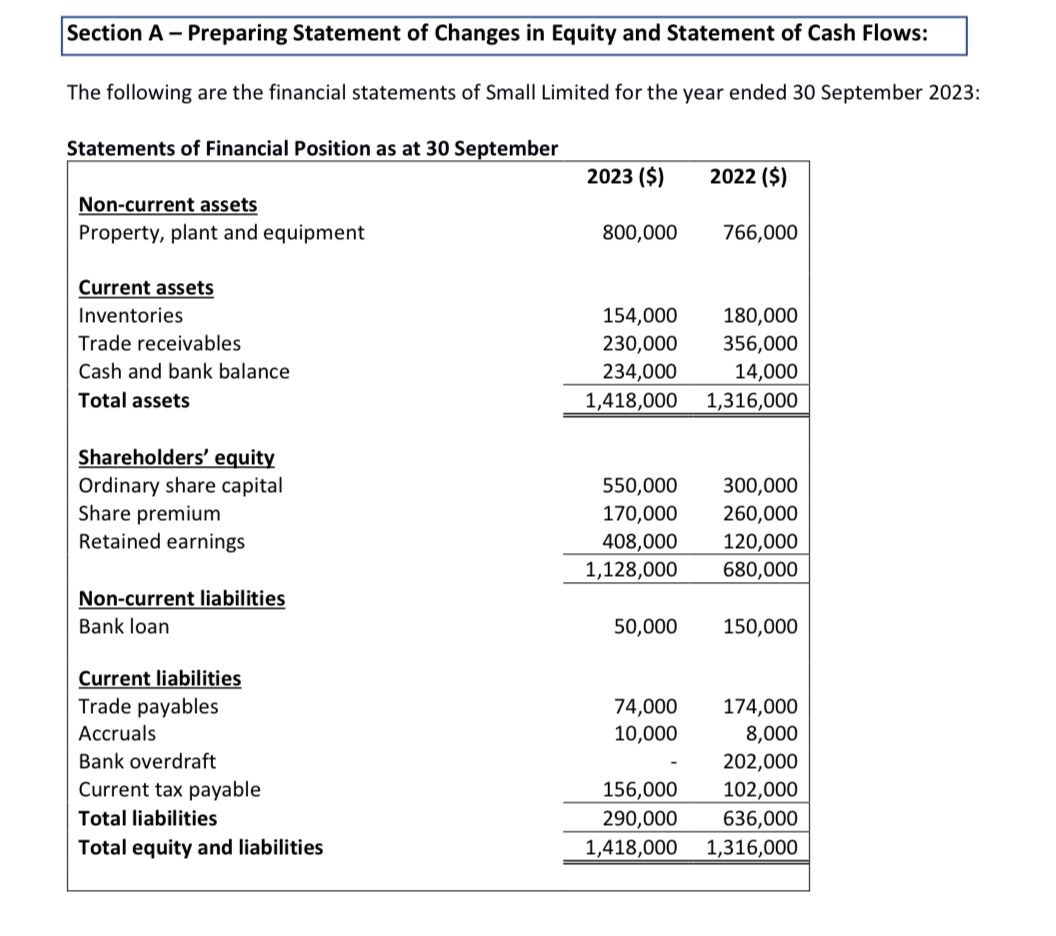

Question: Section A Preparing Statement of Changes in Equity and Statement of Cash Flows: The following are the financial statements of Small Limited for the

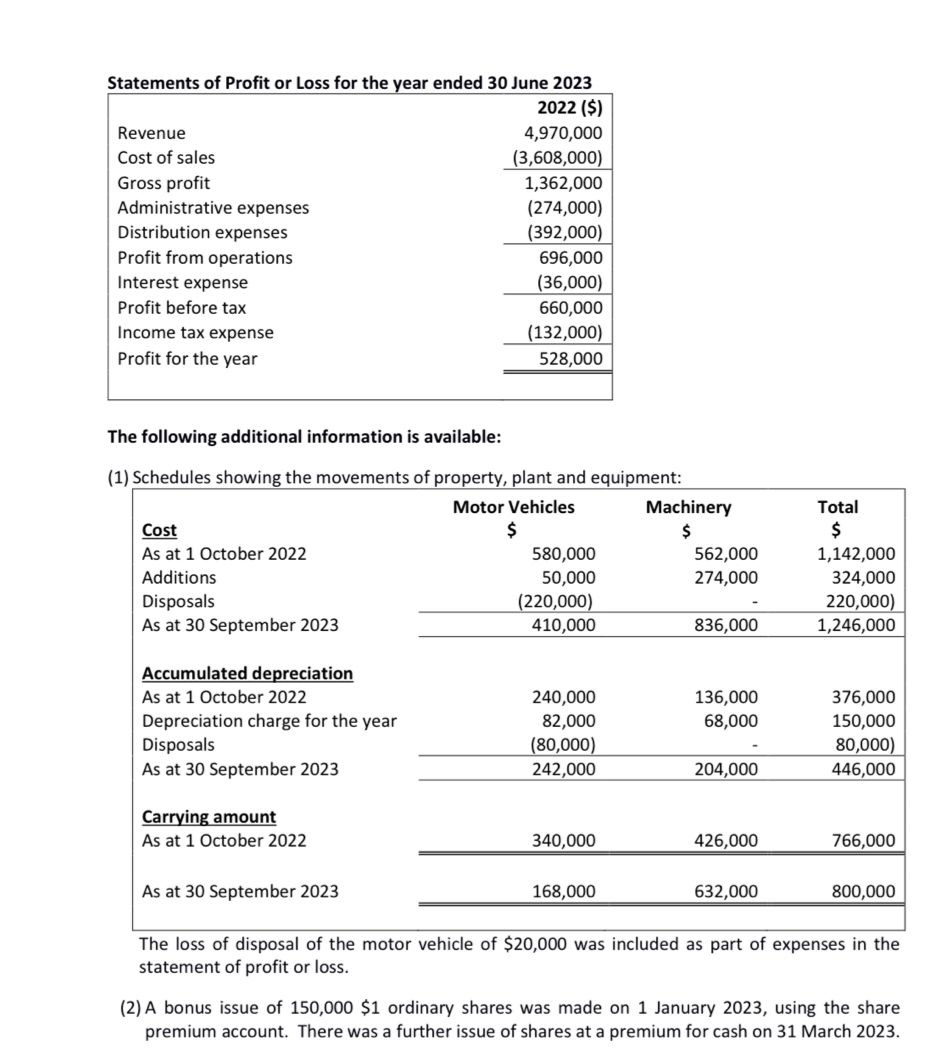

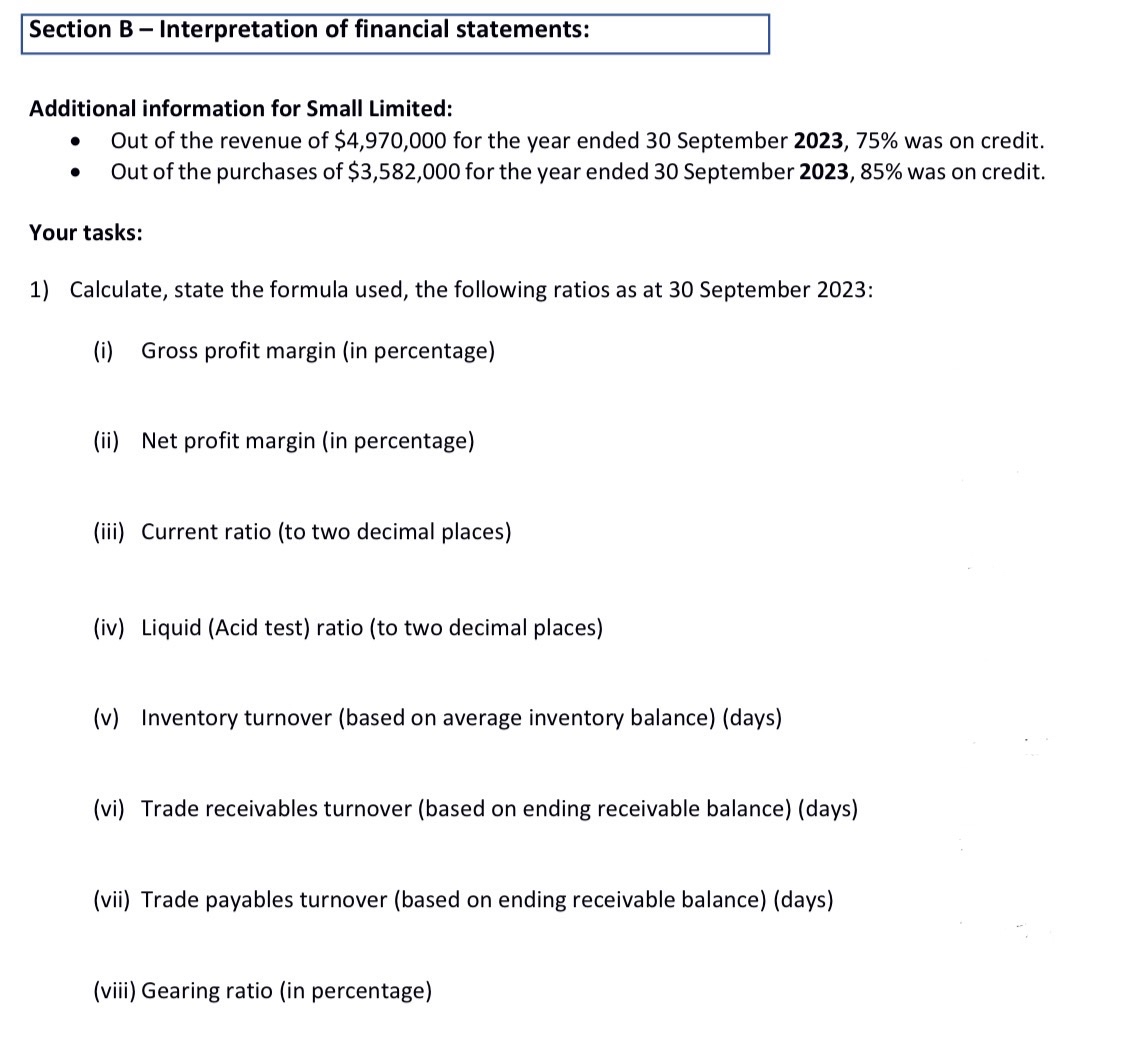

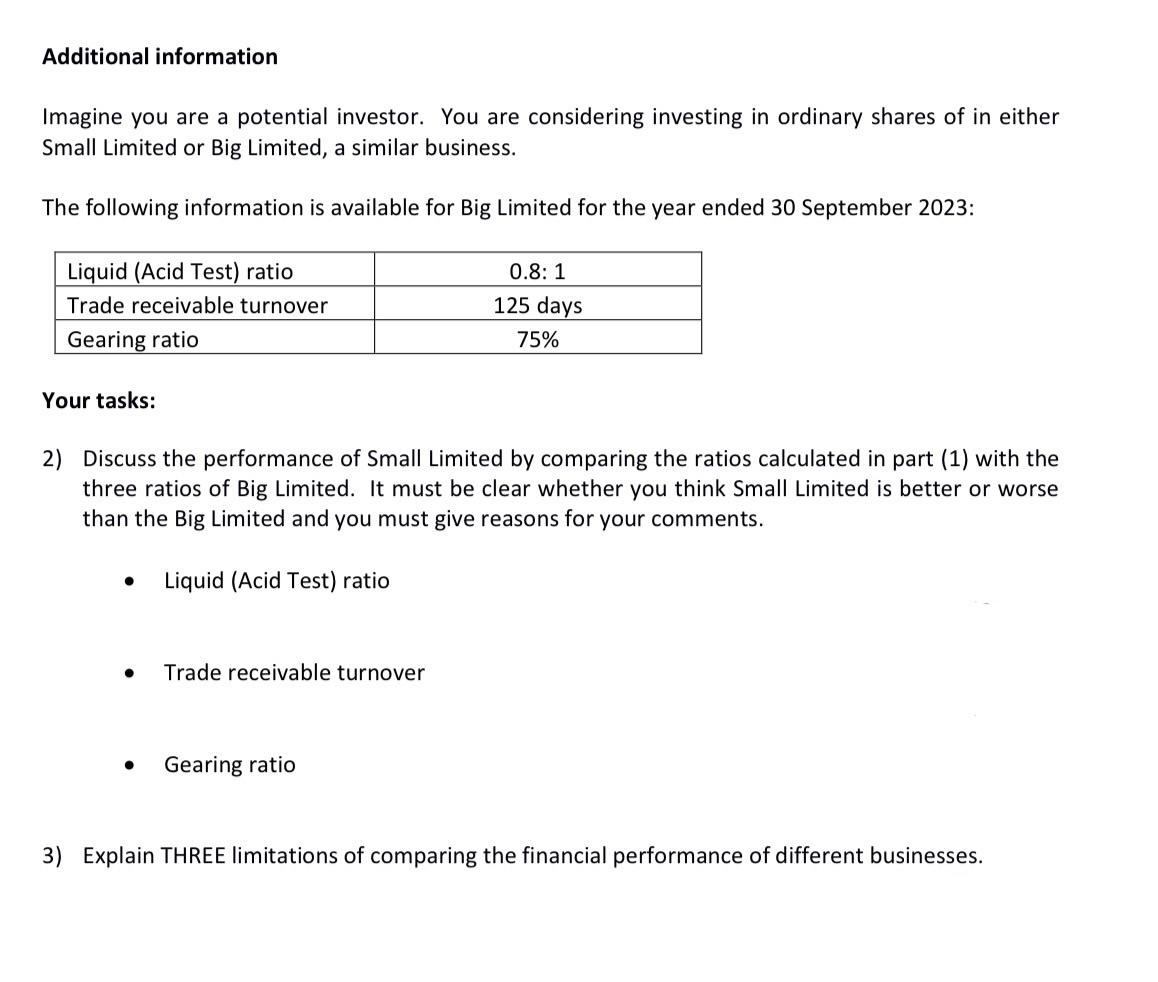

Section A Preparing Statement of Changes in Equity and Statement of Cash Flows: The following are the financial statements of Small Limited for the year ended 30 September 2023: Statements of Financial Position as at 30 September 2023 ($) 2022 ($) Non-current assets Property, plant and equipment 800,000 766,000 Current assets Inventories 154,000 180,000 Trade receivables 230,000 356,000 Cash and bank balance 234,000 14,000 Total assets 1,418,000 1,316,000 Shareholders' equity Ordinary share capital 550,000 300,000 Share premium 170,000 260,000 Retained earnings 408,000 120,000 1,128,000 680,000 Non-current liabilities Bank loan 50,000 150,000 Current liabilities Trade payables Accruals 74,000 174,000 10,000 8,000 Bank overdraft 202,000 Current tax payable 156,000 102,000 Total liabilities 290,000 636,000 Total equity and liabilities 1,418,000 1,316,000 Statements of Profit or Loss for the year ended 30 June 2023 2022 ($) 4,970,000 Revenue Cost of sales Gross profit Administrative expenses Distribution expenses Profit from operations Interest expense Profit before tax Income tax expense Profit for the year (3,608,000) 1,362,000 (274,000) (392,000) 696,000 (36,000) 660,000 (132,000) 528,000 The following additional information is available: (1) Schedules showing the movements of property, plant and equipment: Cost As at 1 October 2022 Additions Disposals Motor Vehicles $ Machinery Total $ $ 580,000 562,000 1,142,000 50,000 274,000 324,000 (220,000) 220,000) 410,000 836,000 1,246,000 As at 30 September 2023 Accumulated depreciation As at 1 October 2022 240,000 136,000 376,000 Depreciation charge for the year 82,000 68,000 150,000 Disposals (80,000) 80,000) As at 30 September 2023 242,000 204,000 446,000 Carrying amount As at 1 October 2022 As at 30 September 2023 340,000 426,000 766,000 168,000 632,000 800,000 The loss of disposal of the motor vehicle of $20,000 was included as part of expenses in the statement of profit or loss. (2) A bonus issue of 150,000 $1 ordinary shares was made on 1 January 2023, using the share premium account. There was a further issue of shares at a premium for cash on 31 March 2023. Section B Interpretation of financial statements: Additional information for Small Limited: Out of the revenue of $4,970,000 for the year ended 30 September 2023, 75% was on credit. Out of the purchases of $3,582,000 for the year ended 30 September 2023, 85% was on credit. Your tasks: 1) Calculate, state the formula used, the following ratios as at 30 September 2023: (i) Gross profit margin (in percentage) (ii) Net profit margin (in percentage) (iii) Current ratio (to two decimal places) (iv) Liquid (Acid test) ratio (to two decimal places) (v) Inventory turnover (based on average inventory balance) (days) (vi) Trade receivables turnover (based on ending receivable balance) (days) (vii) Trade payables turnover (based on ending receivable balance) (days) (viii) Gearing ratio (in percentage) Additional information Imagine you are a potential investor. You are considering investing in ordinary shares of in either Small Limited or Big Limited, a similar business. The following information is available for Big Limited for the year ended 30 September 2023: Liquid (Acid Test) ratio Trade receivable turnover Gearing ratio Your tasks: 0.8: 1 125 days 75% 2) Discuss the performance of Small Limited by comparing the ratios calculated in part (1) with the three ratios of Big Limited. It must be clear whether you think Small Limited is better or worse than the Big Limited and you must give reasons for your comments. Liquid (Acid Test) ratio Trade receivable turnover Gearing ratio 3) Explain THREE limitations of comparing the financial performance of different businesses.

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Section A Preparing Statement of Changes in Equity and Statement of Cash Flows 1 Statement of Changes in Equity for the year ended 30 September 2023 Ordinary Share Capital Share Premium Retained Earni... View full answer

Get step-by-step solutions from verified subject matter experts