Question: SECTION A-45 marks Instructions: This section contains Three (3) questions totalling forty (45) marks. Please answer all questions. Question 1 (13 marks) RBCC Ltd, a

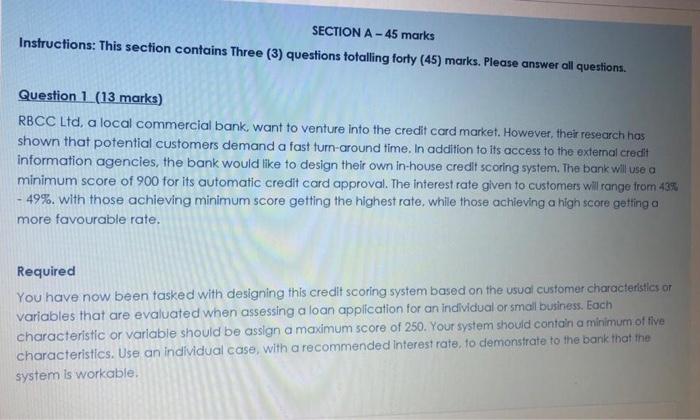

SECTION A-45 marks Instructions: This section contains Three (3) questions totalling forty (45) marks. Please answer all questions. Question 1 (13 marks) RBCC Ltd, a local commercial bank, want to venture into the credit card market. However, their research has shown that potential customers demand a fast turn-around time. In addition to its access to the external credit information agencies, the bank would like to design their own in-house credit scoring system. The bank will use a minimum score of 900 for its automatic credit card approval. The interest rate given to customers will range from 43% - 49%. with those achieving minimum score getting the highest rate, while those achieving a high score getting a more favourable rate. Required You have now been tasked with designing this credit scoring system based on the usual customer characteristics of variables that are evaluated when assessing a loan application for an individual or small business. Each characteristic or variable should be assign a maximum score of 250. Your system should contain a minimum of five characteristics. Use an individual case, with a recommended Interest rate, to demonstrate to the bank that the system is workable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts