Question: Section 3.5 Problem Set Score: 4/13 4/13 answered Progress saved Done 6 VO ... Question 5 B0/1 pt 3 299 Details Assume you need a

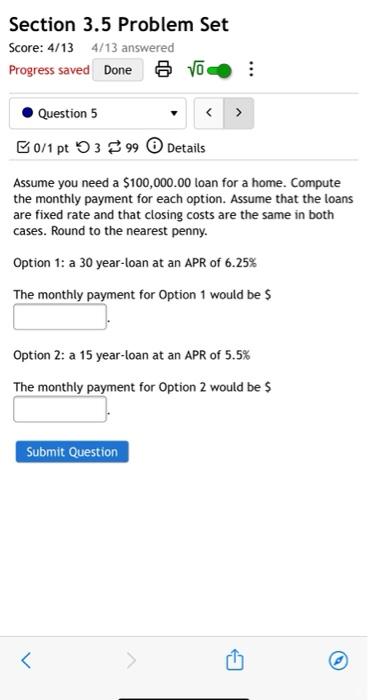

Section 3.5 Problem Set Score: 4/13 4/13 answered Progress saved Done 6 VO ... Question 5 B0/1 pt 3 299 Details Assume you need a $100,000.00 loan for a home. Compute the monthly payment for each option. Assume that the loans are fixed rate and that closing costs are the same in both cases. Round to the nearest penny. Option 1: a 30 year-loan at an APR of 6.25% The monthly payment for Option 1 would be $ Option 2:a 15 year-loan at an APR of 5.5% The monthly payment for Option 2 would be $ Submit Question

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts