Question: SECTION A: Question 1 is compulsory and must be attempted Question 1 AY Co is a Zambian business whose owners are eager to ensure that

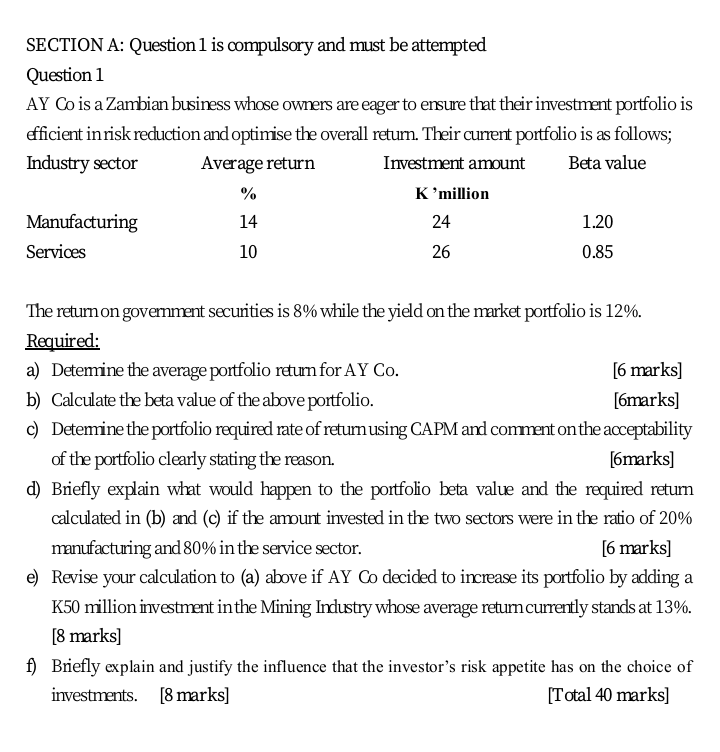

SECTION A: Question 1 is compulsory and must be attempted Question 1 AY Co is a Zambian business whose owners are eager to ensure that their investment portfolio is efficient in risk reduction and optimise the overall return. Their current portfolio is as follows; Industry sector Average return Investment amount Beta value % K 'million Manufacturing 14 24 1.20 Services 10 26 0.85 The return on government securities is 8% while the yield on the market portfolio is 12%. Required: a) Determine the average portfolio return for AY Co. [6 marks) b) Calculate the beta value of the above portfolio. [6marks] c) Determine the portfolio required rate of return using CAPM and comment on the acceptability of the portfolio clearly stating the reason. [6marks) d) Briefly explain what would happen to the portfolio beta value and the required return calculated in (b) and (c) if the amount invested in the two sectors were in the ratio of 20% manufacturing and 80% in the service sector. [6 marks] e) Revise your calculation to (a) above if AY Co decided to increase its portfolio by adding a K50 million investment in the Mining Industry whose average return currently stands at 13%. [8 marks] f) Briefly explain and justify the influence that the investor's risk appetite has on the choice of investments. [8 marks) Total 40 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts