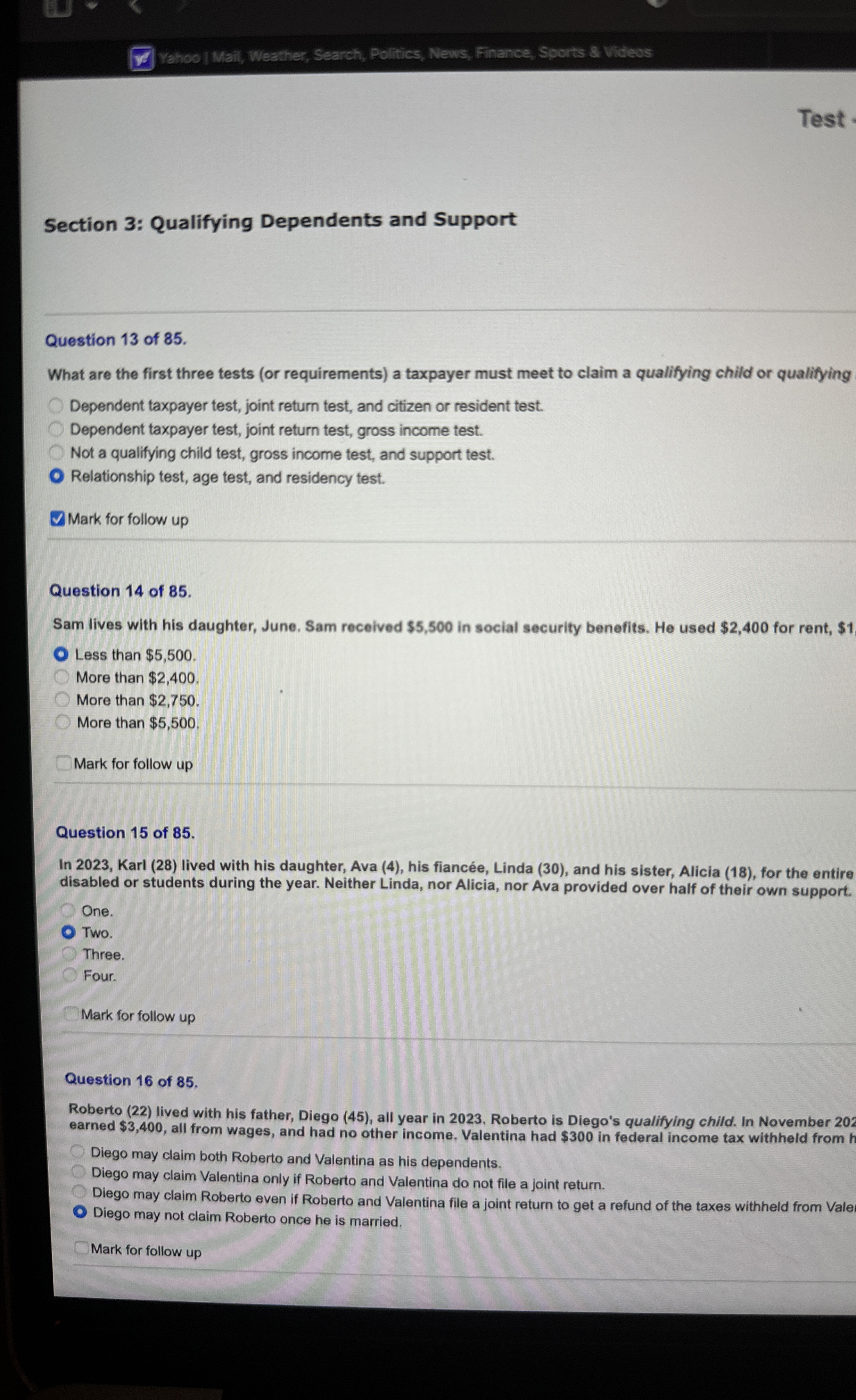

Question: Section 3 : Qualifying Dependents and Support Question 1 3 of 8 5 . What are the first three tests ( or requirements ) a

Section : Qualifying Dependents and Support

Question of

What are the first three tests or requirements a taxpayer must meet to claim a qualifying child or qualifying

Dependent taxpayer test, joint return test, and citizen or resident test.

Dependent taxpayer test, joint return test, gross income test.

Not a qualifying child test, gross income test, and support test.

Relationship test, age test, and residency test.

Mark for follow up

Question of

Sam lives with his daughter, June. Sam received $ in social security benefits. He used $ for rent, $

Less than $

More than $

More than $

More than $

Mark for follow up

Question of

In Karl lived with his daughter, Ava his fiance Linda and his sister, Alicia for the entire

disabled or students during the year. Neither Linda, nor Alicia, nor Ava provided over half of their own support.

One.

Two.

Three.

Four.

Mark for follow up

Question of

Roberto lived with his father, Diego all year in Roberto is Diego's qualifying child. In November

earned $ all from wages, and had no other income. Valentina had $ in federal income tax withheld from

Diego may claim both Roberto and Valentina as his dependents.

Diego may claim Valentina only if Roberto and Valentina do not file a joint return.

Diego may claim Roberto even if Roberto and Valentina file a joint return to get a refund of the taxes withheld from Vale

Diego may not claim Roberto once he is married.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock