Question: Section A: Case Study Answer ALL questions based on the case below (100 marks) Remark: Of its nature, the case questions dont lend themselves to

Section A: Case Study Answer ALL questions based on the case below (100 marks)

Remark: Of its nature, the case questions dont lend themselves to model answers. What we are looking for in the answers to these questions is a level of maturity, and the theory and logic that they present to support your discussion. Classification of marks is based largely on how a student shows evidence of critical or evaluative thinking, evidence of synthesis, etc.

*You are required to find additional information on the company to aid the strength of your arguments.

Founded in 1968 and listed on the Hong Kong Stock Exchange in July 1986, Caf de Coral Group () is one of Asias largest publicly listed restaurant and catering groups. Although Caf de Coral Holdings is largely known for its namesake chain of fast-food restaurants, the group also owns and operates quick service restaurants (e.g., Super Super), casual dining chains (e.g., The Spaghetti House, Olivers Super Sandwiches, Shanghai Lao

Lao), institutional catering (e.g., Asia Pacific Catering, Luncheon Star) and food processing (e.g., ScanFoods Ltd.). With deep roots in Hong Kong, the Group has established themselves as a market leader in the fast-food industry over the past 50 years. As of September 30, 2021, Caf de Coral Group operates almost 500 dining outlets and 4 ISO-certified food processing plants in Hong Kong and Mainland China. With its corporate motto of "A Hundred Points of

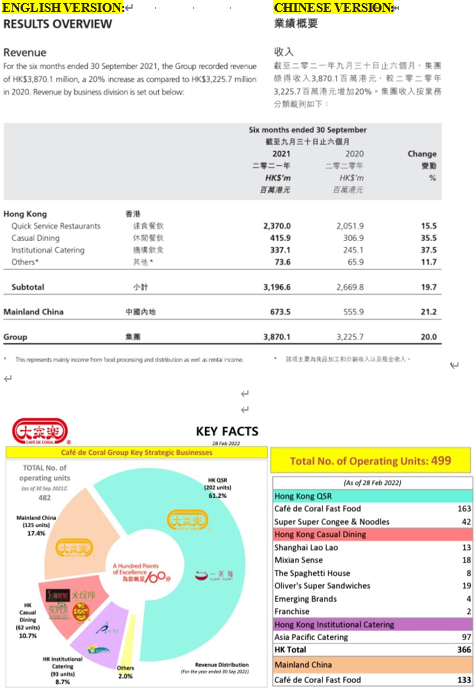

Excellence" (100), Caf de Coral Group continually strives for excellence and staying ahead in a rapidly changing world, focusing on uncompromising standards when it comes to product quality, service quality, and dedication to improvement. As such, they have built a reputation for quality, value, and service to become one of the best-loved catering groups in the Greater Bay Area with leading brands in all our major market sectors (See Figure 1).

Since its establishment, the Group has been through transformations which continuously lead to multiple achievements in performance and net asset value. For example, since the 1980s Caf de Coral Group has consistently recognized the value of a strong Central Food Processing Centre which enables a streamlined standardization of food quality and ensures total control over an ever-increasing volume and range of products and ingredients. Using state-of-the-art technologies, much of the food sold in restaurants is portioned and processed in a main facility where produce, ingredients and packaging materials undergo strict hygiene and safety checks on arrival before processing and distribution to individual restaurants. In 2013, a significant investment was made into a 140,000-square foot plant located in Tai Po that is equipped with advanced facilities to enhance the control of food quality and overall productivity.

Business Recovery to Business Growth

As of 30 September 2021, the Group had a network of 357 stores in Hong Kong (31 March 2021: 352) and 125 stores in Mainland China (31 March 2021: 121). As demonstrated by the

Groups performance during the period for the six months ended 30 September 2021, Caf de Coral has adapted to the new normal of the pandemic. With the pandemic situation mostly under control in Hong Kong and Mainland China, focus has shifted from business continuity to thriving under the new business environment. According to the latest government statistics, the size of Hong Kongs food and beverage market has shrunk significantly in the initial stage of the pandemic.

The COVID-19 environment also caused a shift in consumer dining preferences, with delivery and take-out service now accounting for a significant percentage of the market. At the same time, signs of general economic recovery have sparked a reversal in rental rates, combined with keen competition in the labour market. Overall food costs have also surged due to global supply chain disruptions caused by the pandemic, placing additional pressure on margins. Accepting the current, relatively stable market environment as the new normal, the Group is actively seeking to recover margins and profits by addressing cost structures and underlying operating efficiency whilst pursuing business growth as the local economy recovers. As such, Caf de Coral has shifted operational models to place greater emphasis on delivery and takeaway options, and also moved towards an integrated Online-Merge Offline (OMO) approach that merges the Groups online channels while leveraging the networks of third-party aggregators. The Group, meanwhile, continues to implement prudent cost control measures. They are stepping up efforts on recruitment, retraining and redeployment, and also revamping work processes to balance manpower cost. At the same time, the Group has formed several strategic alliances with landlords and developers to gain access to prime locations at preferential rates and to improve rental costs. A task force has also been set up to address the issue of food costs through smart sourcing, menu reengineering and store execution enhancement.

Figure 1. Caf de Coral Holdings Brands

Mainland China Operations:

Caf de Coral Group has also recognized the potential in the Greater Bay Area. In striving to become the best-loved and most competitive catering group in Greater China with leading brands across all major market sectors, Caf de Coral Group acquired ScanFoods as a strategic step in integrating food distribution and manufacturing in Greater China. One of Hong Kongs leading processed meat suppliers, ScanFoods owns a 40,000-square foot production base in Dongguan. From here, it processes and distributes ham, sausages, and bacon products to institutional customers all over Hong Kong and Mainland China. Furthermore, Caf de Coral continued to leverage their proven business platform and operations by opening a Central Food Processing Centre in Guangzhou in 2011.

In the latest interim report by Caf de Coral for the six months ended on September 30th of 2021, revenue from Mainland China increased by 21.2% to HK$673.5 million (2020: HK$555.9 million). The South China fast food business experienced a 12.1% increase in revenue to RMB540.5 million, with same store sales growth of 7%. Although China was quick to control the initial impact of COVID-19 last year, the June 2021 outbreak of the Delta variant in Guangzhou spread quickly and impacted many cities in the Greater Bay Area. Strict preventative measures were implemented in Guangzhou, Foshan, Zhongshan and Zhuhai; and as a result, 49 of the Groups stores were closed or only able to offer takeaway and delivery service. The pace of new store openings was also seriously impacted due to these restrictions.

Despite isolated COVID-19 outbreaks, the Groups underlying business in Mainland China remains healthy. Proactively implementing measures to improve performance, we strengthened our advantage in Online-to-Offline (O2O) sales and market share; drove repeat purchases and customer loyalty through membership programmes and e-coupons; and proactively managed costs through menu optimisation, efficiency improvement and automation. Strategic emphasis on hero products such as curry beef and sizzling steak have proven popular with consumers, and the business is also focusing on growth of the breakfast market through new product development, menu restructuring and marketing promotion. Digitalisation efforts have helped to drive repeat purchases through a new e-coupon system, which not only improved overall promotion effectiveness but also enabled cross-brand promotion. Other investments in robotics and automation in stores have improved efficiency, reducing manpower requirements.

Even though the pace of new store openings was delayed by the Delta outbreak and related containment measures, the Group continues to focus on network expansion as a key business strategy. The business opened 8 new stores during the period under review, ending the period with 125 stores (31 March 2021: 121); and has 27 new stores in the pipeline for the coming months. The Mainland China market has largely recovered from the effects of the pandemic, despite isolated outbreaks in some regions of the country. The Group remains optimistic about its business prospects in the Greater Bay Area, and is confident in its ability to achieve sustainable growth throughout the region.

Please find below an English Chinese overview of Caf de Corals company results as found on their official website:

Questions:

- Caf de Coral Groups portfolio includes key strategic business such as Casual Dining, Institutional Catering, and Quick Service Restaurants. Identify Caf de Coral Groups corporate level strategy and explain how Caf de Coral uses this strategy to create value for the company. (30 marks) (Maximum: 550 words)

- Due to the success of the expansion into the Mainland China market, Caf de Coral Group is considering further expansion into a new geographic market as a potential avenue for company growth. (30 marks) (Maximum: 550 words)

- First, assess and explain Caf de Coral Groups potential for success in a new international market. (10 marks)

- Based on your analysis, which international market (if any) would you recommend Caf de Coral Group to expand next? Support your reasoning with well-developed arguments using concepts from the course. (10 marks)

- Which entry mode would you recommend (if any) and why? Support your reasoning with well-developed arguments using concepts from the course. (10 marks)

- Imagine that Caf de Coral Group have hired you to be a consultant for the firm. Using your knowledge gained from the course, provide 3 strategic recommendations as to how Caf de Coral Group can create more value for the company and increase its strategic competitiveness. Support your recommendations with well-developed arguments and appropriate examples. (40 marks) (Maximum: 800 words) *Answers cannot be the same as previous questions.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts