Question: Q1. You are an owner of a firm that has cash flows of $150 (good state) or $50 (bad state) next year with equal

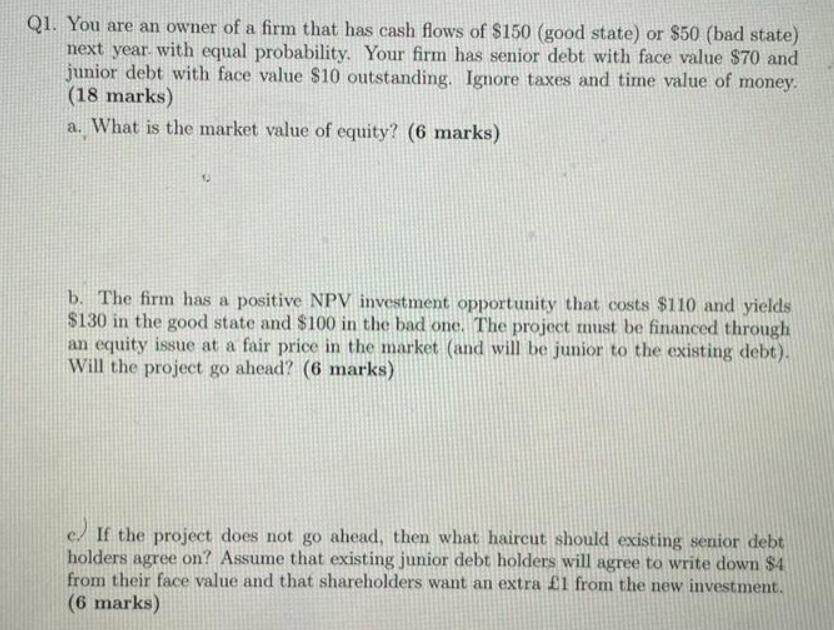

Q1. You are an owner of a firm that has cash flows of $150 (good state) or $50 (bad state) next year with equal probability. Your firm has senior debt with face value $70 and junior debt with face value $10 outstanding. Ignore taxes and time value of money. (18 marks) a. What is the market value of equity? (6 marks) b. The firm has a positive NPV investment opportunity that costs $110 and yields $130 in the good state and $100 in the bad one. The project must be financed through an equity issue at a fair price in the market (and will be junior to the existing debt). Will the project go ahead? (6 marks) c/ If the project does not go ahead, then what haircut should existing senior debt holders agree on? Assume that existing junior debt holders will agree to write down $4 from their face value and that shareholders want an extra 1 from the new investment. (6 marks)

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

G iven solution a Equity Value Maximum of Cash Flow Debt0 In good state Equity Value Maximum of 1508... View full answer

Get step-by-step solutions from verified subject matter experts