Question: Section A: (20 marks) A European put option on a dividend-paying stock is most likely to increase if there is an increase in: A. Carrying

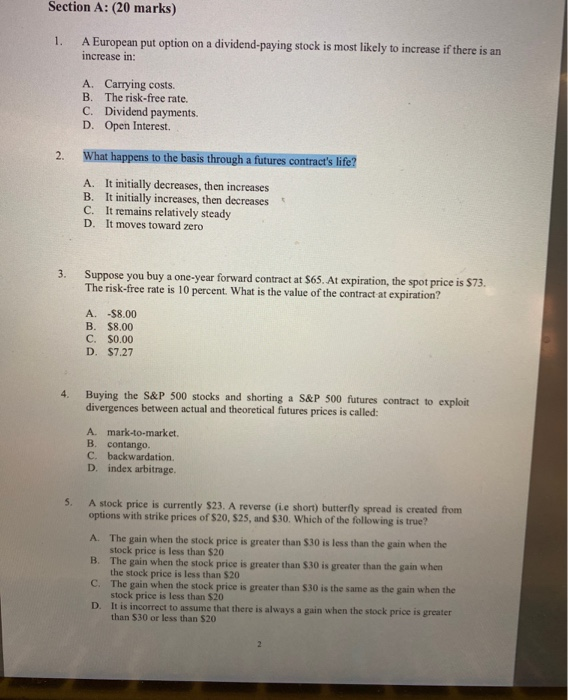

Section A: (20 marks) A European put option on a dividend-paying stock is most likely to increase if there is an increase in: A. Carrying costs. B. The risk-free rate. C. Dividend payments. D. Open Interest. What happens to the basis through a futures contract's life? A. It initially decreases, then increases B. It initially increases, then decreases C. It remains relatively steady D. It moves toward zero Suppose you buy a one-year forward contract at $65. At expiration, the spot price is $73. The risk-free rate is 10 percent. What is the value of the contract at expiration? A. B. C. D. 58.00 $8.00 S0.00 $7.27 Buying the S&P 500 stocks and shorting a S&P 500 futures contract to exploit divergences between actual and theoretical futures prices is called: A mark-to-market. B contango. C. backwardation. Dindex arbitrage. A stock price is currently $23. A reverse (ie short) butterfly spread is created from options with strike prices of $20, $25, and $30. Which of the following is true? A The gain when the stock price is greater than $3 is less than the pain when the stock price is less than $20 B. The gain when the stock price is greater than $30 is greater than the gain when the stock price is less than $20 C. The gain when the stock price is greater than $30 is the same as the gain when the stock price is less than $20 D. It is incorrect to assume that there is always a gain when the stock price is greater than $30 or less than $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts