Question: SECTION B (10 MARKS) There is ONE (1) question in this section. Answer the question and write the correct answer in the answer booklet provided.

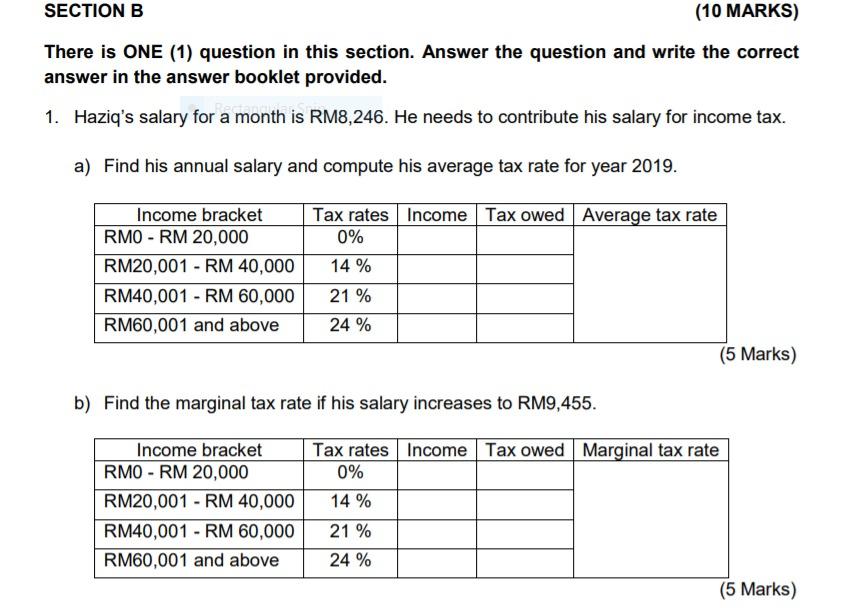

SECTION B (10 MARKS) There is ONE (1) question in this section. Answer the question and write the correct answer in the answer booklet provided. 1. Haziq's salary for a month is RM8,246. He needs to contribute his salary for income tax. a) Find his annual salary and compute his average tax rate for year 2019. Income bracket RMO - RM 20,000 RM20,001 - RM 40,000 RM40,001 - RM 60,000 RM60,001 and above Tax rates Income Tax owed Average tax rate 0% 14 % 21 % 24 % (5 Marks) b) Find the marginal tax rate if his salary increases to RM9,455. Income bracket RMO - RM 20,000 RM20,001 - RM 40,000 RM40,001 - RM 60,000 RM60,001 and above Tax rates Income Tax owed Marginal tax rate 0% 14 % 21 % 24 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts