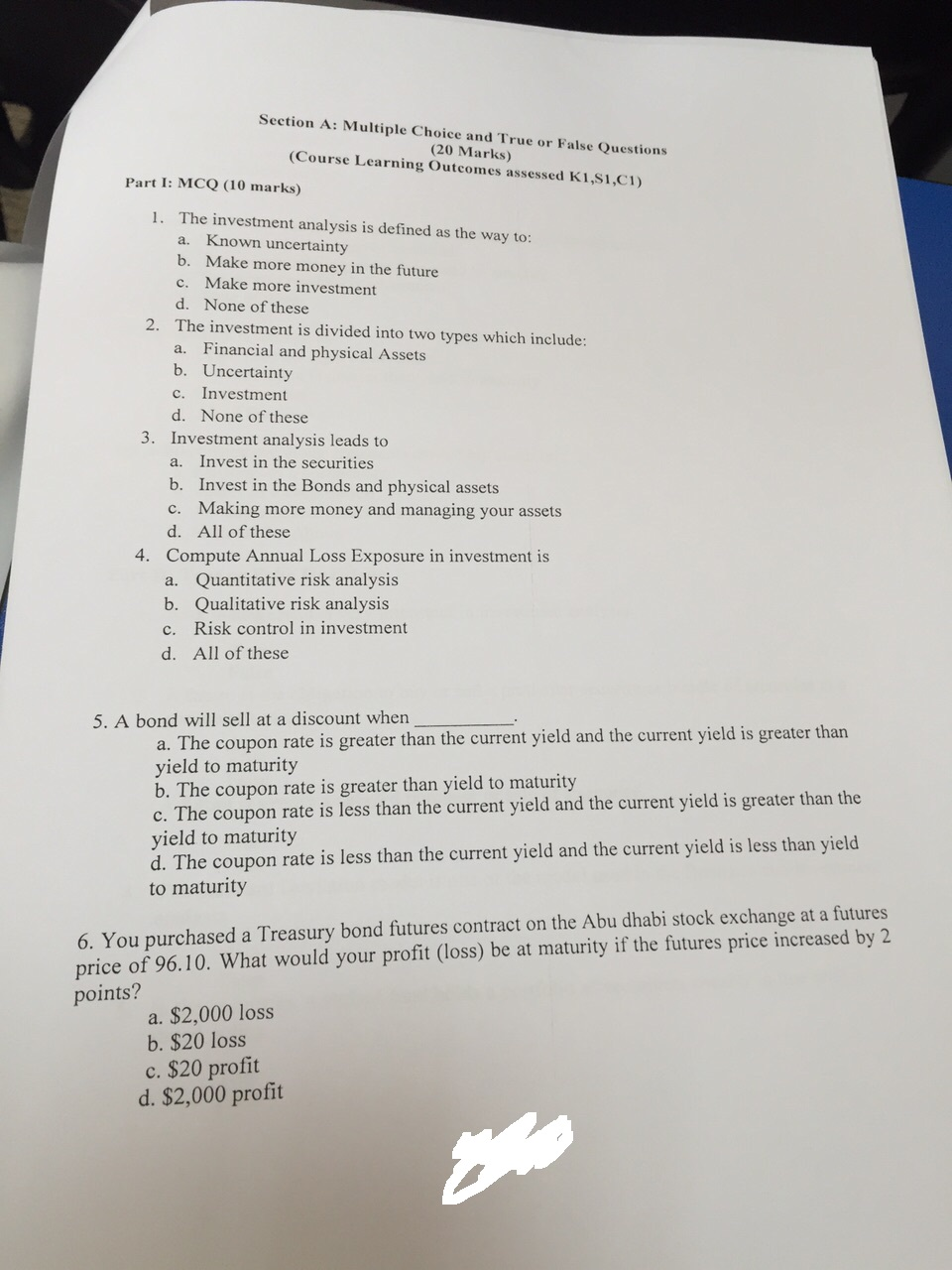

Question: Section A: Multiple Choice and True or False Questions (20 Marks) (Course Learning Outcomes assessed K1,S1,C1) Part I: MCO (10 marks) The investment analysis is

Section A: Multiple Choice and True or False Questions (20 Marks) (Course Learning Outcomes assessed K1,S1,C1) Part I: MCO (10 marks) The investment analysis is defined as the way to a. Known uncertainty b. Make more money in the future c. Make more investment d. None of these The investment is divided into two types which include: a. Financial and physical Assets b. Uncertainty c. Investment d. None of these Investment analysis leads to a. Invest in the securities b. Invest in the Bonds and physical assets c. Making more money and managing your assets d. All of these Compute Annual Loss Exposure in investment is a. Quantitative risk analysis 1 2. 3. 4. b. Qualitative risk analysis c. Risk control in investment d. All of these 5. A bond will sell at a discount when a. The coupon rate is greater than the current yield and the current yield is greater than yield to maturity b. The coupon rate is greater than yield to maturity c. The coupon rate is less than the current yield and the current yield is greater than the yield to maturity d. The coupon rate is less than the current yield and the current yield is less than yield to maturity 6. You purchased a Treasury bond futures contract on the Abu dhabi stock exchange at a futures price of 96.10. What would your profit (loss) be at maturity if the futures price increased by2 points? a. $2,000 loss b. $20 loss c. $20 profit d. $2,000 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts