Question: SECTION A: Students MUST ANSWER QUESTION 1 QUESTION 1 (COMPULSORY) (a) (1) Discuss in detail SIX steps a financial analyst might undertake when performing an

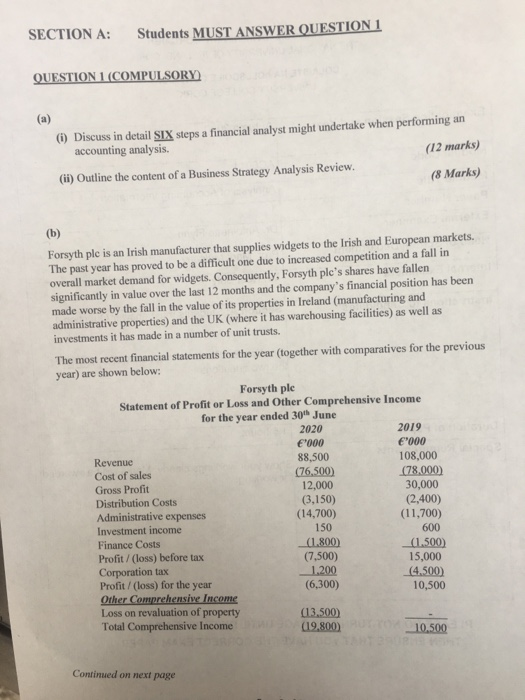

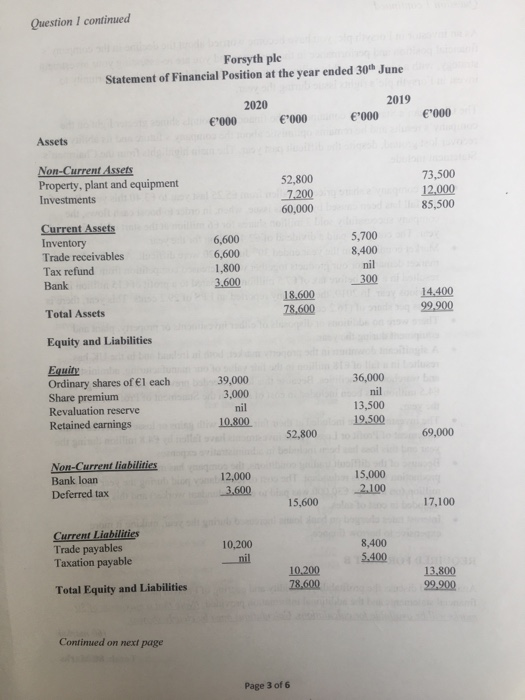

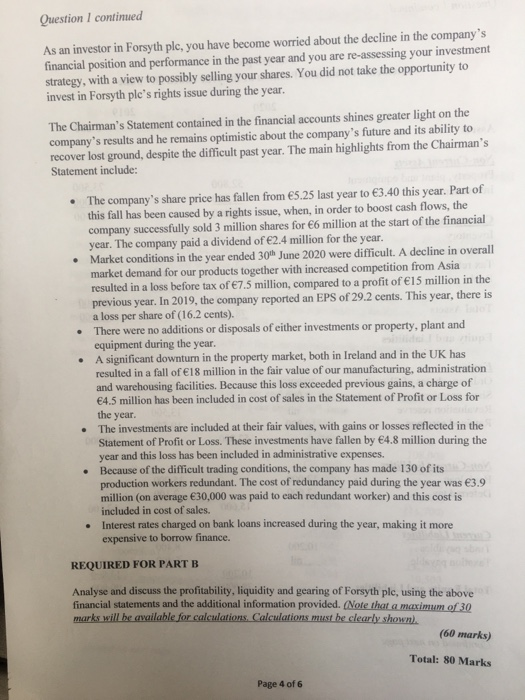

SECTION A: Students MUST ANSWER QUESTION 1 QUESTION 1 (COMPULSORY) (a) (1) Discuss in detail SIX steps a financial analyst might undertake when performing an accounting analysis. (12 marks) (11) Outline the content of a Business Strategy Analysis Review. (8 Marks) (b) Forsyth ple is an Irish manufacturer that supplies widgets to the Irish and European markets. The past year has proved to be a difficult one due to increased competition and a fall in overall market demand for widgets. Consequently, Forsyth ple's shares have fallen significantly in value over the last 12 months and the company's financial position has been made worse by the fall in the value of its properties in Ireland (manufacturing and administrative properties) and the UK (where it has warehousing facilities) as well as investments it has made in a number of unit trusts. The most recent financial statements for the year (together with comparatives for the previous year) are shown below: Forsyth ple Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020 2019 '000 "000 Revenue 88,500 108,000 Cost of sales (76,500) (78,000) Gross Profit 12,000 30,000 Distribution Costs (3,150) (2,400) Administrative expenses (14,700) (11,700) Investment income 150 600 Finance Costs (1.800 (1.500) Profit/(loss) before tax (7,500) 15,000 Corporation tax 1.200 (4.500) Profit/(loss) for the year (6,300) 10,500 Other Comprehensive Income Loss on revaluation of property (13.500) Total Comprehensive Income (19.800) 10.500 Continued on next page Question I continued Forsyth ple Statement of Financial Position at the year ended 30 June 2020 2019 '000 '000 '000 "000 Assets Non-Current Assets Property, plant and equipment Investments 52,800 7.200 60,000 73,500 12.000 85,500 Current Assets Inventory Trade receivables Tax refund Bank 6,600 6,600 1.800 3.600 5,700 8,400 nil 300 18.600 78.600 14,400 99.900 Total Assets Equity and Liabilities Equity Ordinary shares of 1 each Share premium Revaluation reserve Retained earnings 39.000 3.000 nil 10.800 36,000 nil 13,500 19.500 52,800 69,000 Non-Current liabilities Bank loan Deferred tax 12,000 15,000 2.100 3.600 15,600 17,100 Current Liabilities Trade payables Taxation payable 10,200 nil 8,400 5.400 10.200 78.600 13.800 99.900 Total Equity and Liabilities Continued on next page Page 3 of 6 Question I continued As an investor in Forsyth plc, you have become worried about the decline in the company's financial position and performance in the past year and you are re-assessing your investment strategy, with a view to possibly selling your shares. You did not take the opportunity to invest in Forsyth ple's rights issue during the year. The Chairman's Statement contained in the financial accounts shines greater light on the company's results and he remains optimistic about the company's future and its ability to recover lost ground, despite the difficult past year. The main highlights from the Chairman's Statement include: . The company's share price has fallen from 5.25 last year to 3.40 this year. Part of this fall has been caused by a rights issue, when, in order to boost cash flows, the company successfully sold 3 million shares for 66 million at the start of the financial year. The company paid a dividend of 2.4 million for the year. Market conditions in the year ended 30th June 2020 were difficult. A decline in overall market demand for our products together with increased competition from Asia resulted in a loss before tax of 7.5 million, compared to a profit of 15 million in the previous year. In 2019, the company reported an EPS of 29.2 cents. This year, there is a loss per share of (16.2 cents). There were no additions or disposals of either investments or property, plant and equipment during the year. A significant downturn in the property market, both in Ireland and in the UK has resulted in a fall of 18 million in the fair value of our manufacturing, administration and warehousing facilities. Because this loss exceeded previous gains, a charge of 4.5 million has been included in cost of sales in the Statement of Profit or Loss for the year. The investments are included at their fair values, with gains or losses reflected in the Statement of Profit or Loss. These investments have fallen by 4.8 million during the year and this loss has been included in administrative expenses. Because of the difficult trading conditions, the company has made 130 of its production workers redundant. The cost of redundancy paid during the year was 3.9 million (on average 30,000 was paid to each redundant worker) and this cost is Interest rates charged on bank loans increased during the year, making it more expensive to borrow finance. . included in cost of sales. REQUIRED FOR PART B Analyse and discuss the profitability, liquidity and gearing of Forsyth ple, using the above financial statements and the additional information provided. (Note that a maximum of 30 marks will be available for calculations. Calculations must be clearly shown). (60 marks) Total: 80 Marks Page 4 of 6 SECTION A: Students MUST ANSWER QUESTION 1 QUESTION 1 (COMPULSORY) (a) (1) Discuss in detail SIX steps a financial analyst might undertake when performing an accounting analysis. (12 marks) (11) Outline the content of a Business Strategy Analysis Review. (8 Marks) (b) Forsyth ple is an Irish manufacturer that supplies widgets to the Irish and European markets. The past year has proved to be a difficult one due to increased competition and a fall in overall market demand for widgets. Consequently, Forsyth ple's shares have fallen significantly in value over the last 12 months and the company's financial position has been made worse by the fall in the value of its properties in Ireland (manufacturing and administrative properties) and the UK (where it has warehousing facilities) as well as investments it has made in a number of unit trusts. The most recent financial statements for the year (together with comparatives for the previous year) are shown below: Forsyth ple Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020 2019 '000 "000 Revenue 88,500 108,000 Cost of sales (76,500) (78,000) Gross Profit 12,000 30,000 Distribution Costs (3,150) (2,400) Administrative expenses (14,700) (11,700) Investment income 150 600 Finance Costs (1.800 (1.500) Profit/(loss) before tax (7,500) 15,000 Corporation tax 1.200 (4.500) Profit/(loss) for the year (6,300) 10,500 Other Comprehensive Income Loss on revaluation of property (13.500) Total Comprehensive Income (19.800) 10.500 Continued on next page Question I continued Forsyth ple Statement of Financial Position at the year ended 30 June 2020 2019 '000 '000 '000 "000 Assets Non-Current Assets Property, plant and equipment Investments 52,800 7.200 60,000 73,500 12.000 85,500 Current Assets Inventory Trade receivables Tax refund Bank 6,600 6,600 1.800 3.600 5,700 8,400 nil 300 18.600 78.600 14,400 99.900 Total Assets Equity and Liabilities Equity Ordinary shares of 1 each Share premium Revaluation reserve Retained earnings 39.000 3.000 nil 10.800 36,000 nil 13,500 19.500 52,800 69,000 Non-Current liabilities Bank loan Deferred tax 12,000 15,000 2.100 3.600 15,600 17,100 Current Liabilities Trade payables Taxation payable 10,200 nil 8,400 5.400 10.200 78.600 13.800 99.900 Total Equity and Liabilities Continued on next page Page 3 of 6 Question I continued As an investor in Forsyth plc, you have become worried about the decline in the company's financial position and performance in the past year and you are re-assessing your investment strategy, with a view to possibly selling your shares. You did not take the opportunity to invest in Forsyth ple's rights issue during the year. The Chairman's Statement contained in the financial accounts shines greater light on the company's results and he remains optimistic about the company's future and its ability to recover lost ground, despite the difficult past year. The main highlights from the Chairman's Statement include: . The company's share price has fallen from 5.25 last year to 3.40 this year. Part of this fall has been caused by a rights issue, when, in order to boost cash flows, the company successfully sold 3 million shares for 66 million at the start of the financial year. The company paid a dividend of 2.4 million for the year. Market conditions in the year ended 30th June 2020 were difficult. A decline in overall market demand for our products together with increased competition from Asia resulted in a loss before tax of 7.5 million, compared to a profit of 15 million in the previous year. In 2019, the company reported an EPS of 29.2 cents. This year, there is a loss per share of (16.2 cents). There were no additions or disposals of either investments or property, plant and equipment during the year. A significant downturn in the property market, both in Ireland and in the UK has resulted in a fall of 18 million in the fair value of our manufacturing, administration and warehousing facilities. Because this loss exceeded previous gains, a charge of 4.5 million has been included in cost of sales in the Statement of Profit or Loss for the year. The investments are included at their fair values, with gains or losses reflected in the Statement of Profit or Loss. These investments have fallen by 4.8 million during the year and this loss has been included in administrative expenses. Because of the difficult trading conditions, the company has made 130 of its production workers redundant. The cost of redundancy paid during the year was 3.9 million (on average 30,000 was paid to each redundant worker) and this cost is Interest rates charged on bank loans increased during the year, making it more expensive to borrow finance. . included in cost of sales. REQUIRED FOR PART B Analyse and discuss the profitability, liquidity and gearing of Forsyth ple, using the above financial statements and the additional information provided. (Note that a maximum of 30 marks will be available for calculations. Calculations must be clearly shown). (60 marks) Total: 80 Marks Page 4 of 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts