Question: SECTION A Answer two questions and no more than one further question from this section. 1. Orion pic and Stardust plc are two companies that

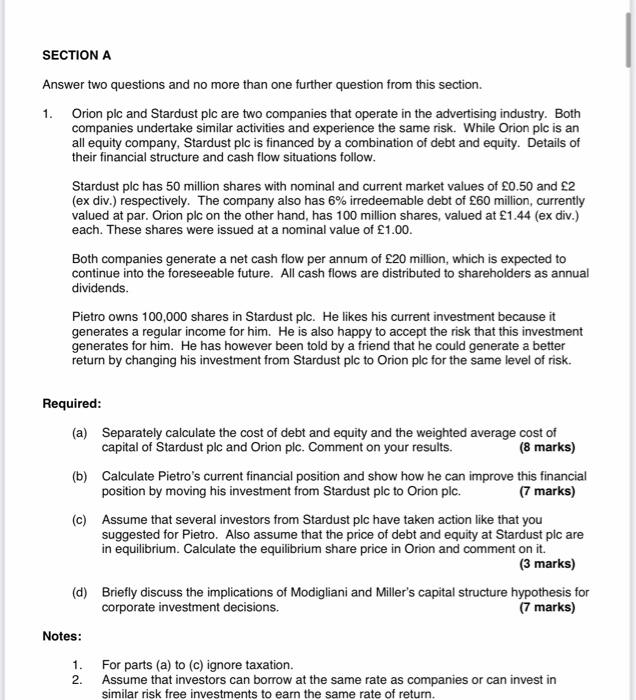

SECTION A Answer two questions and no more than one further question from this section. 1. Orion pic and Stardust plc are two companies that operate in the advertising industry. Both companies undertake similar activities and experience the same risk. While Orion plc is an all equity company, Stardust pic is financed by a combination of debt and equity. Details of their financial structure and cash flow situations follow. Stardust plc has 50 million shares with nominal and current market values of 0.50 and 2 (ex div.) respectively. The company also has 6% irredeemable debt of 60 million, currently valued at par. Orion plc on the other hand, has 100 million shares, valued at 1.44 (ex div.) each. These shares were issued at a nominal value of 1.00. Both companies generate a net cash flow per annum of 20 million, which is expected to continue into the foreseeable future. All cash flows are distributed to shareholders as annual dividends. Pietro owns 100,000 shares in Stardust pic. He likes his current investment because it generates a regular income for him. He is also happy to accept the risk that this investment generates for him. He has however been told by a friend that he could generate a better return by changing his investment from Stardust plc to Orion plc for the same level of risk. Required: (a) Separately calculate the cost of debt and equity and the weighted average cost of capital of Stardust plc and Orion plc. Comment on your results. (8 marks) (b) Calculate Pietro's current financial position and show how he can improve this financial position by moving his investment from Stardust plc to Orion plc. (7 marks) (c) Assume that several investors from Stardust plc have taken action like that you suggested for Pietro. Also assume that the price of debt and equity at Stardust pic are in equilibrium. Calculate the equilibrium share price in Orion and comment on it. (3 marks) (d) Briefly discuss the implications of Modigliani and Miller's capital structure hypothesis for corporate investment decisions. (7 marks) Notes: For parts (a) to (c) ignore taxation. Assume that investors can borrow at the same rate as companies or can invest in similar risk free investments to earn the same rate of return. 1. 2. SECTION A Answer two questions and no more than one further question from this section. 1. Orion pic and Stardust plc are two companies that operate in the advertising industry. Both companies undertake similar activities and experience the same risk. While Orion plc is an all equity company, Stardust pic is financed by a combination of debt and equity. Details of their financial structure and cash flow situations follow. Stardust plc has 50 million shares with nominal and current market values of 0.50 and 2 (ex div.) respectively. The company also has 6% irredeemable debt of 60 million, currently valued at par. Orion plc on the other hand, has 100 million shares, valued at 1.44 (ex div.) each. These shares were issued at a nominal value of 1.00. Both companies generate a net cash flow per annum of 20 million, which is expected to continue into the foreseeable future. All cash flows are distributed to shareholders as annual dividends. Pietro owns 100,000 shares in Stardust pic. He likes his current investment because it generates a regular income for him. He is also happy to accept the risk that this investment generates for him. He has however been told by a friend that he could generate a better return by changing his investment from Stardust plc to Orion plc for the same level of risk. Required: (a) Separately calculate the cost of debt and equity and the weighted average cost of capital of Stardust plc and Orion plc. Comment on your results. (8 marks) (b) Calculate Pietro's current financial position and show how he can improve this financial position by moving his investment from Stardust plc to Orion plc. (7 marks) (c) Assume that several investors from Stardust plc have taken action like that you suggested for Pietro. Also assume that the price of debt and equity at Stardust pic are in equilibrium. Calculate the equilibrium share price in Orion and comment on it. (3 marks) (d) Briefly discuss the implications of Modigliani and Miller's capital structure hypothesis for corporate investment decisions. (7 marks) Notes: For parts (a) to (c) ignore taxation. Assume that investors can borrow at the same rate as companies or can invest in similar risk free investments to earn the same rate of return. 1. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts