Question: SECTION ANSWER ANY TWO QUESTIONS 20 MARKS EACH Oton (20 Marku 4) The development and selection of alternative risk management methods fundamental trade between the

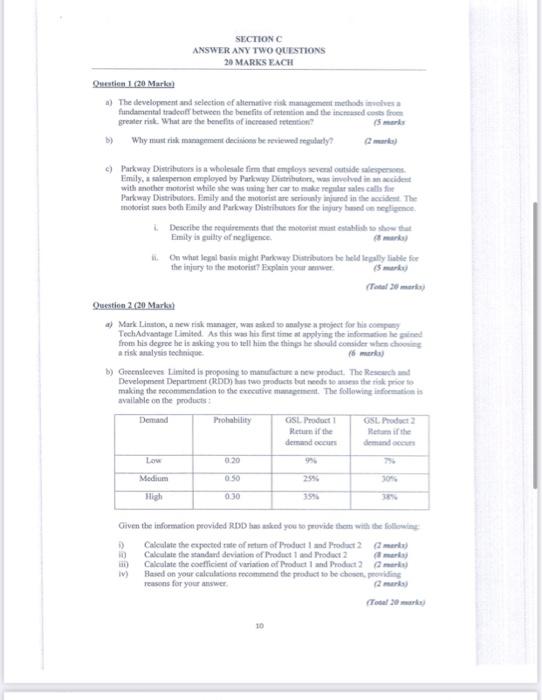

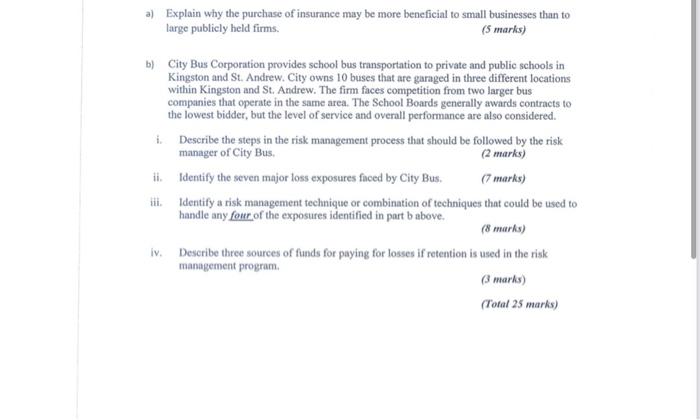

SECTION ANSWER ANY TWO QUESTIONS 20 MARKS EACH Oton (20 Marku 4) The development and selection of alternative risk management methods fundamental trade between the benefits oftention and the incased costs from greater risk. What are the benefits of increased 5 Why must risk management decisions be reviewed tegully? c) Parkway Distributors is a wholesale firm that employs several outside salespersons Emily, alesperson employed by Parkway Distributors, was made with another motorist while she was ning her car to make repur sales calls for Parkway Distributors. Pmily and the motoristare seriously injured in the accident. The motorists both Emily and Parkway Distributors for the injury Describe the requirements that the motor mest establish sa show Emily is guilty of negligence On what legal basis might Parkway Distributo be held legally Bible for the injury to the motor? Faxplain your we Question 2 (20 Markut a) Mark Linton, new risk manager, was to analyse project for his company TechAdvantage Limited. As this was his fint time at applying the informatie from his degree he is asking you to tell him the things he should consider when choose a risk analysis technique 15 m b) Grecasleeves Limited is proposing to manufacture a new product. The Recht Development Department (RDD) to products but needs to use the riski making the recommendation to the executive mag. The following informatii available on the products Demand Probability GSL Prodot GSL Product Reumi the Low Medium 050 High 0.30 Given the information provided RDD asked you to provide them with the following Calculate the expected tute of rum of Product and Product 2 (mark) 10 Calculate the standard deviation of Product and Product 2 Calcolate the coefficient of variation of Product I und Product mark Based on your calculations recommend the products he chosen viding reasons for your ser 2 marks 10 a) Explain why the purchase of insurance may be more beneficial to small businesses than to large publicly held firms. (5 marks) b) City Bus Corporation provides school bus transportation to private and public schools in Kingston and St. Andrew. City owns 10 buses that are garaged in three different locations within Kingston and St. Andrew. The firm faces competition from two larger bus companies that operate in the same area. The School Boards generally awards contracts to the lowest bidder, but the level of service and overall performance are also considered. i Describe the steps in the risk management process that should be followed by the risk manager of City Bus (2 marks) ii. Identify the seven major loss exposures faced by City Bus. (7 marks) lii. Identify a risk management technique or combination of techniques that could be used to handle any four of the exposures identified in part b above. (8 marks) iv. Describe three sources of funds for paying for losses if retention is used in the risk management program (3 marks) (Total 25 marks) SECTION ANSWER ANY TWO QUESTIONS 20 MARKS EACH Oton (20 Marku 4) The development and selection of alternative risk management methods fundamental trade between the benefits oftention and the incased costs from greater risk. What are the benefits of increased 5 Why must risk management decisions be reviewed tegully? c) Parkway Distributors is a wholesale firm that employs several outside salespersons Emily, alesperson employed by Parkway Distributors, was made with another motorist while she was ning her car to make repur sales calls for Parkway Distributors. Pmily and the motoristare seriously injured in the accident. The motorists both Emily and Parkway Distributors for the injury Describe the requirements that the motor mest establish sa show Emily is guilty of negligence On what legal basis might Parkway Distributo be held legally Bible for the injury to the motor? Faxplain your we Question 2 (20 Markut a) Mark Linton, new risk manager, was to analyse project for his company TechAdvantage Limited. As this was his fint time at applying the informatie from his degree he is asking you to tell him the things he should consider when choose a risk analysis technique 15 m b) Grecasleeves Limited is proposing to manufacture a new product. The Recht Development Department (RDD) to products but needs to use the riski making the recommendation to the executive mag. The following informatii available on the products Demand Probability GSL Prodot GSL Product Reumi the Low Medium 050 High 0.30 Given the information provided RDD asked you to provide them with the following Calculate the expected tute of rum of Product and Product 2 (mark) 10 Calculate the standard deviation of Product and Product 2 Calcolate the coefficient of variation of Product I und Product mark Based on your calculations recommend the products he chosen viding reasons for your ser 2 marks 10 a) Explain why the purchase of insurance may be more beneficial to small businesses than to large publicly held firms. (5 marks) b) City Bus Corporation provides school bus transportation to private and public schools in Kingston and St. Andrew. City owns 10 buses that are garaged in three different locations within Kingston and St. Andrew. The firm faces competition from two larger bus companies that operate in the same area. The School Boards generally awards contracts to the lowest bidder, but the level of service and overall performance are also considered. i Describe the steps in the risk management process that should be followed by the risk manager of City Bus (2 marks) ii. Identify the seven major loss exposures faced by City Bus. (7 marks) lii. Identify a risk management technique or combination of techniques that could be used to handle any four of the exposures identified in part b above. (8 marks) iv. Describe three sources of funds for paying for losses if retention is used in the risk management program (3 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts