Question: Section 3 : Uncovered Interest Parity ( UIP ) Assume that the following rates between the US dollar and the Brazilian real currently exist: Spot

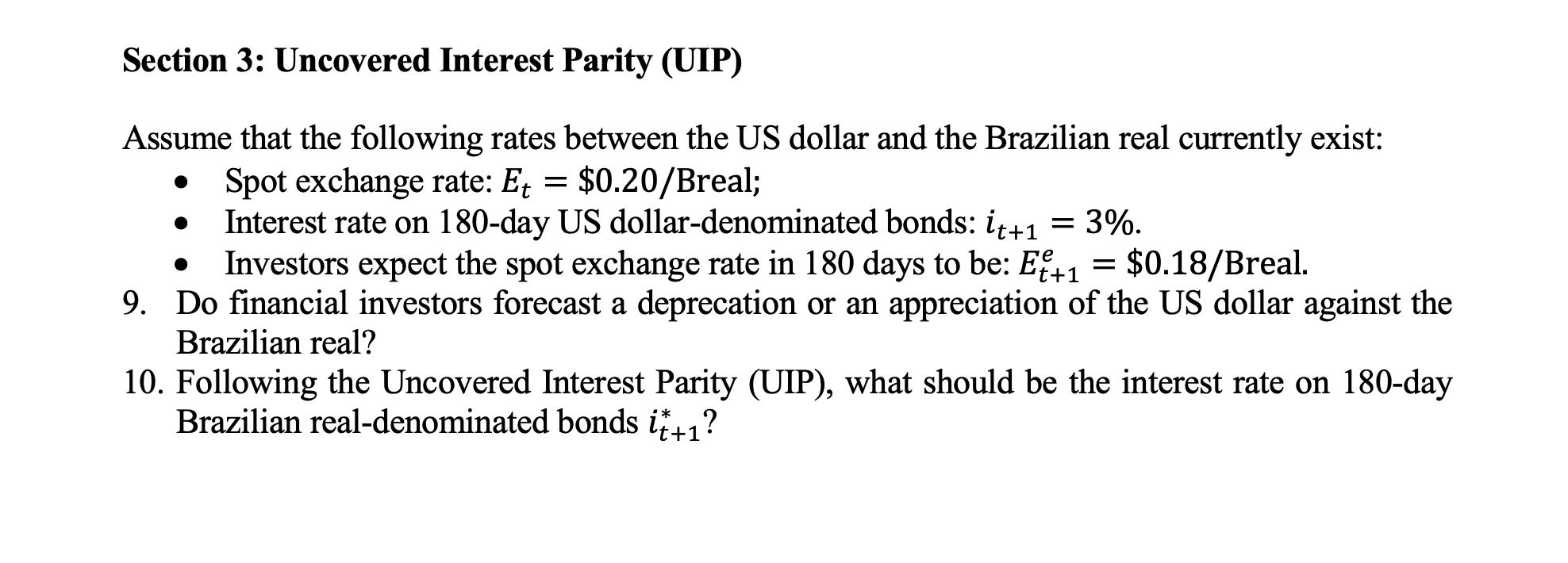

Section : Uncovered Interest Parity UIP

Assume that the following rates between the US dollar and the Brazilian real currently exist:

Spot exchange rate: $real;

Interest rate on day US dollardenominated bonds:

Investors expect the spot exchange rate in days to be: $ Breal.

Do financial investors forecast a deprecation or an appreciation of the US dollar against the

Brazilian real?

Following the Uncovered Interest Parity UIP what should be the interest rate on day

Brazilian realdenominated bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock