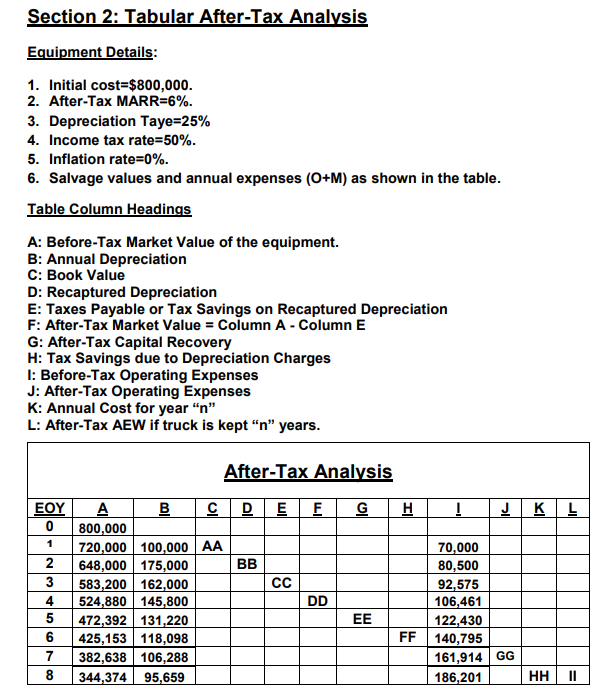

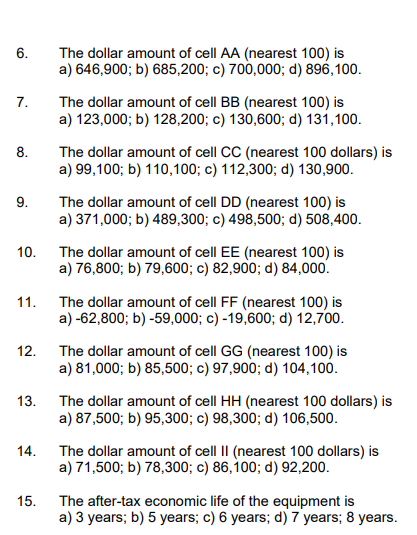

Question: Section 2: Tabular After-Tax Analysis en Initial cost-$800.000 2. 1. After-Tax MARR-6%. 3. Depreciation Taye-25% 4. Income tax rate-50% 5. Inflation rate=0%. 6. Salvage values

Section 2: Tabular After-Tax Analysis en Initial cost-$800.000 2. 1. After-Tax MARR-6%. 3. Depreciation Taye-25% 4. Income tax rate-50% 5. Inflation rate=0%. 6. Salvage values and annual expenses (O+M) as shown in the table Table Column Headin A: Before-Tax Market Value of the equipment. B: Annual Depreciation C: Book Value D: Recaptured Depreciation E: Taxes Payable or Tax Savings on Recaptured Depreciation F: After-Tax Market Value Column A - Column E G: After-Tax Capital Recovery H: Tax Savings due to Depreciation Charges I: Before-Tax Operating Expenses J: After-Tax Operating Expenses K: Annual Cost for year "n" L: After-Tax AEW if truck is kept "n" years After-Tax Analysis EOYA 0 800,000 1720,000 100,000 AA 2648,000 175,000 3 583,200 162,000 4 524,880 145,800 5 472.392 131,220 6 425,153 118,098 70,000 80,500 92,575 106,461 122,430 FF 140,795 161,914 GG 186,201 8344,374 95,659 The dollar amount of cell AA (nearest 100) is a) 646,900; b) 685,200; c) 700,000; d) 896,100 6. The dollar amount of cell BB (nearest 100) is a) 123,000; b) 128,200; c) 130,600; d) 131,100. 7. 8. The dollar amount of cell CC (nearest 100 dollars) is a) 99,100; b) 110,100; c) 112,300; d) 130,900 The dollar amount of cell DD (nearest 100) is a) 371,000; b)489,300; c)498,500; d) 508,400 9. The dollar amount of cell EE (nearest 100) is a) 76,800; b) 79,600; c) 82,900; d) 84,000. 10. The dollar amount of cell FF (nearest 100) is a) -62,800; b) -59,000; c) -19,600; d) 12,700. 11. 12. The dollar amount of cell GG (nearest 100) is a) 81,000; b) 85,500; c) 97,900; d) 104,100. 13. The dollar amount of cell HH (nearest 100 dollars) is a) 87,500; b) 95,300; c) 98,300; d) 106,500. The dollar amount of cell II (nearest 100 dollars) is a) 71,500; b) 78,300; c) 86,100; d) 92,200. 14. The after-tax economic life of the equipment is a) 3 years; b) 5 years; c) 6 years; d) 7 years; 8 years 15. Section 2: Tabular After-Tax Analysis en Initial cost-$800.000 2. 1. After-Tax MARR-6%. 3. Depreciation Taye-25% 4. Income tax rate-50% 5. Inflation rate=0%. 6. Salvage values and annual expenses (O+M) as shown in the table Table Column Headin A: Before-Tax Market Value of the equipment. B: Annual Depreciation C: Book Value D: Recaptured Depreciation E: Taxes Payable or Tax Savings on Recaptured Depreciation F: After-Tax Market Value Column A - Column E G: After-Tax Capital Recovery H: Tax Savings due to Depreciation Charges I: Before-Tax Operating Expenses J: After-Tax Operating Expenses K: Annual Cost for year "n" L: After-Tax AEW if truck is kept "n" years After-Tax Analysis EOYA 0 800,000 1720,000 100,000 AA 2648,000 175,000 3 583,200 162,000 4 524,880 145,800 5 472.392 131,220 6 425,153 118,098 70,000 80,500 92,575 106,461 122,430 FF 140,795 161,914 GG 186,201 8344,374 95,659 The dollar amount of cell AA (nearest 100) is a) 646,900; b) 685,200; c) 700,000; d) 896,100 6. The dollar amount of cell BB (nearest 100) is a) 123,000; b) 128,200; c) 130,600; d) 131,100. 7. 8. The dollar amount of cell CC (nearest 100 dollars) is a) 99,100; b) 110,100; c) 112,300; d) 130,900 The dollar amount of cell DD (nearest 100) is a) 371,000; b)489,300; c)498,500; d) 508,400 9. The dollar amount of cell EE (nearest 100) is a) 76,800; b) 79,600; c) 82,900; d) 84,000. 10. The dollar amount of cell FF (nearest 100) is a) -62,800; b) -59,000; c) -19,600; d) 12,700. 11. 12. The dollar amount of cell GG (nearest 100) is a) 81,000; b) 85,500; c) 97,900; d) 104,100. 13. The dollar amount of cell HH (nearest 100 dollars) is a) 87,500; b) 95,300; c) 98,300; d) 106,500. The dollar amount of cell II (nearest 100 dollars) is a) 71,500; b) 78,300; c) 86,100; d) 92,200. 14. The after-tax economic life of the equipment is a) 3 years; b) 5 years; c) 6 years; d) 7 years; 8 years 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts