Question: SECTION A (10 marks): Answer ALL Questions in this section. QUESTION ONE a. Mr. George Amoako commenced business on 1st April, 2017 and submitted the

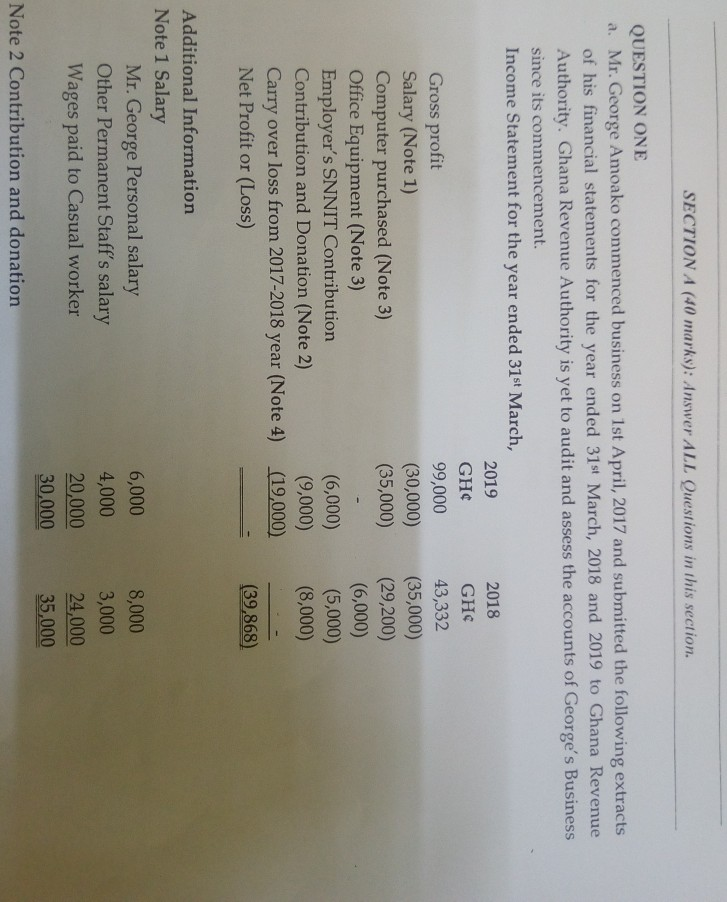

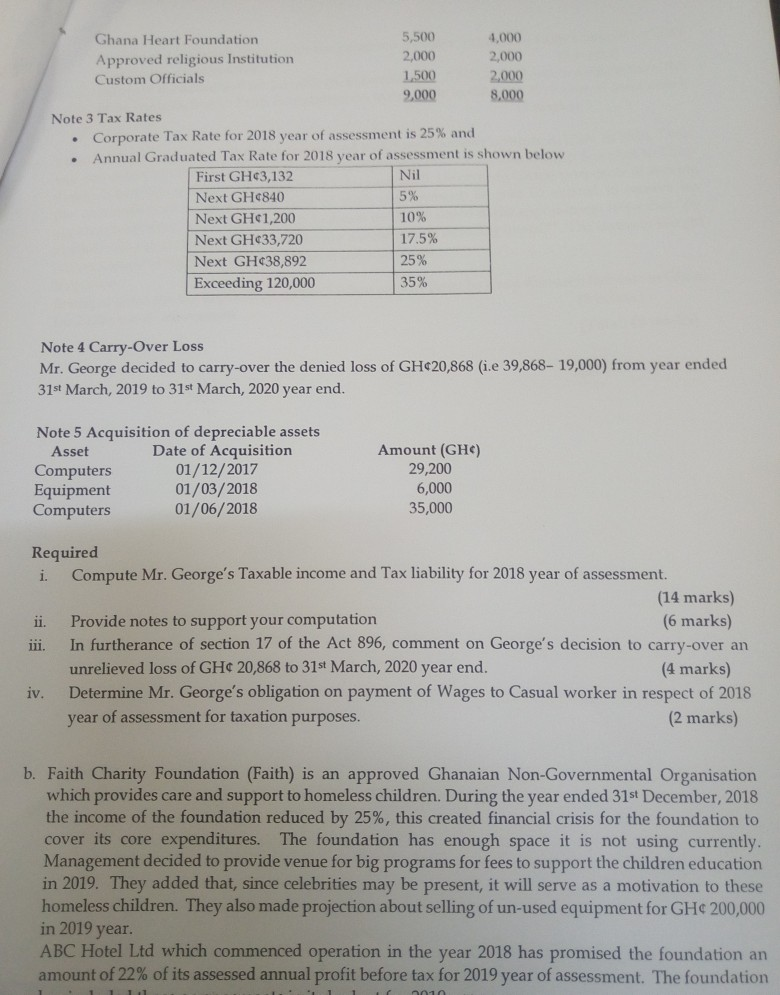

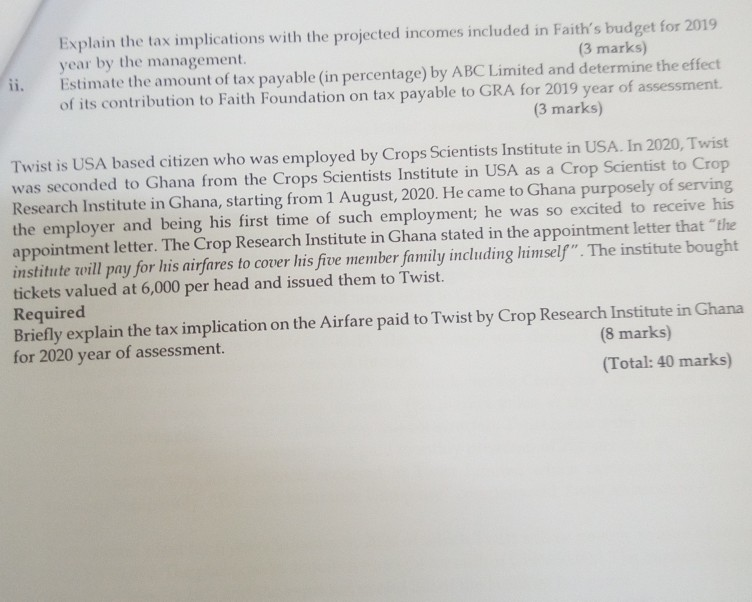

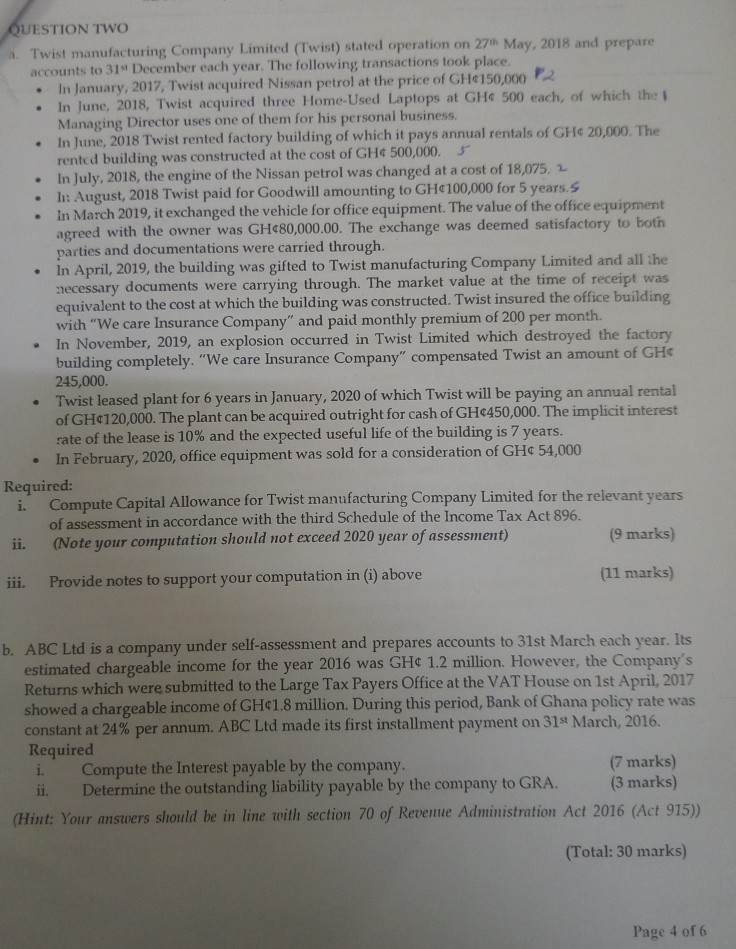

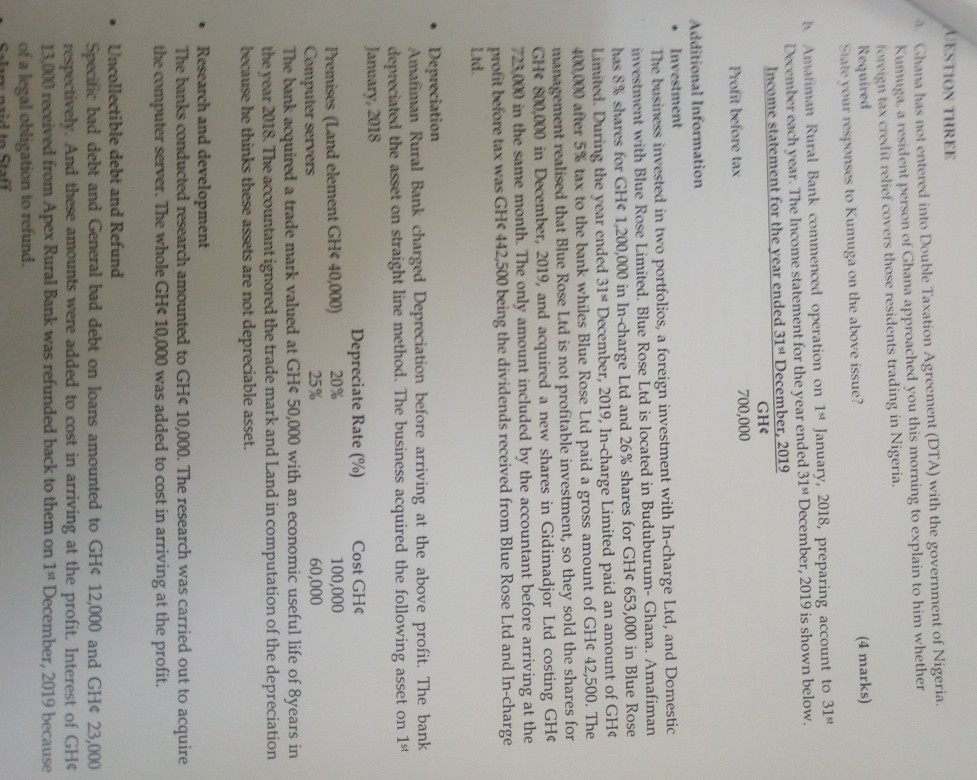

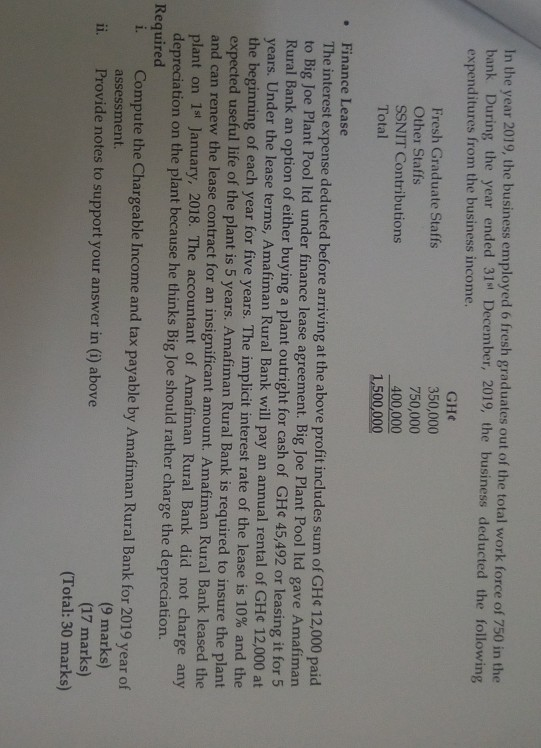

SECTION A (10 marks): Answer ALL Questions in this section. QUESTION ONE a. Mr. George Amoako commenced business on 1st April, 2017 and submitted the following extracts of his financial statements for the year ended 31st March, 2018 and 2019 to Ghana Revenue Authority. Ghana Revenue Authority is yet to audit and assess the accounts of George's Business since its commencement. Income Statement for the year ended 31st March, 2019 2018 GHC GHC Gross profit 99,000 43,332 Salary (Note 1) (30,000) (35,000) Computer purchased (Note 3) (35,000) (29,200) Office Equipment (Note 3) (6,000) Employer's SNNIT Contribution (6,000) (5,000) Contribution and Donation (Note 2) (9,000) (8,000) Carry over loss from 2017-2018 year (Note 4) (19,000) Net Profit or (Loss) (39,868) Additional Information Note 1 Salary Mr. George Personal salary Other Permanent Staff's salary Wages paid to Casual worker 6,000 4,000 20,000 30,000 8,000 3,000 24,000 35,000 Note 2 Contribution and donation . Ghana Heart Foundation 5,500 4.000 Approved religious Institution 2,000 2,000 Custom Officials 1,500 2,000 9,000 8,000 Note 3 Tax Rates Corporate Tax Rate for 2018 year of assessment is 25% and Annual Graduated Tax Rate for 2018 year of assessment is shown below First GH43,132 Nil Next GH4840 5% Next GH1,200 10% Next GH433,720 17.5% Next GH438,892 25% Exceeding 120,000 35% Note 4 Carry-Over Loss Mr. George decided to carry-over the denied loss of GH20,868 (i.e 39,868- 19,000) from year ended 31st March, 2019 to 31st March, 2020 year end. Amount (GH) Note 5 Acquisition of depreciable assets Asset Date of Acquisition Computers 01/12/2017 Equipment 01/03/2018 Computers 01/06/2018 29,200 6,000 35,000 ii. Required Compute Mr. George's Taxable income and Tax liability for 2018 year of assessment. (14 marks) Provide notes to support your computation (6 marks) iii. In furtherance of section 17 of the Act 896, comment on George's decision to carry-over an unrelieved loss of GH 20,868 to 31st March, 2020 year end. (4 marks) iv. Determine Mr. George's obligation on payment of Wages to Casual worker in respect of 2018 year of assessment for taxation purposes. (2 marks) b. Faith Charity Foundation (Faith) is an approved Ghanaian Non-Governmental Organisation which provides care and support to homeless children. During the year ended 31st December, 2018 the income of the foundation reduced by 25%, this created financial crisis for the foundation to cover its core expenditures. The foundation has enough space it is not using currently. Management decided to provide venue for big programs for fees to support the children education in 2019. They added that, since celebrities may be present, it will serve as a motivation to these homeless children. They also made projection about selling of un-used equipment for GHC 200,000 in 2019 year. ABC Hotel Ltd which commenced operation in the year 2018 has promised the foundation an amount of 22% of its assessed annual profit before tax for 2019 year of assessment. The foundation Explain the tax implications with the projected incomes included in Faith's budget for 2019 year by the management. (3 marks) Estimate the amount of tax payable (in percentage) by ABC Limited and determine the effect of its contribution to Faith Foundation on tax payable to GRA for 2019 year of assessment. (3 marks) Twist is USA based citizen who was employed by Crops Scientists Institute in USA. In 2020, Twist was seconded to Ghana from the Crops Scientists Institute in USA as a Crop Scientist to Crop Research Institute in Ghana, starting from 1 August, 2020. He came to Ghana purposely of serving the employer and being his first time of such employment; he was so excited to receive his appointment letter. The Crop Research Institute in Ghana stated in the appointment letter that the institute will pay for his airfares to cover his five member family including himself". The institute bought tickets valued at 6,000 per head and issued them to Twist. Required Briefly explain the tax implication on the Airfare paid to Twist by Crop Research Institute in Ghana for 2020 year of assessment. (8 marks) (Total: 40 marks) . . QUESTION TWO a. Twist manufacturing Company Limited (Twist) stated operation on 27th May, 2018 and prepare accounts to 31" December each year. The following transactions took place. In January, 2017, Twist acquired Nissan petrol at the price of GH150,000 2 In June, 2018, Twist acquired three Home-Used Laptops at GH 500 each, of which the Managing Director uses one of them for his personal business. In June, 2018 Twist rented factory building of which it pays annual rentals of GH 20,000. The rented building was constructed at the cost of GH4 500,000.5 In July, 2018, the engine of the Nissan petrol was changed at a cost of 18,075. 2 In: August, 2018 Twist paid for Goodwill amounting to GH100,000 for 5 years. S In March 2019, it exchanged the vehicle for office equipment. The value of the office equipment agreed with the owner was GH80,000.00. The exchange was deemed satisfactory to both parties and documentations were carried through. In April, 2019, the building was gifted to Twist manufacturing Company Limited and all the necessary documents were carrying through. The market value at the time of receipt was equivalent to the cost at which the building was constructed. Twist insured the office building with "We care Insurance Company" and paid monthly premium of 200 per month In November, 2019, an explosion occurred in Twist Limited which destroyed the factory building completely. "We care Insurance Company" compensated Twist an amount of GH 245,000 Twist leased plant for 6 years in January, 2020 of which Twist will be paying an annual rental of GH120,000. The plant can be acquired outright for cash of GH450,000. The implicit interest rate of the lease is 10% and the expected useful life of the building is 7 years. In February, 2020, office equipment was sold for a consideration of GH 54,000 Required: i. Compute Capital Allowance for Twist manufacturing Company Limited for the relevant years of assessment in accordance with the third Schedule of the Income Tax Act 896. ii. (Note your computation should not exceed 2020 year of assessment) (9 marks) . (11 marks) iii. Provide notes to support your computation in (i) above b. ABC Ltd is a company under self-assessment and prepares accounts to 31st March each year. Its estimated chargeable income for the year 2016 was GH 1.2 million. However, the Company's Returns which were submitted to the Large Tax Payers Office at the VAT House on 1st April, 2017 showed a chargeable income of GH1.8 million. During this period, Bank of Ghana policy rate was constant at 24% per annum. ABC Ltd made its first installment payment on 31st March, 2016. Required Compute the Interest payable by the company. (7 marks) ii. Determine the outstanding liability payable by the company to GRA. (3 marks) (Hint: Your answers should be in line with section 70 of Revenue Administration Act 2016 (Act 915)) i. (Total: 30 marks) Page 4 of 6 AESTION THREE Ghana has not entered into Double Taxation Agreement (DTA) with the government of Nigeria. Kumaga a resident person of Ghana approached you this morning to explain to him whether foreign tax credit relief covers those residents trading in Nigeria Required State your responses to Kumuga on the above issue? (4 marks) Amaliman Rural Bank commenced operation on 14 January, 2018, preparing account to 31st December each year. The Income statement for the year ended 31 December, 2019 is shown below. Income statement for the year ended 31 December, 2019 GHC Profit before tax 700,000 Additional Information Investment The business invested in two portfolios, a foreign investment with In-charge Ltd, and Domestic investment with Blue Rose Limited, Blue Rose Ltd is located in Buduburum-Ghana. Amafiman has 8% shares for GH 1,200,000 in In-charge Ltd and 26% shares for GH 653,000 in Blue Rose Limited. During the year ended 31 December, 2019, In-charge Limited paid an amount of GH 400.000 after 5% tax to the bank whiles Blue Rose Ltd paid a gross amount of GH 42,500. The management realised that Blue Rose Ltd is not profitable investment, so they sold the shares for GH 800,000 in December, 2019, and acquired a new shares in Gidimadjor Ltd costing GH 723.000 in the same month. The only amount included by the accountant before arriving at the profit before tax was GH 442,500 being the dividends received from Blue Rose Ltd and In-charge Lid Depreciation Amafiman Rural Bank charged Depreciation before arriving at the above profit. The bank depreciated the asset on straight line method. The business acquired the following asset on 1st January, 2018 Depreciate Rate (%) Cost GHC Premises (Land element GH 40,000) 20% 100,000 Computer servers 25% 60,000 The bank acquired a trade mark valued at GHC 50,000 with an economic useful life of years in the year 2018. The accountant ignored the trade mark and Land in computation of the depreciation because he thinks these assets are not depreciable asset. Research and development The banks conducted research amounted to GHC 10,000. The research was carried out to acquire the computer server. The whole GH 10,000 was added to cost in arriving at the profit. Uncollectible debt and Refund Specific bad debt and General bad debt on loans amounted to GH 12,000 and GH 23,000 respectively. And these amounts were added to cost in arriving at the profit. Interest of GH 13.000 received from Apex Rural Bank was refunded back to them on 1st December, 2019 because of a legal obligation to refund. In the year 2019, the business employed 6 fresh graduates out of the total work force of 750 in the bank During the year ended 31 December, 2019, the business deducted the following expenditures from the business income. GH Fresh Graduate Staffs 350,000 Other Staffs 750,000 SSNIT Contributions 400,000 Total 1,500,000 Finance Lease The interest expense deducted before arriving at the above profit includes sum of GH 12,000 paid to Big Joe Plant Pool Itd under finance lease agreement. Big Joe Plant Pool ltd gave Amafiman Rural Bank an option of either buying a plant outright for cash of GH 45,492 or leasing it for 5 years. Under the lease terms, Amafiman Rural Bank will pay an annual rental of GH 12,000 at the beginning of each year for five years. The implicit interest rate of the lease is 10% and the expected useful life of the plant is 5 years. Amafiman Rural Bank is required to insure the plant and can renew the lease contract for an insignificant amount. Amafiman Rural Bank leased the plant on 1st January, 2018. The accountant of Amafiman Rural Bank did not charge any depreciation on the plant because he thinks Big Joe should rather charge the depreciation. Required i. Compute the Chargeable Income and tax payable by Amafiman Rural Bank for 2019 year of assessment. (9 marks) ii. Provide notes to support your answer in (i) above (17 marks) (Total: 30 marks) SECTION A (10 marks): Answer ALL Questions in this section. QUESTION ONE a. Mr. George Amoako commenced business on 1st April, 2017 and submitted the following extracts of his financial statements for the year ended 31st March, 2018 and 2019 to Ghana Revenue Authority. Ghana Revenue Authority is yet to audit and assess the accounts of George's Business since its commencement. Income Statement for the year ended 31st March, 2019 2018 GHC GHC Gross profit 99,000 43,332 Salary (Note 1) (30,000) (35,000) Computer purchased (Note 3) (35,000) (29,200) Office Equipment (Note 3) (6,000) Employer's SNNIT Contribution (6,000) (5,000) Contribution and Donation (Note 2) (9,000) (8,000) Carry over loss from 2017-2018 year (Note 4) (19,000) Net Profit or (Loss) (39,868) Additional Information Note 1 Salary Mr. George Personal salary Other Permanent Staff's salary Wages paid to Casual worker 6,000 4,000 20,000 30,000 8,000 3,000 24,000 35,000 Note 2 Contribution and donation . Ghana Heart Foundation 5,500 4.000 Approved religious Institution 2,000 2,000 Custom Officials 1,500 2,000 9,000 8,000 Note 3 Tax Rates Corporate Tax Rate for 2018 year of assessment is 25% and Annual Graduated Tax Rate for 2018 year of assessment is shown below First GH43,132 Nil Next GH4840 5% Next GH1,200 10% Next GH433,720 17.5% Next GH438,892 25% Exceeding 120,000 35% Note 4 Carry-Over Loss Mr. George decided to carry-over the denied loss of GH20,868 (i.e 39,868- 19,000) from year ended 31st March, 2019 to 31st March, 2020 year end. Amount (GH) Note 5 Acquisition of depreciable assets Asset Date of Acquisition Computers 01/12/2017 Equipment 01/03/2018 Computers 01/06/2018 29,200 6,000 35,000 ii. Required Compute Mr. George's Taxable income and Tax liability for 2018 year of assessment. (14 marks) Provide notes to support your computation (6 marks) iii. In furtherance of section 17 of the Act 896, comment on George's decision to carry-over an unrelieved loss of GH 20,868 to 31st March, 2020 year end. (4 marks) iv. Determine Mr. George's obligation on payment of Wages to Casual worker in respect of 2018 year of assessment for taxation purposes. (2 marks) b. Faith Charity Foundation (Faith) is an approved Ghanaian Non-Governmental Organisation which provides care and support to homeless children. During the year ended 31st December, 2018 the income of the foundation reduced by 25%, this created financial crisis for the foundation to cover its core expenditures. The foundation has enough space it is not using currently. Management decided to provide venue for big programs for fees to support the children education in 2019. They added that, since celebrities may be present, it will serve as a motivation to these homeless children. They also made projection about selling of un-used equipment for GHC 200,000 in 2019 year. ABC Hotel Ltd which commenced operation in the year 2018 has promised the foundation an amount of 22% of its assessed annual profit before tax for 2019 year of assessment. The foundation Explain the tax implications with the projected incomes included in Faith's budget for 2019 year by the management. (3 marks) Estimate the amount of tax payable (in percentage) by ABC Limited and determine the effect of its contribution to Faith Foundation on tax payable to GRA for 2019 year of assessment. (3 marks) Twist is USA based citizen who was employed by Crops Scientists Institute in USA. In 2020, Twist was seconded to Ghana from the Crops Scientists Institute in USA as a Crop Scientist to Crop Research Institute in Ghana, starting from 1 August, 2020. He came to Ghana purposely of serving the employer and being his first time of such employment; he was so excited to receive his appointment letter. The Crop Research Institute in Ghana stated in the appointment letter that the institute will pay for his airfares to cover his five member family including himself". The institute bought tickets valued at 6,000 per head and issued them to Twist. Required Briefly explain the tax implication on the Airfare paid to Twist by Crop Research Institute in Ghana for 2020 year of assessment. (8 marks) (Total: 40 marks) . . QUESTION TWO a. Twist manufacturing Company Limited (Twist) stated operation on 27th May, 2018 and prepare accounts to 31" December each year. The following transactions took place. In January, 2017, Twist acquired Nissan petrol at the price of GH150,000 2 In June, 2018, Twist acquired three Home-Used Laptops at GH 500 each, of which the Managing Director uses one of them for his personal business. In June, 2018 Twist rented factory building of which it pays annual rentals of GH 20,000. The rented building was constructed at the cost of GH4 500,000.5 In July, 2018, the engine of the Nissan petrol was changed at a cost of 18,075. 2 In: August, 2018 Twist paid for Goodwill amounting to GH100,000 for 5 years. S In March 2019, it exchanged the vehicle for office equipment. The value of the office equipment agreed with the owner was GH80,000.00. The exchange was deemed satisfactory to both parties and documentations were carried through. In April, 2019, the building was gifted to Twist manufacturing Company Limited and all the necessary documents were carrying through. The market value at the time of receipt was equivalent to the cost at which the building was constructed. Twist insured the office building with "We care Insurance Company" and paid monthly premium of 200 per month In November, 2019, an explosion occurred in Twist Limited which destroyed the factory building completely. "We care Insurance Company" compensated Twist an amount of GH 245,000 Twist leased plant for 6 years in January, 2020 of which Twist will be paying an annual rental of GH120,000. The plant can be acquired outright for cash of GH450,000. The implicit interest rate of the lease is 10% and the expected useful life of the building is 7 years. In February, 2020, office equipment was sold for a consideration of GH 54,000 Required: i. Compute Capital Allowance for Twist manufacturing Company Limited for the relevant years of assessment in accordance with the third Schedule of the Income Tax Act 896. ii. (Note your computation should not exceed 2020 year of assessment) (9 marks) . (11 marks) iii. Provide notes to support your computation in (i) above b. ABC Ltd is a company under self-assessment and prepares accounts to 31st March each year. Its estimated chargeable income for the year 2016 was GH 1.2 million. However, the Company's Returns which were submitted to the Large Tax Payers Office at the VAT House on 1st April, 2017 showed a chargeable income of GH1.8 million. During this period, Bank of Ghana policy rate was constant at 24% per annum. ABC Ltd made its first installment payment on 31st March, 2016. Required Compute the Interest payable by the company. (7 marks) ii. Determine the outstanding liability payable by the company to GRA. (3 marks) (Hint: Your answers should be in line with section 70 of Revenue Administration Act 2016 (Act 915)) i. (Total: 30 marks) Page 4 of 6 AESTION THREE Ghana has not entered into Double Taxation Agreement (DTA) with the government of Nigeria. Kumaga a resident person of Ghana approached you this morning to explain to him whether foreign tax credit relief covers those residents trading in Nigeria Required State your responses to Kumuga on the above issue? (4 marks) Amaliman Rural Bank commenced operation on 14 January, 2018, preparing account to 31st December each year. The Income statement for the year ended 31 December, 2019 is shown below. Income statement for the year ended 31 December, 2019 GHC Profit before tax 700,000 Additional Information Investment The business invested in two portfolios, a foreign investment with In-charge Ltd, and Domestic investment with Blue Rose Limited, Blue Rose Ltd is located in Buduburum-Ghana. Amafiman has 8% shares for GH 1,200,000 in In-charge Ltd and 26% shares for GH 653,000 in Blue Rose Limited. During the year ended 31 December, 2019, In-charge Limited paid an amount of GH 400.000 after 5% tax to the bank whiles Blue Rose Ltd paid a gross amount of GH 42,500. The management realised that Blue Rose Ltd is not profitable investment, so they sold the shares for GH 800,000 in December, 2019, and acquired a new shares in Gidimadjor Ltd costing GH 723.000 in the same month. The only amount included by the accountant before arriving at the profit before tax was GH 442,500 being the dividends received from Blue Rose Ltd and In-charge Lid Depreciation Amafiman Rural Bank charged Depreciation before arriving at the above profit. The bank depreciated the asset on straight line method. The business acquired the following asset on 1st January, 2018 Depreciate Rate (%) Cost GHC Premises (Land element GH 40,000) 20% 100,000 Computer servers 25% 60,000 The bank acquired a trade mark valued at GHC 50,000 with an economic useful life of years in the year 2018. The accountant ignored the trade mark and Land in computation of the depreciation because he thinks these assets are not depreciable asset. Research and development The banks conducted research amounted to GHC 10,000. The research was carried out to acquire the computer server. The whole GH 10,000 was added to cost in arriving at the profit. Uncollectible debt and Refund Specific bad debt and General bad debt on loans amounted to GH 12,000 and GH 23,000 respectively. And these amounts were added to cost in arriving at the profit. Interest of GH 13.000 received from Apex Rural Bank was refunded back to them on 1st December, 2019 because of a legal obligation to refund. In the year 2019, the business employed 6 fresh graduates out of the total work force of 750 in the bank During the year ended 31 December, 2019, the business deducted the following expenditures from the business income. GH Fresh Graduate Staffs 350,000 Other Staffs 750,000 SSNIT Contributions 400,000 Total 1,500,000 Finance Lease The interest expense deducted before arriving at the above profit includes sum of GH 12,000 paid to Big Joe Plant Pool Itd under finance lease agreement. Big Joe Plant Pool ltd gave Amafiman Rural Bank an option of either buying a plant outright for cash of GH 45,492 or leasing it for 5 years. Under the lease terms, Amafiman Rural Bank will pay an annual rental of GH 12,000 at the beginning of each year for five years. The implicit interest rate of the lease is 10% and the expected useful life of the plant is 5 years. Amafiman Rural Bank is required to insure the plant and can renew the lease contract for an insignificant amount. Amafiman Rural Bank leased the plant on 1st January, 2018. The accountant of Amafiman Rural Bank did not charge any depreciation on the plant because he thinks Big Joe should rather charge the depreciation. Required i. Compute the Chargeable Income and tax payable by Amafiman Rural Bank for 2019 year of assessment. (9 marks) ii. Provide notes to support your answer in (i) above (17 marks) (Total: 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts