Question: SECTION A : SHORT CASE STUDY (50 MARKS) INSTRUCTION : This section consists of TWO (2) questions. Compulsory to answer ALL the questions. Show all

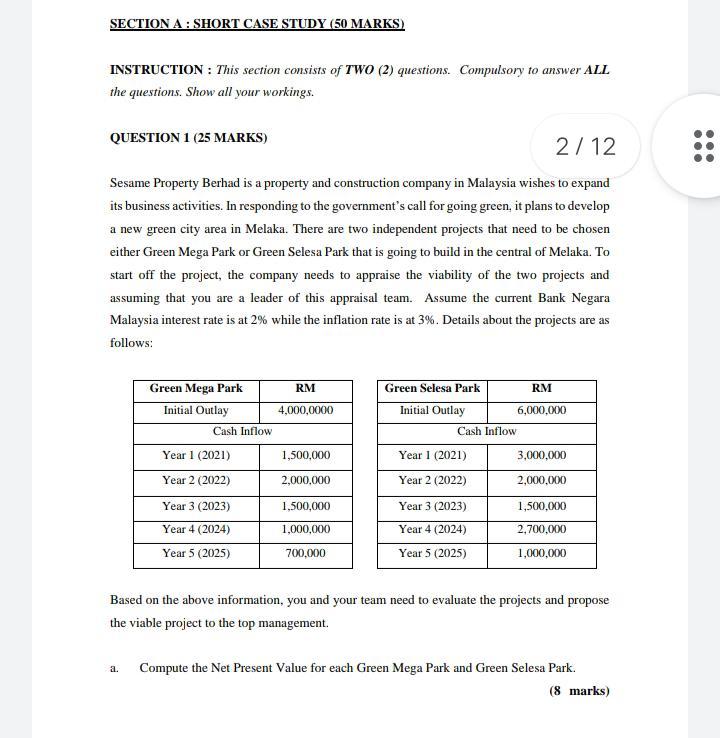

SECTION A : SHORT CASE STUDY (50 MARKS) INSTRUCTION : This section consists of TWO (2) questions. Compulsory to answer ALL the questions. Show all your workings. QUESTION 1 (25 MARKS) 2 / 12 : Sesame Property Berhad is a property and construction company in Malaysia wishes to expand its business activities. In responding to the government's call for going green, it plans to develop a new green city area in Melaka. There are two independent projects that need to be chosen either Green Mega Park or Green Selesa Park that is going to build in the central of Melaka. To start off the project, the company needs to appraise the viability of the two projects and assuming that you are a leader of this appraisal team. Assume the current Bank Negara Malaysia interest rate is at 2% while the inflation rate is at 3%. Details about the projects are as follows: Green Selesa Park RM Initial Outlay 6,000,000 Cash Inflow Year 1 (2021) 3,000,000 Green Mega Park RM Initial Outlay 4,000,0000 Cash Inflow Year 1 (2021) 1,500,000 Year 2 (2022) 2,000,000 Year 3 (2023) 1,500,000 Year 4 (2024) 1,000,000 Year 5 (2025) 700,000 Year 2 (2022) 2,000,000 1,500,000 Year 3 (2023) Year 4 (2024) Year 5 (2025) 2.700.000 1,000,000 Based on the above information, you and your team need to evaluate the projects and propose the viable project to the top management a. Compute the Net Present Value for each Green Mega Park and Green Selesa Park. (8 marks) b. Compute the Discounted Payback Period for each Green Mega Park and Green Selesa Park. (8 marks) c. By comparing the results in a. and b. above, would you rather propose the Green Mega Park or Green Selesa Park? Justify your suggestion. (5 marks) d. Why is capital budgeting such an important process? Support and defend your answer. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts