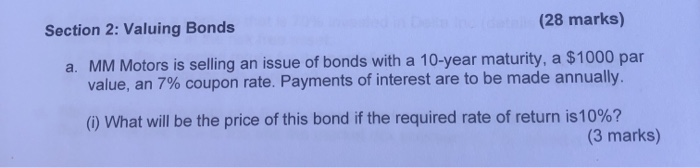

Question: Section 2: Valuing Bonds (28 marks) a. MM Motors is selling an issue of bonds with a 10-year maturity, a $1000 par value, an 7%

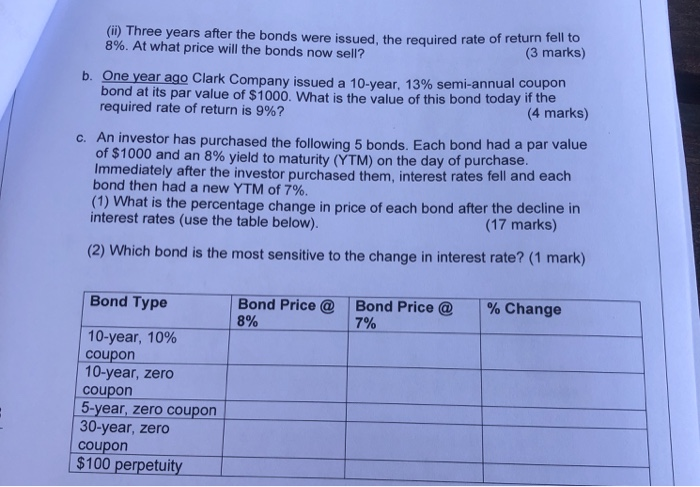

Section 2: Valuing Bonds (28 marks) a. MM Motors is selling an issue of bonds with a 10-year maturity, a $1000 par value, an 7% coupon rate. Payments of interest are to be made annually. (1) What will be the price of this bond if the required rate of return is 10%?! (3 marks) (i) Three years after the bonds were issued, the required rate of return tento 8%. At what price will the bonds now sell? (3 marks) b. One year ago Clark Company issued a 10-year, 13% semi-annual coupon bond at its par value of $1000. What is the value of this bond today if the required rate of return is 9%? (4 marks) C. An investor has purchased the following 5 bonds. Each bond had a par value of $1000 and an 8% yield to maturity (YTM) on the day of purchase. Immediately after the investor purchased them. interest rates fell and each bond then had a new YTM of 7%. (1) What is the percentage change in price of each bond after the decline in interest rates (use the table below). (17 marks) (2) Which bond is the most sensitive to the change in interest rate? (1 mark) Bond Type Bond Price @ 8% Bond Price @ 7% % Change 10-year, 10% coupon 10-year, zero coupon 5-year, zero coupon 30-year, zero coupon $100 perpetuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts