Question: Section A - Answer any three (3) questions from this section Question 1 Consider the information in the following table which contains 20 daily observations

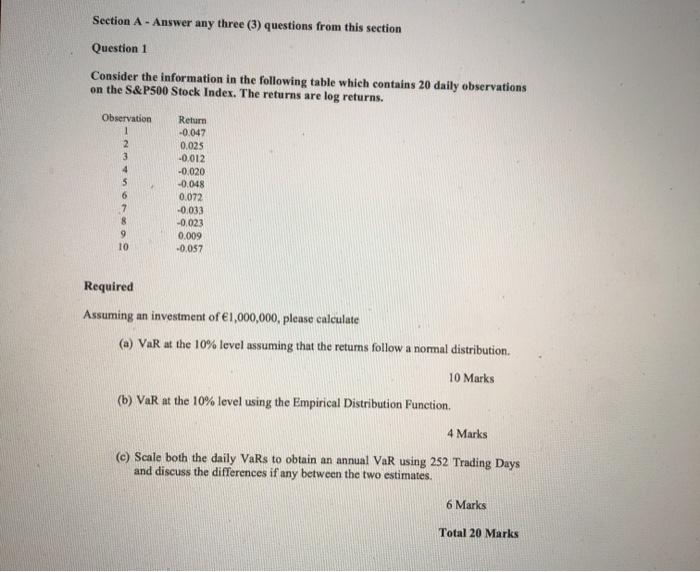

Section A - Answer any three (3) questions from this section Question 1 Consider the information in the following table which contains 20 daily observations on the S&P500 Stock Index. The returns are log returns. Observation 1 2 3 4 5 6 Return -0.047 0.025 -0.012 -0.020 -0.048 0.072 -0.033 -0.023 0.009 -0.057 8 10 Required Assuming an investment of 1,000,000, please calculate (a) VaR at the 10% level assuming that the returns follow a normal distribution 10 Marks (b) VaR at the 10% level using the Empirical Distribution Function, 4 Marks (C) Scale both the daily VaRs to obtain an annual VaR using 252 Trading Days and discuss the differences if any between the two estimates. 6 Marks Total 20 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts