Question: Section A Question 1. Please show all the derivations in your calculations. Suppose today is June 30m, 2015. Consider the following bonds: ID Type Maturity

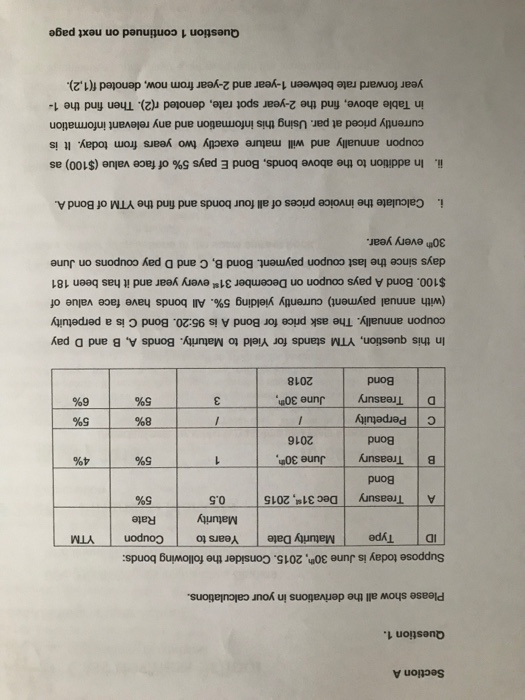

Section A Question 1. Please show all the derivations in your calculations. Suppose today is June 30m, 2015. Consider the following bonds: ID Type Maturity Date Years to YTM MaturityRate 5% A Treasury Dec 31",2015 0.5 Bond BI Treasury 4% June 30h, 2016 / June 30h 2018 5% Bond CI Perpetuity! DI Treasury 8% 5% 5% 6% Bond In this question, YTM stands for Yield to Maturity. Bonds A, B and D pay coupon annually. The ask price for Bond A is 95:20. Bond C is a perpetuity (with annual payment) currently yielding 5%. All bonds have face value of $100. Bond A pays coupon on December 31* every year and it has been 181 days since the last coupon payment. Bond B, C and D pay coupons on June 30th every year. i. Calculate the invoice prices of all four bonds and find the YTM of Bond A. In addition to the above bonds, Bond E pays 5% of face value ($100) as coupon annually and will mature exactly two years from today. It is currently priced at par. Using this information and any relevant information in Table above, find the 2-year spot rate, denoted r(2). Then find the 1- year forward rate between 1-year and 2-year from now, denoted f(1,2). ii. Question 1 continued on next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts