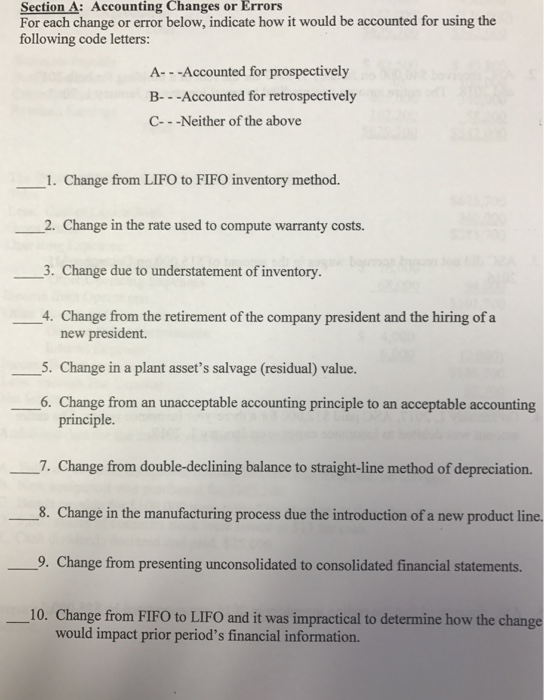

Question: Section A: Accounting Changes or Errors For each change or error below, indicate how it would be accounted for using the following code letters: A-

Section A: Accounting Changes or Errors For each change or error below, indicate how it would be accounted for using the following code letters: A- - -Accounted for prospectively B- -Accounted for retrospectively C- - -Neither of the above 1. Change from LIFO to FIFO inventory method. --,2 Change in the rate used to compute warranty costs. 3. Change due to understatement of inventory. . Change from the retirement of the company president and the hiring of a new president. . Change in a plant asset's salvage (residual) value. 6. Change from an unacceptable accounting principle to an acceptable accounting principle. 7. Change from double-declining balance to straight-line method of depreciation. 8. Change in the manufacturing process due the introduction of a new product line. 9. Change from presenting unconsolidated to consolidated financial statements. 10. Change from FIFO to LIFO and it was impractical to determine how the change would impact prior period's financial information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts