Question: Section A: MCO (this section is worth 20 marks) Question This type of risk is avoidable through proper diversification. a) Portfolio risk b) Systematic risk

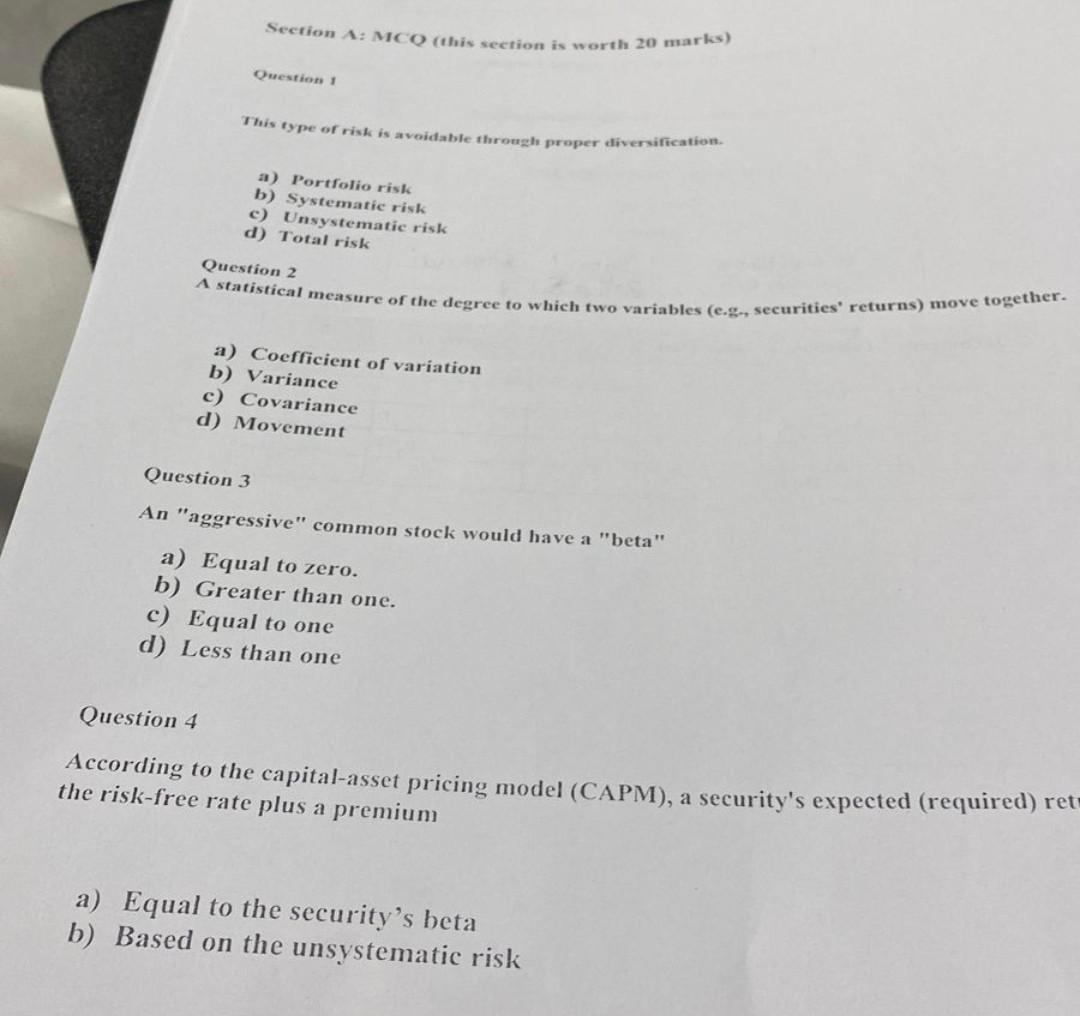

Section A: MCO (this section is worth 20 marks) Question This type of risk is avoidable through proper diversification. a) Portfolio risk b) Systematic risk c) Unsystematic risk d) Total risk Question 2 A statistical measure of the degree to which two variables (eg, securities' returns) move together. a) Coefficient of variation b) Variance c) Covariance d) Movement Question 3 An "aggressive" common stock would have a "beta" a) Equal to zero. b) Greater than one. c) Equal to one d) Less than one Question 4 According to the capital-asset pricing model (CAPM), a security's expected (required) ret the risk-free rate plus a premium a) Equal to the security's beta b) Based on the unsystematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts