Question: SECTION A CASE STUDY QUESTIONS ALL ARE COMPULSORY QUESTION 1 You have recently commenced working for Burung Co and are reviewing a four- year project

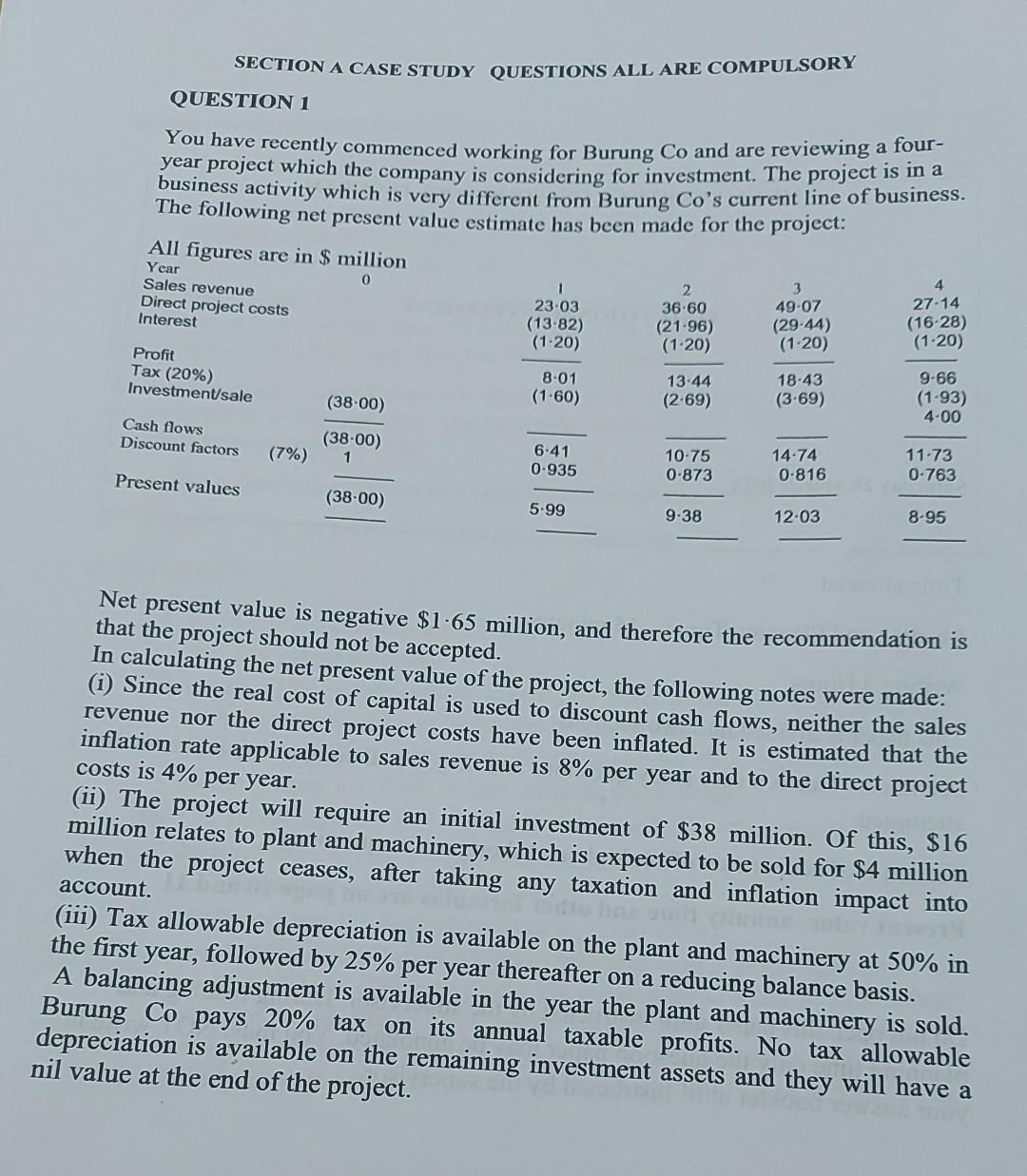

SECTION A CASE STUDY QUESTIONS ALL ARE COMPULSORY QUESTION 1 You have recently commenced working for Burung Co and are reviewing a four- year project which the company is considering for investment. The project is in a business activity which is very different from Burung Co's current line of business. The following net present value estimate has been made for the project: All figures are in $ million 0 Year Sales revenue Direct project costs Interest 1 23.03 (1382) (1-20) 2 36.60 (21-96) (1-20) 3 49.07 (29-44) (1-20) 4 27-14 (16-28) (1-20) Profit Tax (20%) Investment/sale 8-01 (1.60) 13:44 (269) 18-43 (3.69) (38.00) 9-66 (1.93) 4-00 Cash flows Discount factors (7%) (38.00) 1 6.41 0.935 10-75 0.873 14-74 0.816 11.73 0-763 Present values (38.00) 5.99 9.38 12-03 8-95 Net present value is negative $1.65 million, and therefore the recommendation is that the project should not be accepted. In calculating the net present value of the project, the following notes were made: (i) Since the real cost of capital is used to discount cash flows, neither the sales revenue nor the direct project costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 8% per year and to the direct project costs is 4% per year. () The project will require an initial investment of $38 million. Of this, $16 million relates to plant and machinery, which is expected to be sold for $4 million when the project ceases, after taking any taxation and inflation impact into account. (iii) Tax allowable depreciation is available on the plant and machinery at 50% in the first year, followed by 25% per year thereafter on a reducing balance basis. A balancing adjustment is available in the year the plant and machinery is sold. Burung Co pays 20% tax on its annual taxable profits. No tax allowable depreciation is available on the remaining investment assets and they will have a nil value at the end of the project. SECTION A CASE STUDY QUESTIONS ALL ARE COMPULSORY QUESTION 1 You have recently commenced working for Burung Co and are reviewing a four- year project which the company is considering for investment. The project is in a business activity which is very different from Burung Co's current line of business. The following net present value estimate has been made for the project: All figures are in $ million 0 Year Sales revenue Direct project costs Interest 1 23.03 (1382) (1-20) 2 36.60 (21-96) (1-20) 3 49.07 (29-44) (1-20) 4 27-14 (16-28) (1-20) Profit Tax (20%) Investment/sale 8-01 (1.60) 13:44 (269) 18-43 (3.69) (38.00) 9-66 (1.93) 4-00 Cash flows Discount factors (7%) (38.00) 1 6.41 0.935 10-75 0.873 14-74 0.816 11.73 0-763 Present values (38.00) 5.99 9.38 12-03 8-95 Net present value is negative $1.65 million, and therefore the recommendation is that the project should not be accepted. In calculating the net present value of the project, the following notes were made: (i) Since the real cost of capital is used to discount cash flows, neither the sales revenue nor the direct project costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 8% per year and to the direct project costs is 4% per year. () The project will require an initial investment of $38 million. Of this, $16 million relates to plant and machinery, which is expected to be sold for $4 million when the project ceases, after taking any taxation and inflation impact into account. (iii) Tax allowable depreciation is available on the plant and machinery at 50% in the first year, followed by 25% per year thereafter on a reducing balance basis. A balancing adjustment is available in the year the plant and machinery is sold. Burung Co pays 20% tax on its annual taxable profits. No tax allowable depreciation is available on the remaining investment assets and they will have a nil value at the end of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts