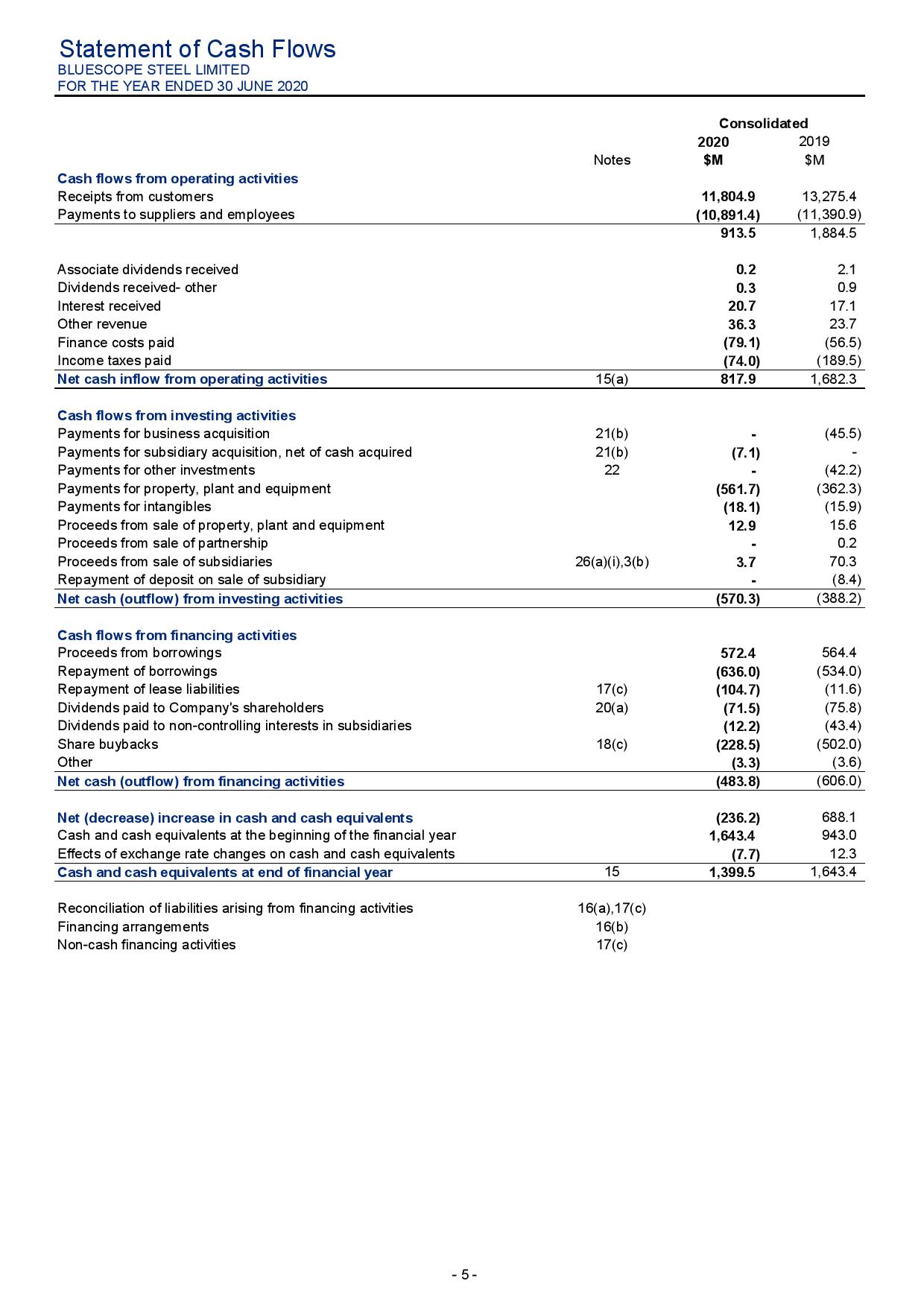

Statement of Comprehensive Income BLUESCOPE STEEL LIMITED FOR THE YEAR ENDED 30 JUNE 2020 Consolidated 2020 2019 Notes $M $M Revenue from continuing operations 11,324.2 12,573.1 Other income 68.3 140.9 Changes in inventories of finished goods and work in progress (124.5) 0.7 Raw materials and consumables used (6,810.1) (7,519.5) Employee benefits expense (1,780.1) (1,705.3) Depreciation and amortisation expense 12,13, 17(b) (534.6) (413.1) Impairment expense of non-current assets 14(f) (160.7) (65.6) nventory spares write-down 14 ( f) (37.0) Freight on external despatches (539.8) (521.3) External services (783.0) (853.3) Finance costs 16(f), 17(d) (77.0) 56.8) Other expenses (292.2) (288.5) Share of net profits of associates and joint venture partnerships accounted for using the equity method 24(a),25(a) 2.8 16.4 Profit before income tax 256.3 1,307.7 Income tax (expense) 4(a) (128.0) (292.6) Profit from continuing operations 128.3 1,015.1 Loss from discontinued operations after income tax 26(b) 4.8) 5.0) Net profit for the year 123.5 1,010.1 Items that may be reclassified to profit or loss Net (loss) on cash flow hedges (20.0) (1.6 - Income tax benefit 6.2 0.3 Net gain (loss) on net investments in foreign subsidiaries 19(a) (1.7) 30.2 -Income tax (expense) benefit 0.4 9.1) Exchange fluctuations on translation of foreign operations attributable to BlueScope Steel Limited 19(a) 7.2 110.2 Exchange fluctuations transferred to profit on translation of foreign operations disposed 19(a) 7.3) Items that will not be reclassified to profit or loss Actuarial losses on defined benefit superannuateon plans 11(i) (111.3) (122.7) - Income tax benefit 31.1 40.4 Investment revaluation 22 (8.7) (19.3) Exchange fluctuations on translation of foreign operations attributable to non-controlling interests 7.1 34.7 Other comprehensive (loss) income for the year (89.7) 55.8 Total comprehensive income for the year 33.8 1,065.9 Profit is attributable to: Owners of BlueScope Steel Limited 96.5 1,015.8 Non-controlling interests 27.0 (5.7) 123.5 1,010.1 Total comprehensive income for the year is attributable to: Owners of Blue Scope Steel Limited (0.7) 1,036.2 Non-controlling interests 34.5 29.7 33.8 1,065.9 Earnings per share for profit attributable to ordinary equity holders of the Company from: 2020 2019 Notes Cents Cents Continuing operations: Basic earnings per share 19.9 190.9 Diluted earnings per share 19.8 188.5 Total operations: Basic earnings per share 19.0 189.9 Diluted earnings per share 18.9 187.6 - 2 -Statement of Financial Position BLUESCOPE STEEL LIMITED AS AT 30 JUNE 202 Consolidated 2020 2019 Notes $M SM ASSETS Current assets Cash and cash equivalents 15 1,399.5 1,644.5 Trade and other receivables 6 1,077.0 1, 199.4 Contract assets 2 (b ) 24.3 25.5 Inventories 7 1,921.6 2,056.9 Operating intangible assets 8 35.9 27.2 Derivative financial instruments 33(d) 0.1 1.5 Deferred charges and prepayments 124.2 122.5 4,582.6 5,077.5 Non-current assets classified as held for sale 12(a) 10.3 1.1 Total current assets 4,592.9 5,078.6 Non-current assets Trade and other receivables 52.1 34.9 Inventories 60.2 73.3 Operating intangible assets 8 78.4 76.3 Derivative financial instruments 33(d) 7.6 12.3 Investments accounted for using the equity method 24,25 89.7 90.4 Other investments - fair value through other comprehensive income 22 15.5 24.7 Property, plant and equipment 12 4, 175.3 4, 147.5 Right-of-use assets 17(b) 338.0 Intangible assets 13 1,721.5 1,723.5 Deferred tax assets 4(d) 413.2 419.1 Deferred charges and prepayments 15.9 15.7 Total non-current assets 6,967.4 6,617.7 Total assets 11,560.3 11, 696.3 LIABILITIES Current liabilities Trade and other payables 9 1,679.2 2, 052.0 Borrowings 16 121.2 200.8 Lease liabilities 17(c) 97.4 11.4 Current tax liabilities 11.7 7.6 Provisions 10 420.9 432.0 Contract liabilities 2 ( b ) 178.7 163.2 Deferred income 26.3 26.3 Derivative financial instruments 33 (d) 5.6 3.7 Total current liabilities 2,54 1.0 2,897.0 Non-current liabilities Trade and other payables 9 59.2 78.3 Borrowings 16 662.8 631.0 Lease liabilities 17(c) 439.0 108.6 Deferred tax liabilities 4(d) 167.6 182.1 Provisions 10 179.0 143.3 Contract liabilities 2 (b ) 7.2 10.5 Retirement benefit obligations 11 439.7 300.4 Deferred income 3.1 3.6 Derivative financial instruments 33(d) 22.1 Total non-current liabilities 1,979.7 1, 457.8 Total liabilities 4,520.7 4,354.8 Net assets 7,039.6 7,341.5 EQUITY Contributed equity 18(a) 3,634.7 3,832.8 Reserves 19 354.6 369.0 Retained profits 2,553.8 2,662.3 Parent entity interest 6,543.1 6,864.1 Non-controlling interests 23 496.5 477.4 Total equity 7,039.6 7,341.5 - 3 -Statement of Changes in Equity BLUESCOPE STEEL LIMITED AS AT 30 JUNE 2020 Consolidated - 30 June 2020 Non- Contributed Retained controlling equity Reserves profits interests Total Notes $M $M $M $M $M Balance at 1 July 2019 3,832.8 369.0 2,662.3 477.4 7,341.5 Accounting policy changes (AASB 16) - 1 July 2019 35(a)(i) (71.6) (71.6) - Tax credit 35(a)(i) 20.3 20.3 Non-controlling interest share of accounting policy changes after tax 3.1 (3.1) Adjusted balance at 1 July 2019 3,832.8 369.0 2,614.1 474.3 7,290.2 Profit (loss) for the period 96.5 27.0 123.5 Other comprehensive income (loss) (17.1 (80.1) 7.5 (89.7) Total comprehensive income (loss) for the year (17.1) 16.4 34.5 33.8 Transactions with owners in their capacity as owners: Issue of share awards 18(b), 19(a) 16.5 (16.5) Share-based payment expense 19(a) 14.0 14.0 Share buybacks 18(c) (220.1) (220.1) Dividends paid (71.5) (12.2) (83.7) Tax credit recognised directly in equity 18 (b ) 5.5 5.5 Other 5.2 (5.2) (0.1) 0.1) (198.1) 2.7 (76.7) (12.3) (284.4) Balance at 30 June 2020 3,634.7 354. 2,553.8 496.5 7,039.6 Consolidated - 30 June 2019 Non- Contributed Retained controlling equity Reserves profits interests Total Notes $M $M $M $M $M Balance at 1 July 2018 4,311.2 272.8 1,809.8 493.8 6,887.6 Accounting policy changes (AASB 9 /AASB 15) - 1 July 2018 (12.1) (12.1) - Tax credit 2.1 2.1 trolling interest share of accounting policy changes after tax 2.7 (2.7) Adjusted balance at 1 July 2018 4,311.2 272.8 1,802.5 491.1 6,877.6 Profit for the period 1,015.8 (5.7) 1,010.1 Other comprehensive income (loss) 104.1 (83.7) 35.4 55.8 Total comprehensive income for the year 104.1 932.1 29.7 1,065.9 Transactions with owners in their capacity as owners: Issue of share a 18(b), 19(a) 17.3 (17.3) Share-based payment expense 19(a) 12.9 12.9 Share buybacks 18(c) (510.4) (510.4) Dividends paid (75.8) (43.4) (119.2) Tax credit recognised directly in equity 18(b) 14.7 14.7 Other (3.5) 3.5 (478.4) (7.9) (72.3) (43.4) (602.0) Balance at 30 June 2019 3,832.8 369.0 2,662.3 477.4 7,341.5 - 4 -Statement of Cash Flows BLUESCOPE STEEL LIMITED FOR THE YEAR ENDED 30 JUNE 2020 Consolidated 2020 2019 Notes $M $M Cash flows from operating activities Receipts from customers 11,804.9 13,275.4 Payments to suppliers and employees (10,891.4) (11,390.9) 913.5 1,884.5 Associate dividends received 0.2 2.1 Dividends received- other 0.3 0.9 Interest received 20.7 17.1 Other revenue 36.3 23.7 Finance costs paid (79.1) (56.5) Income taxes paid (74.0) (189.5) Net cash inflow from operating activities 15(a) 817.9 1,682.3 Cash flows from investing activities Payments for business acquisition 21 (b) (45.5) Payments for subsidiary acquisition, net of cash acquired 21 ( b ) (7.1) Payments for other investments 22 (42.2) Payments for property, plant and equipment (561.7) (362.3 Payments for intangibles (18.1 (15.9) Proceeds from sale of property, plant and equipment 12.9 15.6 Proceeds from sale of partnership 0.2 Proceeds from sale of subsidiaries 26(a)(i),3(b) 3.7 70.3 Repayment of deposit on sale of subsidiary (8.4) Net cash (outflow) from investing activities (570.3) (388.2) Cash flows from financing activities Proceeds from borrowings 572.4 564.4 Repayment of borrowings (636.0) (534.0) Repayment of lease liabilities 17 (c) (104.7) (11.6) Dividends paid to Company's shareholders 20 (a ) (71.5) (75.8) Dividends paid to non-controlling interests in subsidiaries (12.2) (43.4) Share buybacks 18(c) (228.5 (502.0) Other (3.3) 3.6) Net cash (outflow) from financing activities (483.8) 606.0) Net (decrease) increase in cash and cash equivalents (236.2) 688.1 Cash and cash equivalents at the beginning of the financial year 1,643.4 943.0 Effects of exchange rate changes on cash and cash equivalents (7.7) 12.3 Cash and cash equivalents at end of financial year 15 1,399.5 1,643.4 Reconciliation of liabilities arising from financing activities 16(a), 17(c) Financing arrangements 16(b) Non-cash financing activities 17(c) - 5 -BlueScope Steel Limited 30 June 2020 ABOUT THIS REPORT BlueScope Steel Limited is a company limited by shares incorporated in Australia whose shares are publicly traded on the Australian Securities Exchange. The registered office of the Company is Level 11, 120 Collins Street, Melbourne, Victoria, Australia 3000. The nature of the operations and principal activities of the Group are described in note 1(a) and the Directors' Report. The financial report of BlueScope Steel Limited for the year ended 30 June 2020 was authorised for issue in accordance with a resolution of the Directors on 17 August 2020 Basis of preparation This financial report is a general purpose financial report, prepared by a for-profit entity, which: Has been prepared in accordance with the requirements of the Australian Corporations Act 2001 , Australian Accounting Standards and other authoritative pronouncements of the Australian Accounting Standards Board (AASB) and International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). . Includes consolidated financial statements, incorporating the assets and liabilities of all subsidiaries of BlueScope Steel Limited ('the Company' or 'parent entity') as at 30 June 2020 and the results of all subsidiaries for the year then ended. BlueScope Steel Limited and its subsidiaries together are referred to in this financial report as 'the Group'. Has been prepared on a historical cost basis, except for derivative financial instruments which have been measured at fair value and other investments fair valued through other comprehensive income . Is presented in Australian dollars with values rounded to the nearest hundred thousand dollars or in certain cases, the nearest dollar, in accordance with the Australian Securities and Investments Commission Corporations (Rounding in Financial/Directors' Reports) Instrument 2016/191. . Presents comparative information where required for consistency with the current year's presentation. . Adopts all new and amended Accounting Standards and Interpretations issued by the AASB that are relevant to the operations of the Group and effective for reporting periods beginning on or after 1 July 2019 as disclosed in note 35(a). Does not early adopt any Accounting Standards and Interpretations that have been issued or amended but are not yet effective as disclosed in note 35(b). Functional and presentation currency Items included in the financial statements of each of the Group's entities are measured using the currency of the primary economic environment in which the entity operates (the functional currency'). The consolidated financial statements are presented in Australian dollars, which is BlueScope Steel Limited's functional and presentation currency. Key estimates and judgements In the process of applying the Group's accounting policies, management has made a number of judgements and applied estimates of future events. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements, are disclosed in the following notes: Note 4 Income tax Note 10 Provisions Note 11 Retirement benefit obligations Note 12 Property, plant and equipment Note 14 Carrying value of non-financial assets Note 17 Leases Note 29 Share-based payments - 6