Question: SECTION A: MULTIPLE CHOICE QUESTION (20 marks 1. Which of the following is NOT the transactions you can perform using saving account (a) Withdrawals (b)

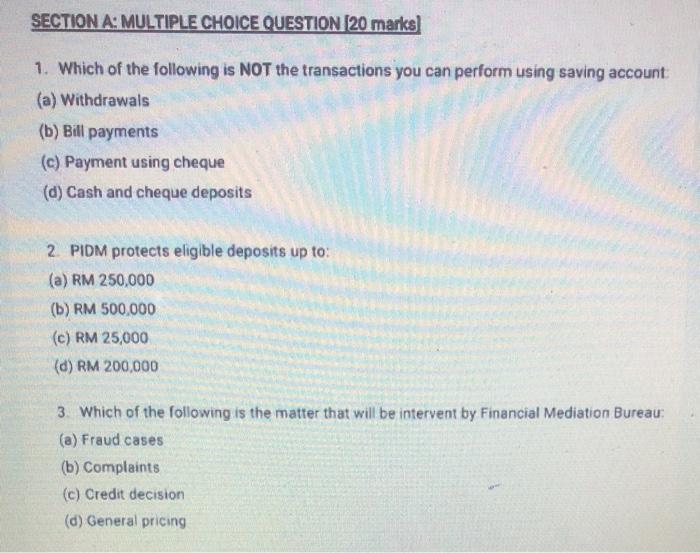

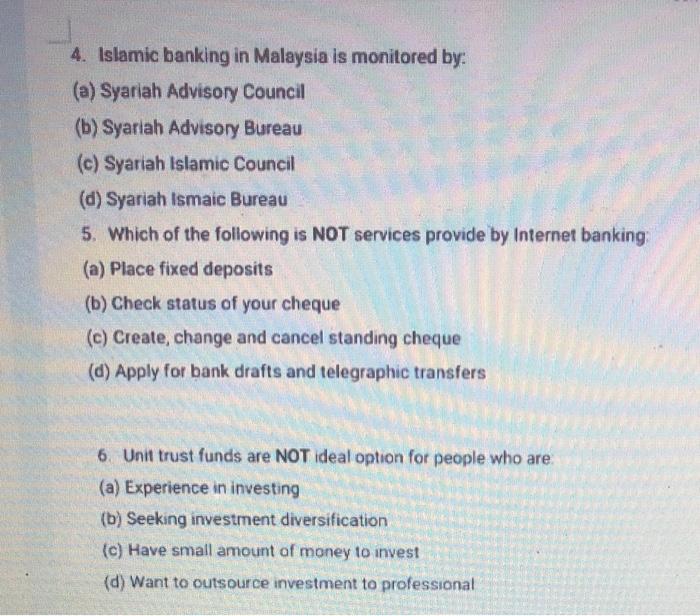

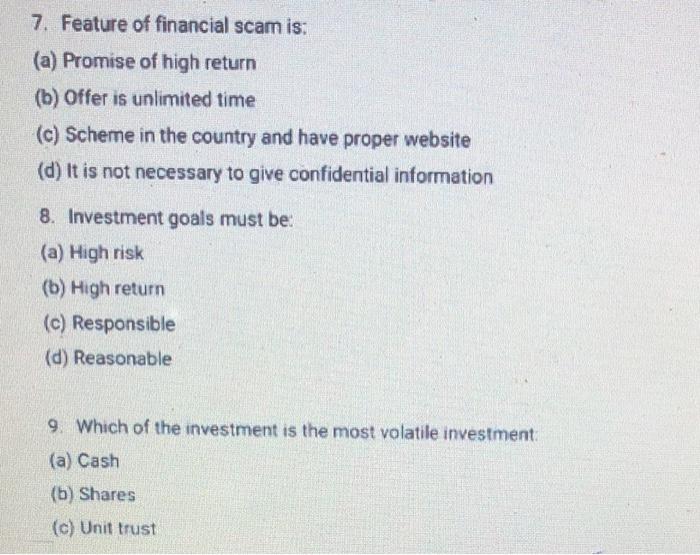

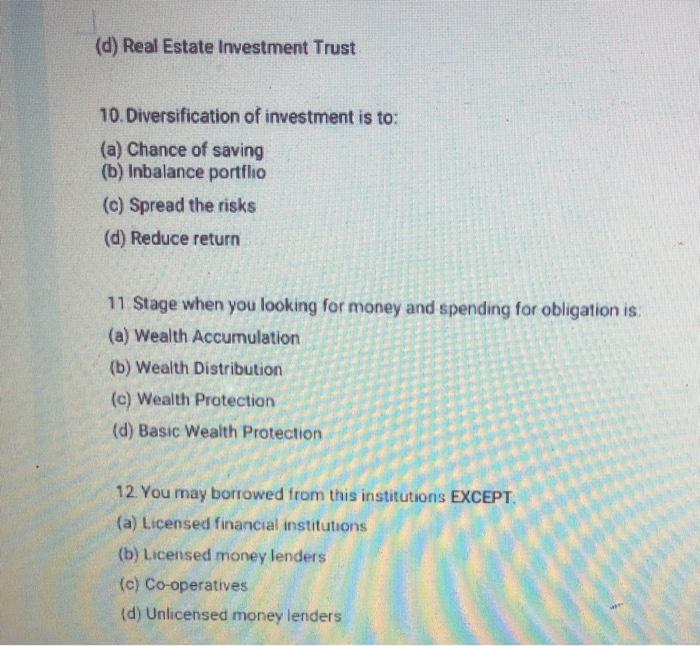

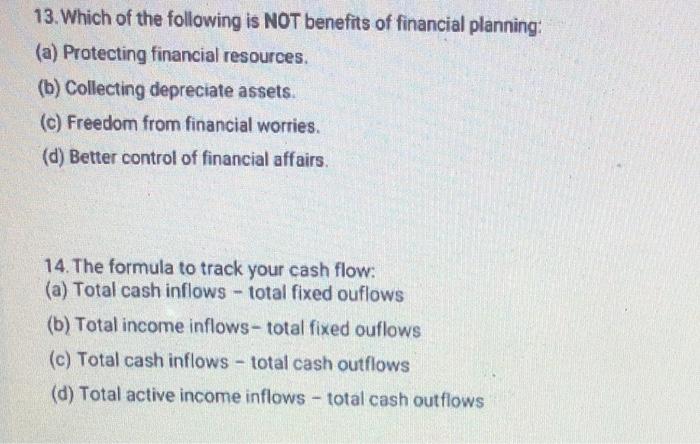

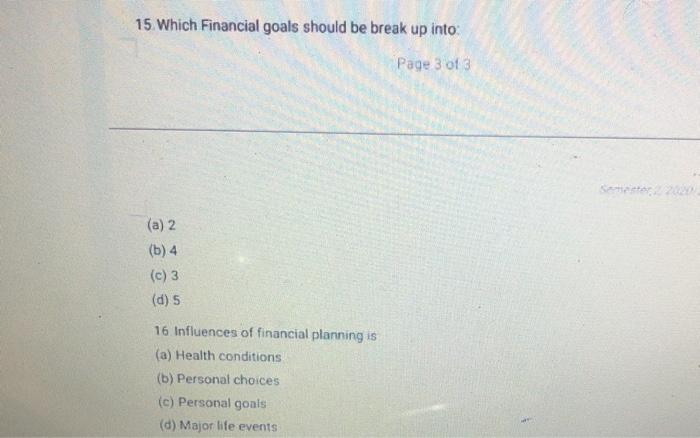

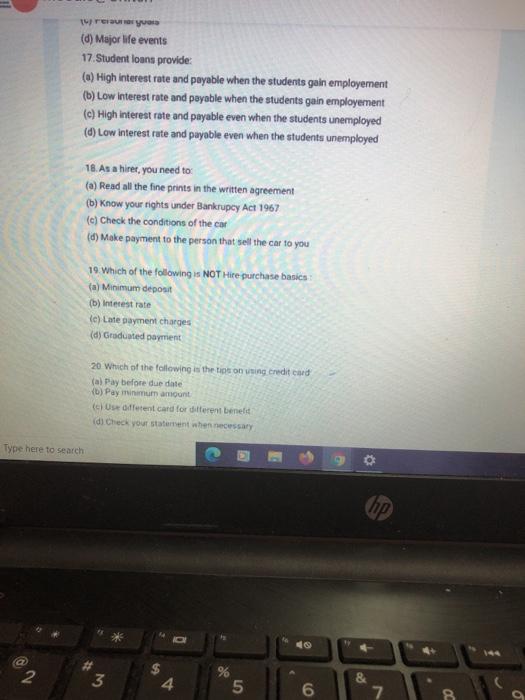

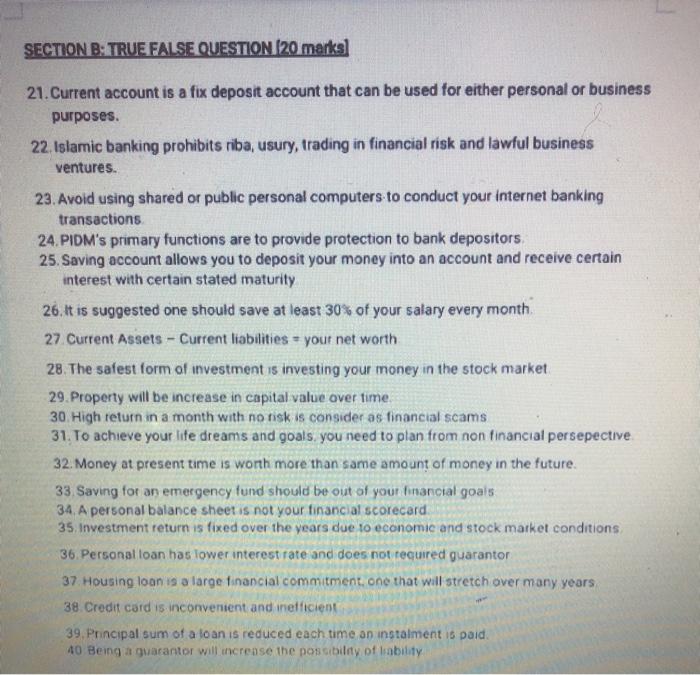

SECTION A: MULTIPLE CHOICE QUESTION (20 marks 1. Which of the following is NOT the transactions you can perform using saving account (a) Withdrawals (b) Bill payments (c) Payment using cheque (d) Cash and cheque deposits 2 PIDM protects eligible deposits up to: (a) RM 250,000 (b) RM 500.000 (c) RM 25,000 (d) RM 200,000 3. Which of the following is the matter that will be intervent by Financial Mediation Bureau (a) Fraud cases (b) Complaints (c) Credit decision (d) General pricing 4. Islamic banking in Malaysia is monitored by: (a) Syariah Advisory Council (b) Syariah Advisory Bureau (c) Syariah Islamic Council (d) Syariah Ismaic Bureau 5. Which of the following is NOT services provide by Internet banking (a) Place fixed deposits (b) Check status of your cheque (c) Create, change and cancel standing cheque (d) Apply for bank drafts and telegraphic transfers 6 Unit trust funds are NOT ideal option for people who are (a) Experience in investing (b) Seeking investment diversification (c) Have small amount of money to invest (d) Want to outsource investment to professional 7. Feature of financial scam is: (a) Promise of high return (b) Offer is unlimited time (c) Scheme in the country and have proper website (d) It is not necessary to give confidential information 8. Investment goals must be: (a) High risk (b) High return (c) Responsible (d) Reasonable 9. Which of the investment is the most volatile investment (a) Cash (b) Shares (c) Unit trust (d) Real Estate Investment Trust 10. Diversification of investment is to: (a) Chance of saving (b) Inbalance portflio (c) Spread the risks (d) Reduce return 11 Stage when you looking for money and spending for obligation is (a) Wealth Accumulation (b) Wealth Distribution (c) Wealth Protection (d) Basic Wealth Protection 12. You may borrowed from this institutions EXCEPT. (a) Licensed financial institutions (b) Licensed money lenders (c) Co-operatives (d) Unlicensed money lenders 13. Which of the following is NOT benefits of financial planning: (a) Protecting financial resources. (b) Collecting depreciate assets. (c) Freedom from financial worries. (d) Better control of financial affairs. 14. The formula to track your cash flow: (a) Total cash inflows - total fixed ouflows (b) Total income inflows-total fixed ouflows (c) Total cash inflows - total cash outflows (d) Total active income inflows - total cash outflows 15. Which Financial goals should be break up into Page 3 of 3 (a) 2 (b) 4 (c) 3 (d) 5 16 Influences of financial planning is (a) Health conditions (b) Personal choices (c) Personal goals (d) Major life events erautor yos (d) Major life events 17. Student loans provide (a) High interest rate and payable when the students gain employement (b) low interest rate and payable when the students gain employement (c) High interest rate and payable even when the students unemployed (d) Low interest rate and payable even when the students unemployed 18. As a hirer, you need to (a) Read all the fine prints in the written agreement (b) Know your rights under Bankrupcy Act 1967 (c) Check the conditions of the car (dl) Make payment to the person that sell the car to you 19. Which of the following is NOT Hire purchase basics (a) Minimum deposit (b) Interest rate le) Late payment charges (d) Graduated payment 20 Which of the following is the tining credit card (a) Pay before due date () Pay minimum amount ( cs Offerent card for different bened (di Check your statement when necessary Type here to search (hp a $ 2 % 3 4 5 02 & 7 OC SECTION B: TRUE FALSE QUESTION (20 marks 21. Current account is a fix deposit account that can be used for either personal or business purposes. 22. Islamic banking prohibits riba, usury, trading in financial risk and lawful business ventures. 23. Avoid using shared or public personal computers to conduct your internet banking transactions 24.PIDM's primary functions are to provide protection to bank depositors 25. Saving account allows you to deposit your money into an account and receive certain interest with certain stated maturity 26. It is suggested one should save at least 30% of your salary every month 27. Current Assets - Current liabilities - your net worth 28. The safest form of investment is investing your money in the stock market 29. Property will be increase in capital value over time. 30. High return in a month with no nisk is consider as financial scams 31. To achieve your life dreams and goals, you need to plan from non financial persepective 32. Money at present time is wonth more than same amount of money in the future. 33. Saving for an emergency fund should be out of your financial goals 34. A personal balance sheet is not your financial scorecard. 35 Investment return is fixed over the years due 10 economic and stock market conditions 36. Personal loan has lower interest rate and does not required guarantor 37 Housing loan is a large financial commitment. one that will stretch over many years 38. Credit card is inconvenient and inefficient 39. Principal sum of a loan is reduced each time on instalment is paid 40 Being a guarantor will increase the possibilny of liability SECTION A: MULTIPLE CHOICE QUESTION (20 marks 1. Which of the following is NOT the transactions you can perform using saving account (a) Withdrawals (b) Bill payments (c) Payment using cheque (d) Cash and cheque deposits 2 PIDM protects eligible deposits up to: (a) RM 250,000 (b) RM 500.000 (c) RM 25,000 (d) RM 200,000 3. Which of the following is the matter that will be intervent by Financial Mediation Bureau (a) Fraud cases (b) Complaints (c) Credit decision (d) General pricing 4. Islamic banking in Malaysia is monitored by: (a) Syariah Advisory Council (b) Syariah Advisory Bureau (c) Syariah Islamic Council (d) Syariah Ismaic Bureau 5. Which of the following is NOT services provide by Internet banking (a) Place fixed deposits (b) Check status of your cheque (c) Create, change and cancel standing cheque (d) Apply for bank drafts and telegraphic transfers 6 Unit trust funds are NOT ideal option for people who are (a) Experience in investing (b) Seeking investment diversification (c) Have small amount of money to invest (d) Want to outsource investment to professional 7. Feature of financial scam is: (a) Promise of high return (b) Offer is unlimited time (c) Scheme in the country and have proper website (d) It is not necessary to give confidential information 8. Investment goals must be: (a) High risk (b) High return (c) Responsible (d) Reasonable 9. Which of the investment is the most volatile investment (a) Cash (b) Shares (c) Unit trust (d) Real Estate Investment Trust 10. Diversification of investment is to: (a) Chance of saving (b) Inbalance portflio (c) Spread the risks (d) Reduce return 11 Stage when you looking for money and spending for obligation is (a) Wealth Accumulation (b) Wealth Distribution (c) Wealth Protection (d) Basic Wealth Protection 12. You may borrowed from this institutions EXCEPT. (a) Licensed financial institutions (b) Licensed money lenders (c) Co-operatives (d) Unlicensed money lenders 13. Which of the following is NOT benefits of financial planning: (a) Protecting financial resources. (b) Collecting depreciate assets. (c) Freedom from financial worries. (d) Better control of financial affairs. 14. The formula to track your cash flow: (a) Total cash inflows - total fixed ouflows (b) Total income inflows-total fixed ouflows (c) Total cash inflows - total cash outflows (d) Total active income inflows - total cash outflows 15. Which Financial goals should be break up into Page 3 of 3 (a) 2 (b) 4 (c) 3 (d) 5 16 Influences of financial planning is (a) Health conditions (b) Personal choices (c) Personal goals (d) Major life events erautor yos (d) Major life events 17. Student loans provide (a) High interest rate and payable when the students gain employement (b) low interest rate and payable when the students gain employement (c) High interest rate and payable even when the students unemployed (d) Low interest rate and payable even when the students unemployed 18. As a hirer, you need to (a) Read all the fine prints in the written agreement (b) Know your rights under Bankrupcy Act 1967 (c) Check the conditions of the car (dl) Make payment to the person that sell the car to you 19. Which of the following is NOT Hire purchase basics (a) Minimum deposit (b) Interest rate le) Late payment charges (d) Graduated payment 20 Which of the following is the tining credit card (a) Pay before due date () Pay minimum amount ( cs Offerent card for different bened (di Check your statement when necessary Type here to search (hp a $ 2 % 3 4 5 02 & 7 OC SECTION B: TRUE FALSE QUESTION (20 marks 21. Current account is a fix deposit account that can be used for either personal or business purposes. 22. Islamic banking prohibits riba, usury, trading in financial risk and lawful business ventures. 23. Avoid using shared or public personal computers to conduct your internet banking transactions 24.PIDM's primary functions are to provide protection to bank depositors 25. Saving account allows you to deposit your money into an account and receive certain interest with certain stated maturity 26. It is suggested one should save at least 30% of your salary every month 27. Current Assets - Current liabilities - your net worth 28. The safest form of investment is investing your money in the stock market 29. Property will be increase in capital value over time. 30. High return in a month with no nisk is consider as financial scams 31. To achieve your life dreams and goals, you need to plan from non financial persepective 32. Money at present time is wonth more than same amount of money in the future. 33. Saving for an emergency fund should be out of your financial goals 34. A personal balance sheet is not your financial scorecard. 35 Investment return is fixed over the years due 10 economic and stock market conditions 36. Personal loan has lower interest rate and does not required guarantor 37 Housing loan is a large financial commitment. one that will stretch over many years 38. Credit card is inconvenient and inefficient 39. Principal sum of a loan is reduced each time on instalment is paid 40 Being a guarantor will increase the possibilny of liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts