Question: SECTION A Answer at least one question from this section . New Land Corporation has received a proposal from Malaysian government to investment RM70 million

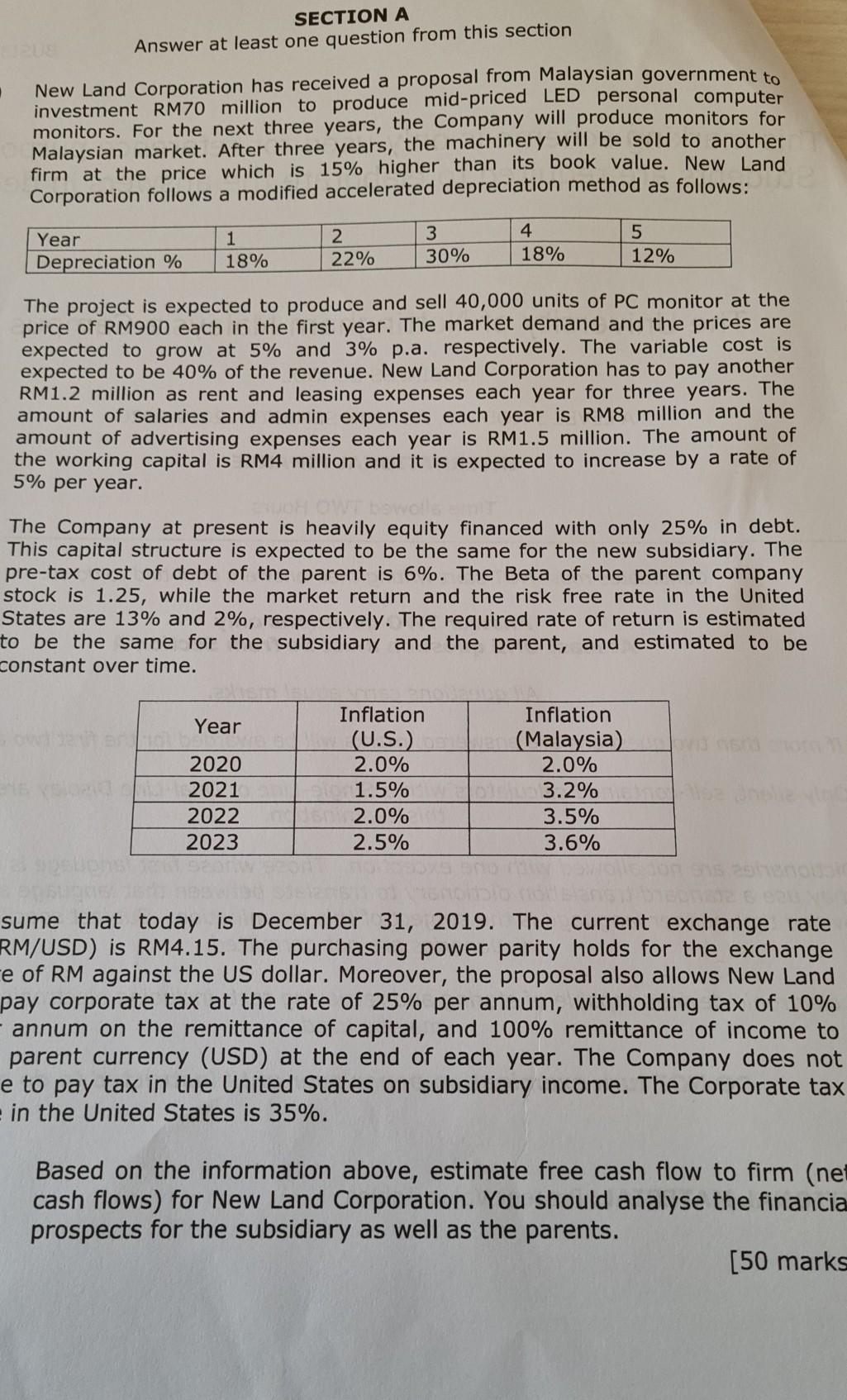

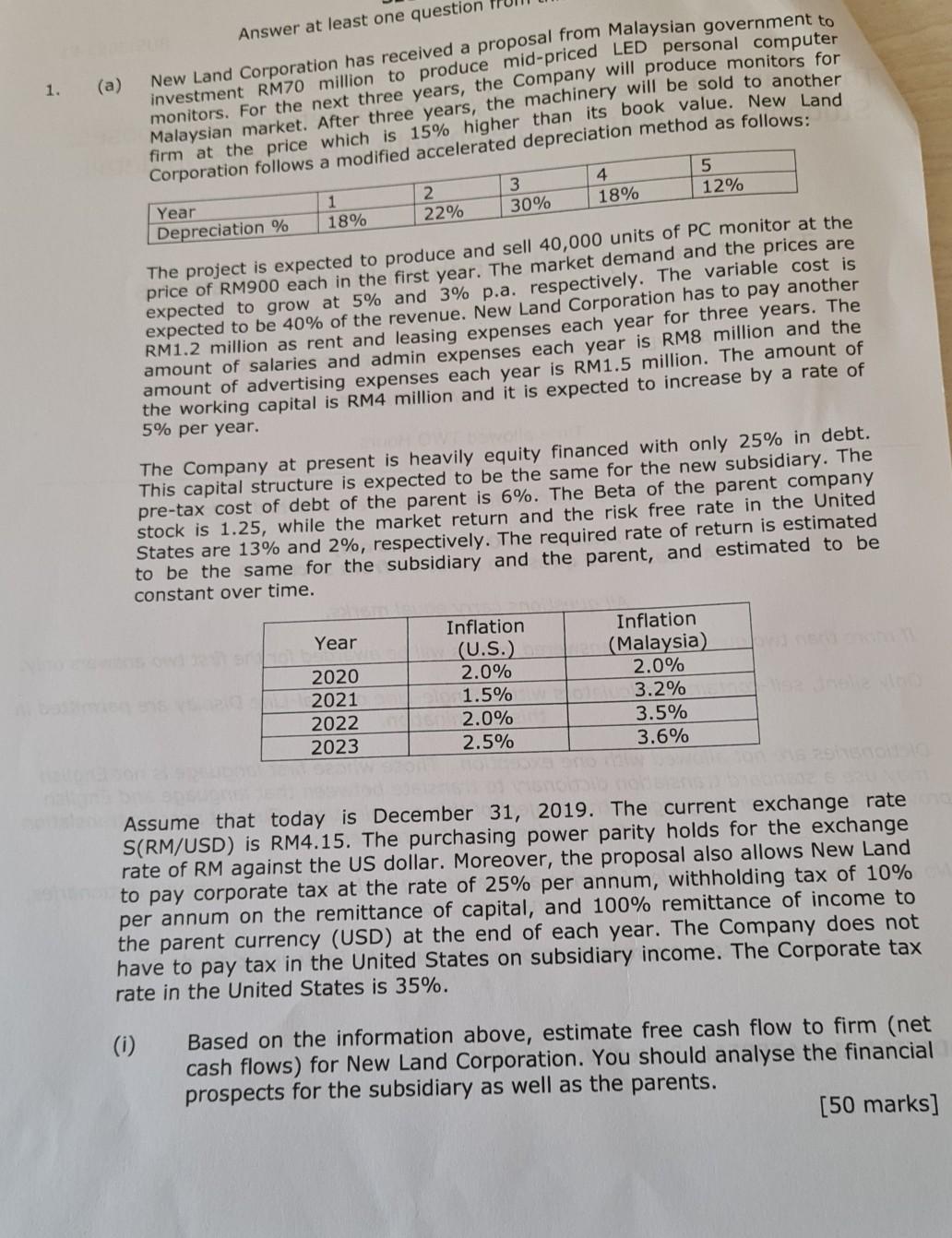

SECTION A Answer at least one question from this section . New Land Corporation has received a proposal from Malaysian government to investment RM70 million to produce mid-priced LED personal computer monitors. For the next three years, the Company will produce monitors for Malaysian market. After three years, the machinery will be sold to another firm at the price which is 15% higher than its book value. New Land Corporation follows a modified accelerated depreciation method as follows: Year 1 2. 3 4 5 Depreciation % 18% 22% 30% 18% 12% The project is expected to produce and sell 40,000 units of PC monitor at the price of RM900 each in the first year. The market demand and the prices are expected to grow at 5% and 3% p.a. respectively. The variable cost is expected to be 40% of the revenue. New Land Corporation has to pay another RM1.2 million as rent and leasing expenses each year for three years. The amount of salaries and admin expenses each year is RM8 million and the amount of advertising expenses each year is RM1.5 million. The amount of the working capital is RM4 million and it is expected to increase by a rate of 5% per year. The Company at present is heavily equity financed with only 25% in debt. This capital structure is expected to be the same for the new subsidiary. The pre-tax cost of debt of the parent is 6%. The Beta of the parent company stock is 1.25, while the market return and the risk free rate in the United States are 13% and 2%, respectively. The required rate of return is estimated to be the same for the subsidiary and the parent, and estimated to be constant over time. Year 2020 2021 2022 2023 Inflation (U.S.) 2.0% 1.5% 2.0% 2.5% Inflation (Malaysia) 2.0% 3.2% 3.5% 3.6% sume that today is December 31, 2019. The current exchange rate RM/USD) is RM4.15. The purchasing power parity holds for the exchange e of RM against the US dollar. Moreover, the proposal also allows New Land pay corporate tax at the rate of 25% per annum, withholding tax of 10% annum on the remittance of capital, and 100% remittance of income to parent currency (USD) at the end of each year. The Company does not e to pay tax in the United States on subsidiary income. The Corporate tax in the United States is 35%. Based on the information above, estimate free cash flow to firm (net cash flows) for New Land Corporation. You should analyse the financia prospects for the subsidiary as well as the parents. [50 marks 1. (a) Answer at least one question New Land Corporation has received a proposal from Malaysian government to investment RM70 million to produce mid-priced LED personal computer monitors. For the next three years, the Company will produce monitors for Malaysian market. After three years, the machinery will be sold to another firm at the price which is 15% higher than its book value. New Land Corporation follows a modified accelerated depreciation method as follows: Year 1 2. 3 4 5 Depreciation % 18% 22% 30% 18% 12% The project is expected to produce and sell 40,000 units of PC monitor at the price of RM900 each in the first year. The market demand and the prices are expected to grow at 5% and 3% p.a. respectively. The variable cost is expected to be 40% of the revenue. New Land Corporation has to pay another RM1.2 million as rent and leasing expenses each year for three years. The amount of salaries and admin expenses each year is RM8 million and the amount of advertising expenses each year is RM1.5 million. The amount of the working capital is RM4 million and it is expected to increase by a rate of 5% per year. The Company at present is heavily equity financed with only 25% in debt. This capital structure is expected to be the same for the new subsidiary. The pre-tax cost of debt of the parent is 6%. The Beta of the parent company stock is 1.25, while the market return and the risk free rate in the United States are 13% and 2%, respectively. The required rate of return is estimated to be the same for the subsidiary and the parent, and estimated to be constant over time. Year 2020 2021 2022 2023 Inflation (U.S.) 2.0% 1.5% 2.0% 2.5% Inflation (Malaysia) 2.0% 3.2% 3.5% 3.6% Assume that today is December 31, 2019. The current exchange rate S(RM/USD) is RM4.15. The purchasing power parity holds for the exchange rate of RM against the US dollar. Moreover, the proposal also allows New Land to pay corporate tax at the rate of 25% per annum, withholding tax of 10% per annum on the remittance of capital, and 100% remittance of income to the parent currency (USD) at the end of each year. The Company does not have to pay tax in the United States on subsidiary income. The Corporate tax rate in the United States is 35%. (i) Based on the information above, estimate free cash flow to firm (net cash flows) for New Land Corporation. You should analyse the financial prospects for the subsidiary as well as the parents. [50 marks] Evaluate the project based on the net present value (NPV) method. [15 marks] (b) Critically explain whether the weighted average cost of capital (WACC) of multinational corporations (MNCs) is normally higher or lower than the WACC of domestic firms. 135 marks) SECTION A Answer at least one question from this section . New Land Corporation has received a proposal from Malaysian government to investment RM70 million to produce mid-priced LED personal computer monitors. For the next three years, the Company will produce monitors for Malaysian market. After three years, the machinery will be sold to another firm at the price which is 15% higher than its book value. New Land Corporation follows a modified accelerated depreciation method as follows: Year 1 2. 3 4 5 Depreciation % 18% 22% 30% 18% 12% The project is expected to produce and sell 40,000 units of PC monitor at the price of RM900 each in the first year. The market demand and the prices are expected to grow at 5% and 3% p.a. respectively. The variable cost is expected to be 40% of the revenue. New Land Corporation has to pay another RM1.2 million as rent and leasing expenses each year for three years. The amount of salaries and admin expenses each year is RM8 million and the amount of advertising expenses each year is RM1.5 million. The amount of the working capital is RM4 million and it is expected to increase by a rate of 5% per year. The Company at present is heavily equity financed with only 25% in debt. This capital structure is expected to be the same for the new subsidiary. The pre-tax cost of debt of the parent is 6%. The Beta of the parent company stock is 1.25, while the market return and the risk free rate in the United States are 13% and 2%, respectively. The required rate of return is estimated to be the same for the subsidiary and the parent, and estimated to be constant over time. Year 2020 2021 2022 2023 Inflation (U.S.) 2.0% 1.5% 2.0% 2.5% Inflation (Malaysia) 2.0% 3.2% 3.5% 3.6% sume that today is December 31, 2019. The current exchange rate RM/USD) is RM4.15. The purchasing power parity holds for the exchange e of RM against the US dollar. Moreover, the proposal also allows New Land pay corporate tax at the rate of 25% per annum, withholding tax of 10% annum on the remittance of capital, and 100% remittance of income to parent currency (USD) at the end of each year. The Company does not e to pay tax in the United States on subsidiary income. The Corporate tax in the United States is 35%. Based on the information above, estimate free cash flow to firm (net cash flows) for New Land Corporation. You should analyse the financia prospects for the subsidiary as well as the parents. [50 marks 1. (a) Answer at least one question New Land Corporation has received a proposal from Malaysian government to investment RM70 million to produce mid-priced LED personal computer monitors. For the next three years, the Company will produce monitors for Malaysian market. After three years, the machinery will be sold to another firm at the price which is 15% higher than its book value. New Land Corporation follows a modified accelerated depreciation method as follows: Year 1 2. 3 4 5 Depreciation % 18% 22% 30% 18% 12% The project is expected to produce and sell 40,000 units of PC monitor at the price of RM900 each in the first year. The market demand and the prices are expected to grow at 5% and 3% p.a. respectively. The variable cost is expected to be 40% of the revenue. New Land Corporation has to pay another RM1.2 million as rent and leasing expenses each year for three years. The amount of salaries and admin expenses each year is RM8 million and the amount of advertising expenses each year is RM1.5 million. The amount of the working capital is RM4 million and it is expected to increase by a rate of 5% per year. The Company at present is heavily equity financed with only 25% in debt. This capital structure is expected to be the same for the new subsidiary. The pre-tax cost of debt of the parent is 6%. The Beta of the parent company stock is 1.25, while the market return and the risk free rate in the United States are 13% and 2%, respectively. The required rate of return is estimated to be the same for the subsidiary and the parent, and estimated to be constant over time. Year 2020 2021 2022 2023 Inflation (U.S.) 2.0% 1.5% 2.0% 2.5% Inflation (Malaysia) 2.0% 3.2% 3.5% 3.6% Assume that today is December 31, 2019. The current exchange rate S(RM/USD) is RM4.15. The purchasing power parity holds for the exchange rate of RM against the US dollar. Moreover, the proposal also allows New Land to pay corporate tax at the rate of 25% per annum, withholding tax of 10% per annum on the remittance of capital, and 100% remittance of income to the parent currency (USD) at the end of each year. The Company does not have to pay tax in the United States on subsidiary income. The Corporate tax rate in the United States is 35%. (i) Based on the information above, estimate free cash flow to firm (net cash flows) for New Land Corporation. You should analyse the financial prospects for the subsidiary as well as the parents. [50 marks] Evaluate the project based on the net present value (NPV) method. [15 marks] (b) Critically explain whether the weighted average cost of capital (WACC) of multinational corporations (MNCs) is normally higher or lower than the WACC of domestic firms. 135 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts