Question: SECTION A Answer ALL the questions in this section. QUESTION 1 The following information relates to Tabita Lit. The financial year ended on 28 February

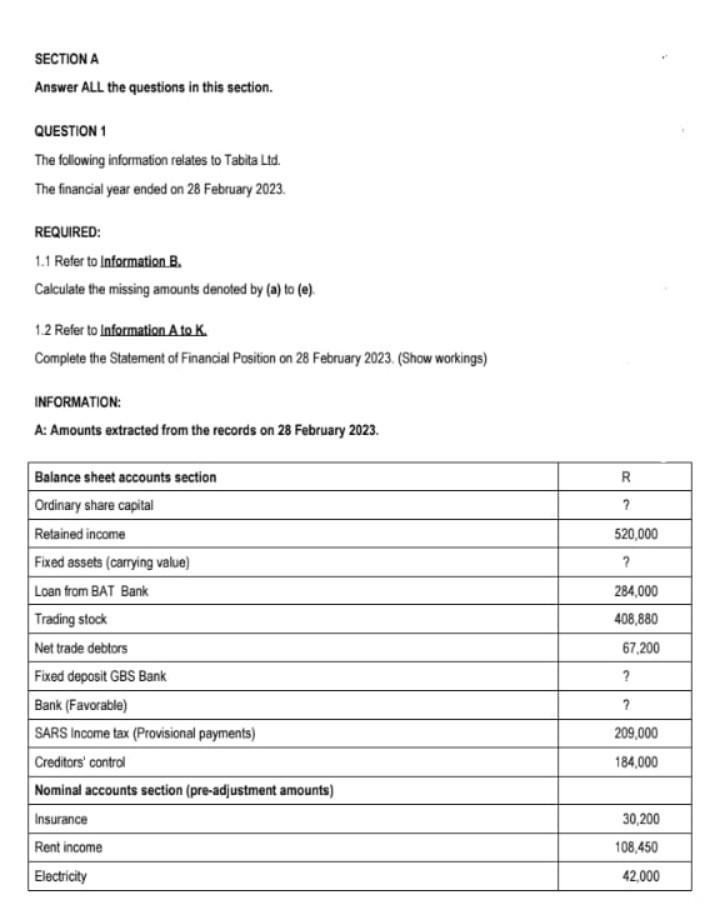

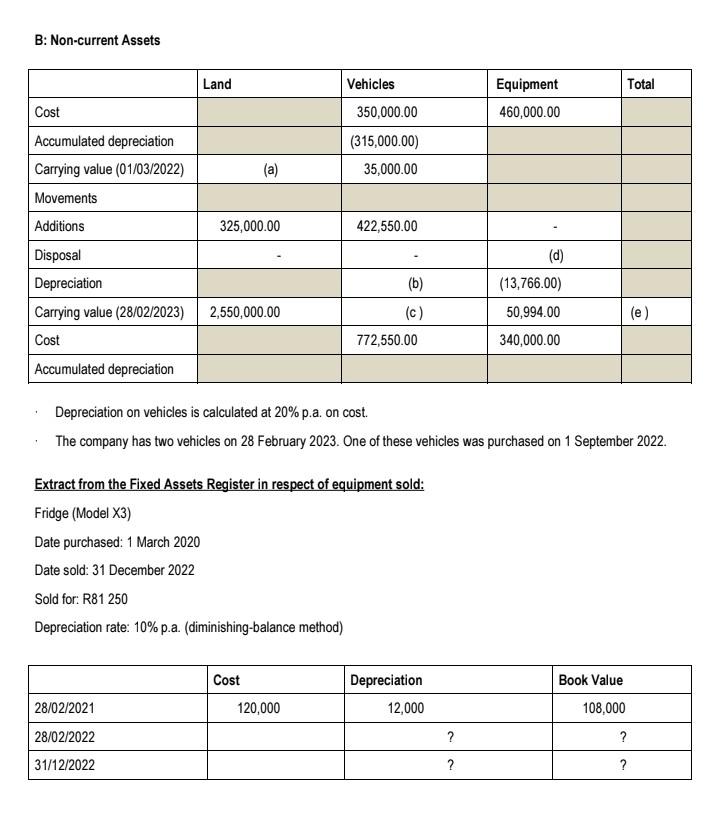

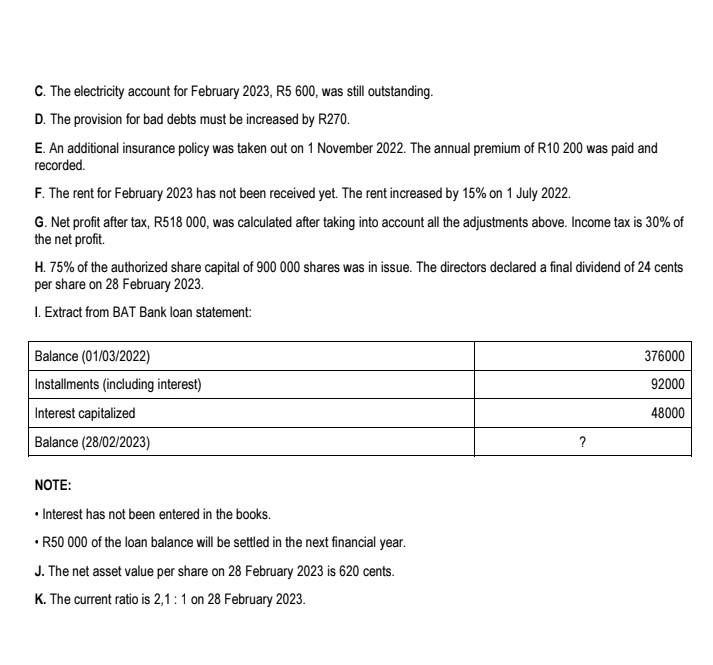

SECTION A Answer ALL the questions in this section. QUESTION 1 The following information relates to Tabita Lit. The financial year ended on 28 February 2023. REQUIRED: 1.1 Refer to Information B. Calculate the missing amounts denoted by (a) to (e). 1.2 Refer to Information Ato K. Complete the Statement of Financial Position on 28 February 2023. (Show workings) INFORMATION: A: Amounts extracted from the records on 28 February 2023. \begin{tabular}{|l|c|} \hline Balance sheet accounts section & R \\ \hline Ordinary share capital & ? \\ \hline Retained income & 520,000 \\ \hline Fixed assets (carrying value) & ? \\ \hline Loan from BAT Bank & 284,000 \\ \hline Trading stock & 408,880 \\ \hline Net trade debtors & 67,200 \\ \hline Fixed deposit GBS Bank & ? \\ \hline Bank (Favorable) & ? \\ \hline SARS Income tax (Provisional payments) & 209,000 \\ \hline Creditors' control & 184,000 \\ \hline Nominal accounts section (pre-adjustment amounts) & \\ \hline Insurance & 30,200 \\ \hline Rent income & 108,450 \\ \hline Electricity & 42,000 \\ \hline \end{tabular} B: Non-current Assets Depreciation on vehicles is calculated at 20% p.a. on cost. The company has two vehicles on 28 February 2023. One of these vehicles was purchased on 1 September 2022. Extract from the Fixed Assets Register in respect of equipment sold: Fridge (Model X3) Date purchased: 1 March 2020 Date sold: 31 December 2022 Sold for: R81 250 Depreciation rate: 10% p.a. (diminishing-balance method) C. The electricity account for February 2023, R5 600, was still outstanding. D. The provision for bad debts must be increased by R270. E. An additional insurance policy was taken out on 1 November 2022. The annual premium of R10 200 was paid and recorded. F. The rent for February 2023 has not been received yet. The rent increased by 15% on 1 July 2022 . G. Net profit after tax, R518 000, was calculated after taking into account all the adjustments above. Income tax is 30% of the net profit. H. 75% of the authorized share capital of 900000 shares was in issue. The directors declared a final dividend of 24 cents per share on 28 February 2023. I. Extract from BAT Bank loan statement: NOTE: - Interest has not been entered in the books. - R50 000 of the loan balance will be settled in the next financial year. J. The net asset value per share on 28 February 2023 is 620 cents. K. The current ratio is 2,1:1 on 28 February 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts